R 1353 799 State of Louisiana Department of Reven 2024-2026

Understanding the R 1353 799 Form

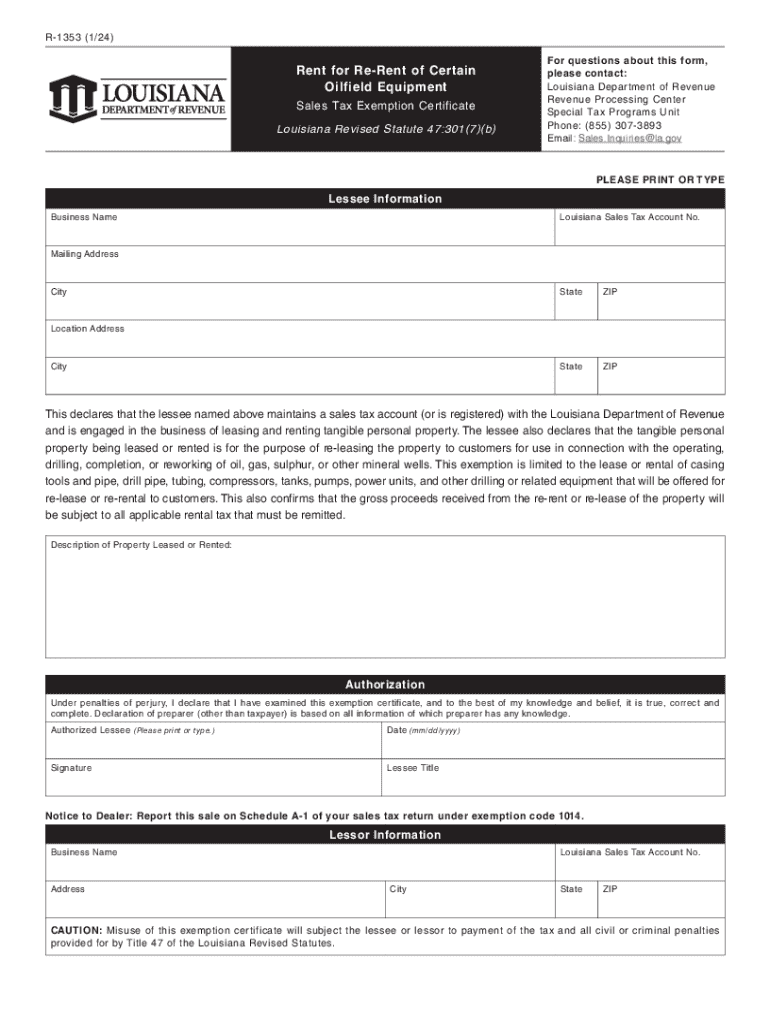

The R 1353 799 form, issued by the State of Louisiana Department of Revenue, is a crucial document for taxpayers in Louisiana. It is primarily used for reporting specific tax information and ensuring compliance with state tax regulations. This form is essential for individuals and businesses alike, as it helps in the accurate reporting of income and deductions, ultimately affecting tax liabilities.

Steps to Complete the R 1353 799 Form

Completing the R 1353 799 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and prior tax returns. Next, carefully fill out each section of the form, ensuring that all figures are accurate and correspond to your financial records. Pay special attention to any specific instructions provided by the Louisiana Department of Revenue. Once completed, review the form for any errors before submission.

Required Documents for the R 1353 799 Form

To successfully complete the R 1353 799 form, you will need to provide several supporting documents. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation for any deductions claimed, such as receipts or statements

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother filing process and help ensure that all information reported is accurate.

Filing Deadlines for the R 1353 799 Form

It is important to be aware of the filing deadlines associated with the R 1353 799 form to avoid penalties. Typically, the deadline for submission coincides with the federal tax filing deadline, which is usually April fifteenth. However, if additional time is needed, taxpayers may apply for an extension, but it is crucial to ensure that any taxes owed are paid by the original deadline to avoid interest and penalties.

Legal Use of the R 1353 799 Form

The R 1353 799 form must be used in accordance with Louisiana state tax laws. It is legally binding and provides the state with necessary information regarding an individual’s or business’s tax obligations. Misuse or failure to file this form can result in significant penalties, including fines or legal action. Therefore, understanding the legal implications of this form is essential for compliance.

Who Issues the R 1353 799 Form

The R 1353 799 form is issued by the Louisiana Department of Revenue, which is responsible for administering state tax laws and ensuring compliance among taxpayers. This department provides resources and support for individuals and businesses to help them navigate the complexities of state taxation, including guidance on how to properly fill out and submit the R 1353 799 form.

Create this form in 5 minutes or less

Find and fill out the correct r 1353 799 state of louisiana department of reven

Create this form in 5 minutes!

How to create an eSignature for the r 1353 799 state of louisiana department of reven

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the 47 301 in airSlate SignNow?

The 47 301 refers to a specific feature set within airSlate SignNow that enhances document management and eSigning capabilities. This feature allows users to streamline their workflows, ensuring that documents are signed and processed efficiently. By utilizing the 47 301, businesses can improve their operational efficiency and reduce turnaround times.

-

How does airSlate SignNow's pricing structure relate to the 47 301 feature?

The pricing for airSlate SignNow is designed to be cost-effective while providing access to essential features like the 47 301. Customers can choose from various plans that include this feature, ensuring they get the best value for their investment. This flexibility allows businesses of all sizes to benefit from advanced eSigning capabilities without breaking the bank.

-

What are the key benefits of using the 47 301 feature in airSlate SignNow?

Using the 47 301 feature in airSlate SignNow offers numerous benefits, including enhanced security, faster document turnaround, and improved collaboration. This feature allows users to track document status in real-time, ensuring that all parties are informed throughout the signing process. Ultimately, the 47 301 helps businesses save time and reduce errors.

-

Can I integrate the 47 301 feature with other applications?

Yes, the 47 301 feature in airSlate SignNow can be seamlessly integrated with various applications, enhancing its functionality. This integration allows users to connect their existing tools and workflows, making document management even more efficient. By leveraging these integrations, businesses can maximize the benefits of the 47 301 feature.

-

Is the 47 301 feature suitable for small businesses?

Absolutely! The 47 301 feature in airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises. Its user-friendly interface and cost-effective pricing make it an ideal solution for small businesses looking to streamline their document signing processes. With the 47 301, small businesses can compete effectively in their markets.

-

What types of documents can I manage with the 47 301 feature?

The 47 301 feature in airSlate SignNow supports a wide range of document types, including contracts, agreements, and forms. This versatility allows users to manage all their essential documents in one place, simplifying the eSigning process. Whether you need to send a simple form or a complex contract, the 47 301 has you covered.

-

How does the 47 301 feature enhance security for my documents?

The 47 301 feature in airSlate SignNow includes advanced security measures to protect your documents during the signing process. This includes encryption, secure access controls, and audit trails that track every action taken on a document. By utilizing the 47 301, businesses can ensure that their sensitive information remains secure.

Get more for R 1353 799 State Of Louisiana Department Of Reven

- Chase credit card agreement form

- Af form 1466 11603472

- Orthodontics claim form pinellas county pinellascounty

- How to reactivate standard chartered bank account form

- Celebrity form

- Ap biology chapter 41 reading guide answers form

- Underage permissionwithdrawal form

- News career enrichment center albuquerque public schools form

Find out other R 1353 799 State Of Louisiana Department Of Reven

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form