Form it 272 Claim for College Tuition Credit or Itemized Deduction Tax Year

What is the Form IT-272 for College Tuition Credit or Itemized Deduction?

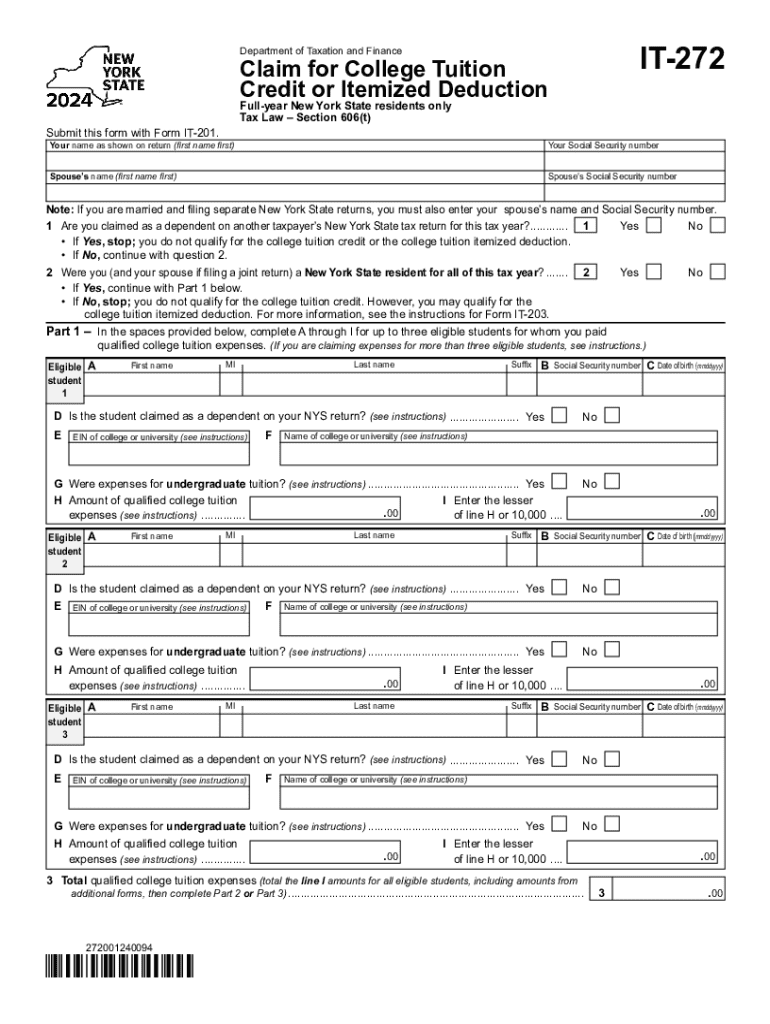

The IT-272 form is a tax document used by residents of New York to claim a credit or deduction for qualified college tuition expenses. This form allows taxpayers to report eligible tuition payments made for themselves, their spouses, or dependents attending eligible institutions. The primary purpose is to help reduce the overall tax burden for individuals and families investing in higher education. Understanding this form is essential for maximizing potential tax benefits associated with educational expenses.

Steps to Complete the Form IT-272

Completing the IT-272 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including tuition statements and proof of payments. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report the total amount of qualified tuition expenses paid during the tax year. Be sure to include any applicable credits or deductions from other sources. Finally, review the form for completeness and accuracy before submitting it to the New York State Department of Taxation and Finance.

Key Elements of the Form IT-272

The IT-272 form contains several important sections that taxpayers must understand. Key elements include:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Tuition Expenses: Taxpayers must detail the total qualified tuition expenses paid during the tax year.

- Credits and Deductions: This section allows taxpayers to report any other credits or deductions that may apply.

- Signature: The form must be signed and dated by the taxpayer to validate the submission.

Eligibility Criteria for the IT-272 Form

To qualify for the benefits associated with the IT-272 form, certain eligibility criteria must be met. Taxpayers must be residents of New York and have incurred qualified tuition expenses for themselves or their dependents. The educational institution must be recognized and eligible for federal financial aid. Additionally, the expenses must be for courses that lead to a degree or other recognized credential. Understanding these criteria is crucial for ensuring that the claim is valid and accepted by tax authorities.

Filing Deadlines for the IT-272 Form

Filing deadlines for the IT-272 form are aligned with the general tax filing deadlines in New York. Typically, taxpayers must submit their forms by April fifteenth of the following tax year. It is important to keep track of these deadlines to avoid penalties or missed opportunities for claiming credits or deductions. Taxpayers may also consider filing for an extension if they require additional time to gather necessary documentation.

How to Obtain the IT-272 Form

Taxpayers can obtain the IT-272 form through several convenient methods. The form is available for download directly from the New York State Department of Taxation and Finance website. Additionally, physical copies can often be found at local tax offices or public libraries. It is advisable to ensure that the most current version of the form is being used to avoid any discrepancies during the filing process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 272 claim for college tuition credit or itemized deduction tax year 772088883

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 272 form and how can airSlate SignNow help?

The IT 272 form is a tax document used for various purposes, including reporting income and deductions. airSlate SignNow simplifies the process of signing and sending the IT 272 form electronically, ensuring that your documents are securely managed and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the IT 272 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution allows you to manage the IT 272 form and other documents without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing the IT 272 form?

airSlate SignNow provides features such as electronic signatures, document templates, and real-time tracking for the IT 272 form. These tools streamline the signing process, making it faster and more efficient for users.

-

Can I integrate airSlate SignNow with other software for the IT 272 form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the IT 272 form alongside your existing tools. This enhances productivity and ensures a smooth workflow.

-

How secure is the airSlate SignNow platform for the IT 272 form?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and compliance measures to protect your IT 272 form and other sensitive documents, ensuring that your data remains safe and confidential.

-

Can I access the IT 272 form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage the IT 272 form on the go. This flexibility ensures that you can sign and send documents anytime, anywhere.

-

What are the benefits of using airSlate SignNow for the IT 272 form?

Using airSlate SignNow for the IT 272 form offers numerous benefits, including increased efficiency, reduced paper usage, and faster turnaround times. Our user-friendly interface makes it easy for anyone to manage their documents effectively.

Get more for Form IT 272 Claim For College Tuition Credit Or Itemized Deduction Tax Year

- Etebanking form

- Fall river public schools cori form

- 30 day notice to change the terms of your rental agreement to residents and all others in possession of apt located at street form

- Ahba entry form american herding breed association

- Application for tenancy tryourrentals com form

- Shamrock foundation cats form

- If you require this form in large print please contact

- Supportstaffapplicationform doc

Find out other Form IT 272 Claim For College Tuition Credit Or Itemized Deduction Tax Year

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney