Westpac Foreign Tax Residency Declaration Form

What is the Westpac Foreign Tax Residency Declaration Form

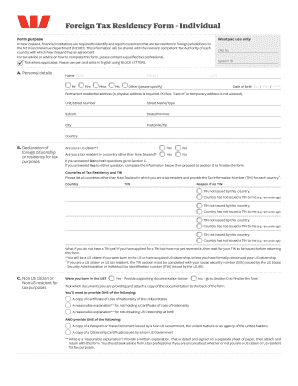

The Westpac Foreign Tax Residency Declaration Form is a document used by individuals and entities to declare their tax residency status for foreign tax purposes. This form is essential for customers of Westpac who may be subject to foreign tax obligations. It helps Westpac comply with international tax regulations and ensures that the correct tax treatment is applied to your financial accounts. Understanding your tax residency is crucial, as it affects how your income is taxed both in the United States and abroad.

How to use the Westpac Foreign Tax Residency Declaration Form

Using the Westpac Foreign Tax Residency Declaration Form involves several straightforward steps. Begin by obtaining the form from Westpac's official resources. Once you have the form, fill in your personal details, including your name, address, and tax identification number. Indicate your residency status by selecting the appropriate options provided on the form. After completing the form, review it for accuracy and ensure all required fields are filled. Finally, submit the form as directed, either online or through the specified submission methods.

Steps to complete the Westpac Foreign Tax Residency Declaration Form

Completing the Westpac Foreign Tax Residency Declaration Form requires careful attention to detail. Follow these steps:

- Download the form from Westpac's website or request a physical copy.

- Provide your personal information, including your full name and contact details.

- Clearly indicate your foreign tax residency status by selecting the appropriate options.

- Include any additional information required, such as your tax identification number.

- Review the form for completeness and accuracy.

- Submit the form according to the instructions provided.

Required Documents

When filling out the Westpac Foreign Tax Residency Declaration Form, certain documents may be required to support your declaration. These documents typically include:

- A valid form of identification, such as a passport or driver's license.

- Proof of residency, which may include utility bills or lease agreements.

- Your tax identification number or Social Security number.

Having these documents ready will facilitate a smoother completion process and ensure that your declaration is accurate.

Form Submission Methods

The Westpac Foreign Tax Residency Declaration Form can be submitted through various methods, depending on your preference and the options provided by Westpac. Common submission methods include:

- Online submission through Westpac's secure portal.

- Mailing the completed form to the designated address.

- In-person submission at a local Westpac branch.

Choose the method that best suits your needs and ensure that your submission is timely to avoid any potential issues with your tax residency declaration.

Eligibility Criteria

Eligibility to complete the Westpac Foreign Tax Residency Declaration Form generally applies to individuals and entities who hold accounts with Westpac and have foreign tax residency status. To qualify, you must:

- Be a customer of Westpac, either as an individual or a business.

- Have a tax residency status in a foreign country.

- Provide accurate and truthful information regarding your residency status.

Meeting these criteria is essential for the proper processing of your declaration and compliance with tax regulations.

Quick guide on how to complete westpac foreign tax residency declaration form

Complete Westpac Foreign Tax Residency Declaration Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Westpac Foreign Tax Residency Declaration Form on any platform using airSlate SignNow's Android or iOS applications, and enhance any document-centric operation today.

The easiest way to edit and eSign Westpac Foreign Tax Residency Declaration Form seamlessly

- Find Westpac Foreign Tax Residency Declaration Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Westpac Foreign Tax Residency Declaration Form to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the westpac foreign tax residency declaration form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What documentation do I need for foreign tax credit?

File Form 1116, Foreign Tax Credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a foreign country or U.S. possession. Corporations file Form 1118, Foreign Tax Credit—Corporations, to claim a foreign tax credit.

-

How to claim foreign tax credit relief?

How do I claim Foreign Tax Relief? You can claim Foreign Tax Credit Relief when you report your overseas income in your Self Assessment tax return. You must register for Self Assessment before the 5th of October in any given year, and pay by 31st January the year after the tax year you're paying for.

-

How do I record foreign tax credit?

Key Takeaways Classify your foreign income by category, and complete a separate Form 1116 as required. Attach Form 1116 to your tax return. If a foreign tax redetermination occurs, you must file Form 1040-X to notify the IRS of the change to avoid penalties.

-

Why is my bank asking for tax residency in Australia?

For individual or entity customers, foreign tax residency refers to a country (ies) where typically you may be liable to pay tax irrespective of whether a tax return must be filed, or any tax is payable. To comply with these new laws, we may ask you questions about your foreign tax residency.

-

What are the requirements for the foreign tax credit?

To qualify, the tax must be imposed on you by a foreign country or U.S. possession and you must have paid the tax. Taxes on income, wages, dividends, interest, and royalties generally qualify for the foreign tax credit.

-

Can you claim foreign tax credit without filing form 1116?

A taxpayer may be able to claim the foreign tax credit without filing Form 1116 if the following apply: All foreign gross income is passive. A qualified payee statement reports the income and foreign taxes. The total creditable foreign taxes are not more than $300 ($600 for married filing jointly).

Get more for Westpac Foreign Tax Residency Declaration Form

- Form ct 245 iinstructions for form ct 245 maintenance fee tax ny

- Mvms physical education department monthly exercise log form

- Biometric exception form

- Phone number for the dav form

- Arkansas confidential information sheet

- Formulario 8300

- Toyota credit application pdf form

- Initiating application family court form

Find out other Westpac Foreign Tax Residency Declaration Form

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online