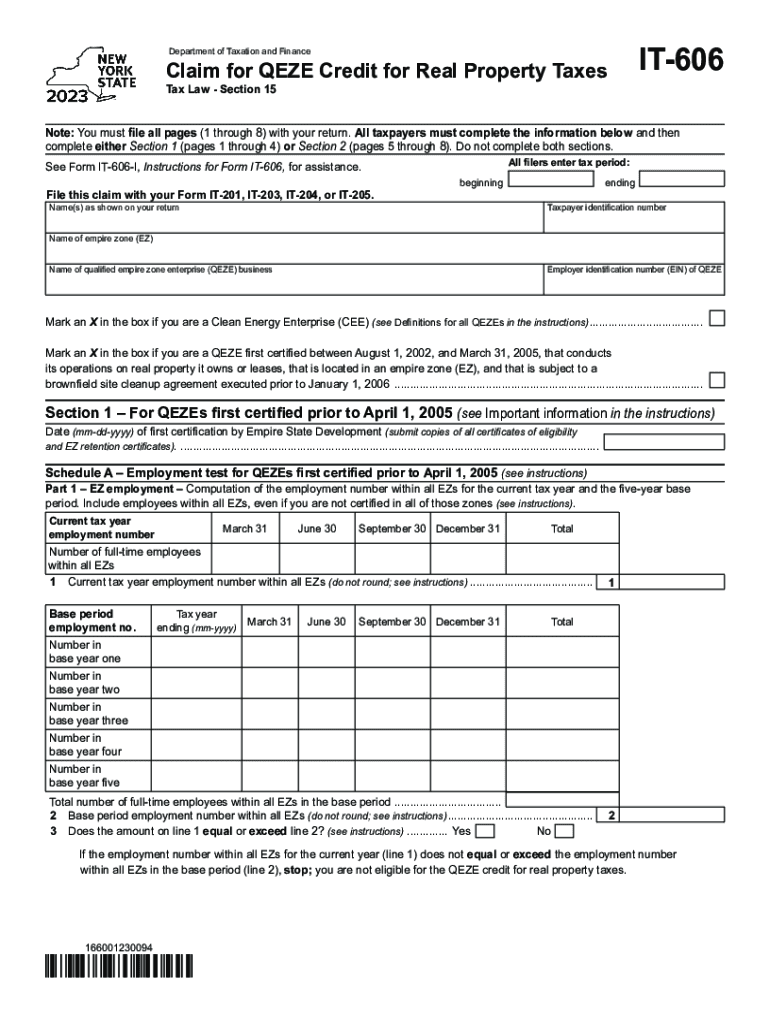

Form it 606 Claim for QEZE Credit for Real Property Taxes 2023

What is the Form IT-606 Claim For QEZE Credit For Real Property Taxes

The Form IT-606 is a tax document used in New York State that allows qualified businesses to claim a credit for real property taxes. This credit is specifically designed for businesses that are part of the Qualified Empire Zone Enterprise (QEZE) program. The purpose of the form is to provide financial relief to eligible businesses by reducing their property tax burden, thereby encouraging economic development in designated areas.

How to use the Form IT-606 Claim For QEZE Credit For Real Property Taxes

To utilize the Form IT-606, businesses must first determine their eligibility under the QEZE program. Once eligibility is confirmed, the form must be filled out accurately, providing necessary information regarding the business and the property taxes paid. The completed form should then be submitted to the appropriate tax authority as part of the annual tax return process. It is essential to follow the specific instructions provided with the form to ensure compliance and maximize the credit received.

Steps to complete the Form IT-606 Claim For QEZE Credit For Real Property Taxes

Completing the Form IT-606 involves several key steps:

- Gather necessary information: Collect all relevant data, including property tax bills and business identification details.

- Fill out the form: Enter the required information accurately, ensuring all figures are correct.

- Review the form: Double-check all entries for accuracy and completeness before submission.

- Submit the form: File the completed form with your annual tax return to the New York State Department of Taxation and Finance.

Eligibility Criteria

To qualify for the credit claimed on the Form IT-606, businesses must meet specific criteria. These include being designated as a Qualified Empire Zone Enterprise, being located within a designated Empire Zone, and having paid real property taxes on the eligible property. Additionally, businesses must comply with all relevant state regulations and maintain proper documentation to support their claim.

Required Documents

When submitting the Form IT-606, businesses need to provide certain supporting documents. These typically include:

- Copies of property tax bills for the relevant tax year.

- Proof of business eligibility as a QEZE.

- Any additional documentation specified in the form instructions.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the Form IT-606. Generally, the form must be submitted along with the annual tax return, which is typically due on April fifteenth for most businesses. However, it is advisable to check for any updates or changes to deadlines each tax year to ensure compliance.

Quick guide on how to complete form it 606 claim for qeze credit for real property taxes

Finish Form IT 606 Claim For QEZE Credit For Real Property Taxes effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally safe substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to generate, modify, and electronically sign your documents swiftly without any holdups. Manage Form IT 606 Claim For QEZE Credit For Real Property Taxes on any system with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Form IT 606 Claim For QEZE Credit For Real Property Taxes without breaking a sweat

- Find Form IT 606 Claim For QEZE Credit For Real Property Taxes and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text (SMS), invite link, or downloading it to your computer.

Disregard the hassle of lost or misplaced documents, tedious form hunts, or mistakes that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any preferred device. Adjust and eSign Form IT 606 Claim For QEZE Credit For Real Property Taxes and ensure excellent communication at every phase of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 606 claim for qeze credit for real property taxes

Create this form in 5 minutes!

How to create an eSignature for the form it 606 claim for qeze credit for real property taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 606 form and how is it used in airSlate SignNow?

A 606 form refers to a document used in certain business transactions. In airSlate SignNow, users can easily create, edit, and eSign 606 forms to streamline their document workflows. This feature enhances efficiency by allowing you to manage your forms digitally.

-

How much does it cost to use airSlate SignNow for sending 606 forms?

The pricing for airSlate SignNow is competitive and varies based on the plan you choose. Each plan includes features ideal for handling documents like the 606 form. You can start with a free trial to explore the options before committing.

-

What features does airSlate SignNow offer for 606 forms?

airSlate SignNow offers numerous features for handling 606 forms, including customizable templates, secure eSigning, and real-time tracking. These features collectively make managing documents simpler and more efficient. You can also automate reminders and notifications for pending 606 forms.

-

Can I integrate airSlate SignNow with other applications for managing 606 forms?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and more. This allows you to manage your 606 forms across platforms, enhancing your workflow and ensuring all documents are readily accessible.

-

Is airSlate SignNow compliant with regulations for eSigning 606 forms?

Absolutely! airSlate SignNow adheres to the legal standards for electronic signatures, ensuring that your 606 forms are compliant and enforceable. This gives you peace of mind when handling sensitive documents.

-

What are the benefits of using airSlate SignNow for 606 forms?

Using airSlate SignNow for 606 forms provides numerous benefits, including improved efficiency, cost savings, and enhanced document security. The easy-to-use interface allows for quick processing of signatures and document exchanges, helping your business save valuable time.

-

How can I start using airSlate SignNow for my 606 forms?

To start using airSlate SignNow for your 606 forms, simply sign up for an account and choose a suitable plan. Once registered, you can immediately begin creating and managing your forms. The intuitive platform guides you through each step.

Get more for Form IT 606 Claim For QEZE Credit For Real Property Taxes

Find out other Form IT 606 Claim For QEZE Credit For Real Property Taxes

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT