Form it 398 New York State Depreciation Schedule for IRC Section 168k Property Tax Year

Understanding Form IT 398 for IRC Section 168k Property

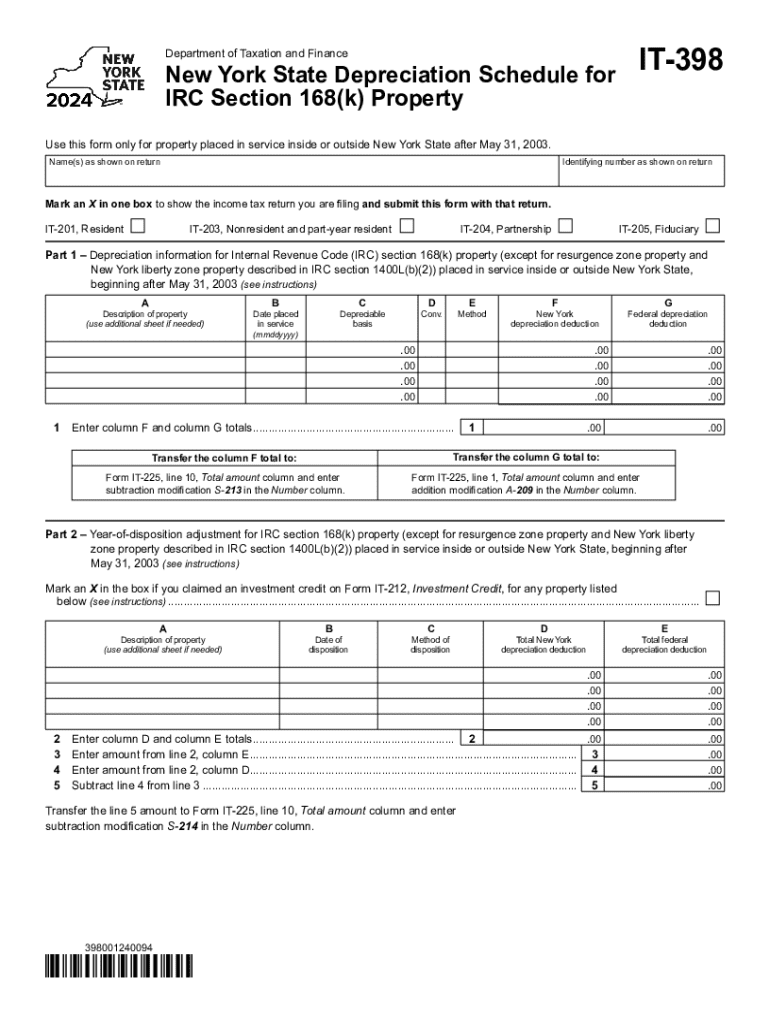

The Form IT 398 is the New York State Depreciation Schedule specifically designed for property that falls under IRC Section 168k. This form is essential for taxpayers who have made qualified property investments and wish to claim depreciation deductions on their state tax returns. The depreciation schedule allows for the systematic allocation of the cost of the property over its useful life, aligning with federal guidelines while adhering to state-specific regulations.

Steps to Complete Form IT 398

Completing Form IT 398 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the property, including purchase invoices and previous depreciation records. Next, enter the property details, such as the type of property and the date it was placed in service. Calculate the depreciation expense according to the guidelines set forth in IRC Section 168k, ensuring to apply any state-specific adjustments. Finally, review the form for completeness before submission.

Key Elements of Form IT 398

Form IT 398 includes several critical components that taxpayers must understand. Key elements consist of property identification, the method of depreciation being applied, and the total amount of depreciation claimed for the tax year. Additionally, the form requires information on any prior depreciation taken and adjustments for state-specific rules. Accurate completion of these elements is crucial for the proper calculation of tax liabilities.

State-Specific Rules for Form IT 398

New York has unique regulations that affect the completion of Form IT 398. Taxpayers must be aware of any modifications to federal depreciation rules that the state may impose. For example, certain property types may be eligible for accelerated depreciation under state law, while others may not. Additionally, understanding the treatment of bonus depreciation and how it interacts with state tax calculations is vital for compliance.

Filing Deadlines for Form IT 398

Filing deadlines for Form IT 398 align with the overall New York State tax return deadlines. Typically, the form must be submitted by the due date of the tax return, which is generally April fifteenth for individual taxpayers. However, extensions may apply, and it is essential to check for any updates regarding deadlines for the current tax year to avoid penalties.

Examples of Using Form IT 398

Utilizing Form IT 398 can vary based on individual taxpayer scenarios. For instance, a small business that purchases new equipment may use the form to claim depreciation over several years, reducing taxable income. Conversely, a property owner who has made significant improvements may also need to file this form to account for the increased value and corresponding depreciation. Each example highlights the importance of accurately reporting depreciation to maximize tax benefits.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 398 new york state depreciation schedule for irc section 168k property tax year 772088881

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the depreciation IRC section?

The depreciation IRC section refers to specific provisions in the Internal Revenue Code that allow businesses to deduct the cost of certain assets over time. Understanding these sections can help businesses optimize their tax strategies and improve cash flow.

-

How can airSlate SignNow assist with depreciation IRC section documentation?

airSlate SignNow provides a seamless way to create, send, and eSign documents related to the depreciation IRC section. This ensures that all necessary paperwork is completed efficiently, allowing businesses to focus on maximizing their deductions.

-

What features does airSlate SignNow offer for managing depreciation IRC section forms?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning, which streamline the management of depreciation IRC section forms. These tools help ensure compliance and accuracy in documentation.

-

Is airSlate SignNow cost-effective for small businesses dealing with depreciation IRC section?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. By simplifying the process of handling depreciation IRC section documents, businesses can save time and reduce administrative costs.

-

Can airSlate SignNow integrate with accounting software for depreciation IRC section management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage depreciation IRC section documentation alongside financial records. This integration enhances efficiency and accuracy in financial reporting.

-

What are the benefits of using airSlate SignNow for depreciation IRC section eSigning?

Using airSlate SignNow for eSigning depreciation IRC section documents offers numerous benefits, including faster turnaround times, enhanced security, and improved tracking of document status. This ensures that your tax-related documents are handled promptly and securely.

-

How does airSlate SignNow ensure compliance with depreciation IRC section regulations?

airSlate SignNow is designed with compliance in mind, providing features that help businesses adhere to depreciation IRC section regulations. This includes secure storage, audit trails, and customizable workflows that align with legal requirements.

Get more for Form IT 398 New York State Depreciation Schedule For IRC Section 168k Property Tax Year

- Account application form template nz 14374334

- Al khazna reimbursement form

- Versenderadresse form

- Sarawak vte risk assesment form july name

- Shipping release form

- Indian association for cognitive behavior iacbt form

- Madhyamik certificate download fill online printable form

- Httpswww ngu ac informsdownload aspx

Find out other Form IT 398 New York State Depreciation Schedule For IRC Section 168k Property Tax Year

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast