INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian River 2005

What is the INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian River

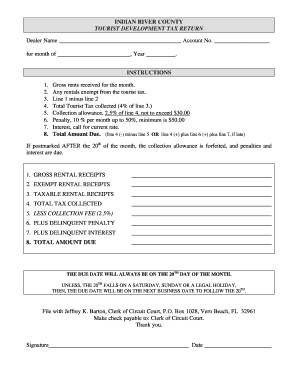

The INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN is a form required by the Clerk of Indian River County for businesses that collect tourist development tax. This tax is imposed on short-term rentals and accommodations within the county, aimed at funding tourism-related projects and initiatives. The form captures essential information about the rental activity, including total rental revenue and the amount of tax collected. Accurate completion of this form is crucial for compliance with local tax regulations.

Steps to complete the INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian River

Completing the INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN involves several steps:

- Gather necessary documentation, including rental income records and tax rates.

- Fill out the form with accurate information, detailing the total revenue and tax collected.

- Review the completed form for any errors or omissions.

- Sign the form electronically or manually, ensuring compliance with signature requirements.

- Submit the form by the designated deadline through the preferred submission method.

Legal use of the INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian River

The legal use of the INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN is governed by local tax laws. This form must be completed accurately to ensure that the tax obligations are met. Electronic submissions are legally valid, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant regulations. Using a reliable electronic signature solution can enhance the legal standing of the submitted form.

Form Submission Methods (Online / Mail / In-Person)

The INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN can be submitted through various methods:

- Online: Use an electronic filing system provided by the Clerk's office.

- Mail: Send the completed form to the designated address for tax returns.

- In-Person: Deliver the form directly to the Clerk's office during business hours.

Filing Deadlines / Important Dates

It is essential to adhere to filing deadlines for the INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN to avoid penalties. Typically, the form is due on a monthly basis, with specific deadlines set by the Clerk's office. Keeping track of these dates ensures timely compliance and helps maintain good standing with local tax authorities.

Key elements of the INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian River

Key elements of the INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN include:

- Taxpayer Information: Name, address, and contact details of the business or individual filing.

- Rental Income: Total income generated from short-term rentals during the reporting period.

- Tax Calculation: The total amount of tourist development tax collected, calculated based on local tax rates.

- Signature: An affirmation that the information provided is accurate and complete.

Quick guide on how to complete indian river county tourist development tax return clerk indian river

Complete INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian river effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without any holdups. Handle INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian river on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian river effortlessly

- Find INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian river and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign function, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian river to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indian river county tourist development tax return clerk indian river

Create this form in 5 minutes!

How to create an eSignature for the indian river county tourist development tax return clerk indian river

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian river?

The INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian river is an official mechanism through which businesses in Indian River County report and remit their tourist development taxes. This tax is essential for funding local tourism initiatives and improving community services. Understanding the requirements and processes involved can greatly benefit local businesses.

-

How can airSlate SignNow help with the INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian river?

airSlate SignNow offers a streamlined solution for sending and eSigning documents related to the INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian river. Our platform simplifies the preparation and submission of required tax documents, ensuring compliance while saving time. With our user-friendly interface, you can easily manage your documentation needs.

-

What features does airSlate SignNow provide for handling tax returns?

airSlate SignNow includes powerful features such as customizable templates, real-time tracking, and status updates. These capabilities simplify the process of submitting your INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian river. Our solution is designed to enhance your workflow and reduce any compliance-related stress.

-

Is airSlate SignNow cost-effective for small businesses managing tax documents?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing the INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian river. Our pricing plans are designed to fit various budgets while providing robust features to assist in document management. By investing in our platform, businesses can save both time and resources on tax-related tasks.

-

Can airSlate SignNow integrate with other accounting software for tax filing?

Absolutely! airSlate SignNow easily integrates with popular accounting software, enhancing your ability to manage the INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian river. By utilizing these integrations, you can streamline the flow of information between platforms, ensuring accurate and timely submissions of your tax returns.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for managing your INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian river documents brings several benefits. These include increased efficiency through automated workflows, enhanced security for sensitive data, and reduced manual errors in the submission process. Our tool ensures that your tax compliance tasks are handled effectively.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security for all users, especially when dealing with sensitive tax information like the INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian river. We employ advanced encryption protocols and stringent security measures to protect your documents. You can trust our solution to keep your tax details safe.

Get more for INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian river

- Instructions for claiming unemployment benefits nj department of form

- Grievance procedure form

- Forms old north state council

- No showcancellation policyorange coast womens form

- Unemployment packet minnesota judicial branch mncourts form

- Independent school district no 727 big lake minnesota form

- Swchs staff applicationdocx form

- Pera form

Find out other INDIAN RIVER COUNTY TOURIST DEVELOPMENT TAX RETURN Clerk Indian river

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile