Form 965 a Rev January Individual Report of Net 965 Tax Liability

What is the Form 965 A Rev January Individual Report of Net 965 Tax Liability

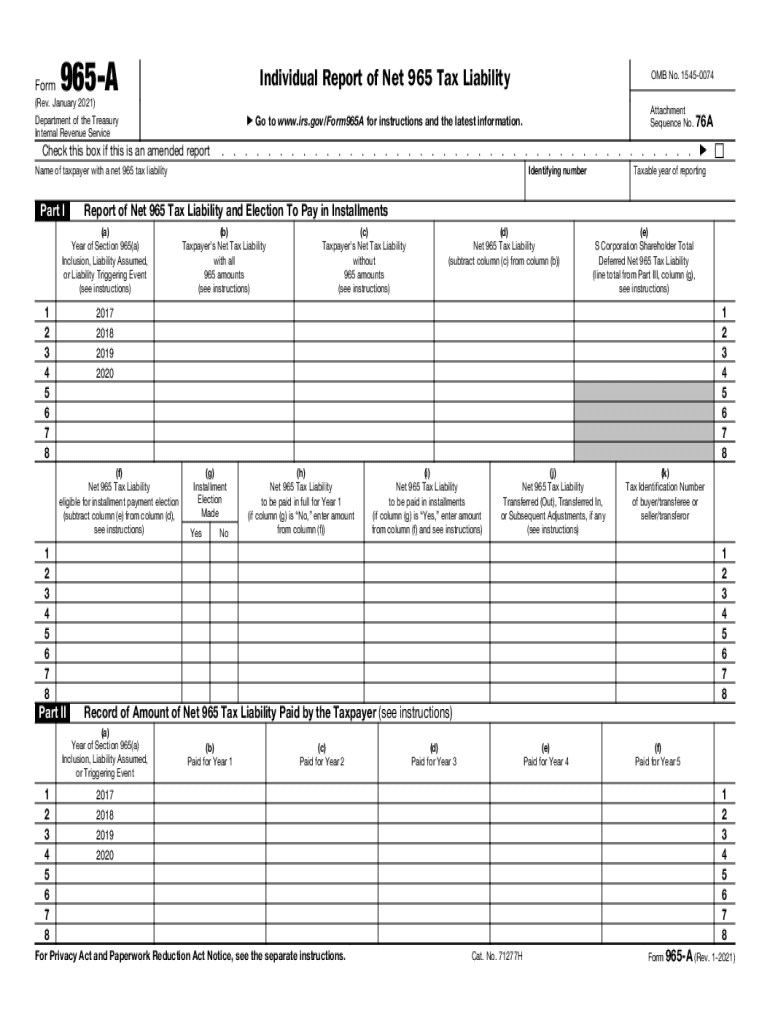

The Form 965 A Rev January is a crucial document used by individuals to report their net tax liability under the provisions of Section 965 of the Internal Revenue Code. This form is specifically designed for taxpayers who have income from foreign corporations and need to comply with U.S. tax regulations regarding repatriated earnings. It provides a structured way to calculate and disclose the tax owed on these earnings, ensuring that individuals meet their legal obligations while also benefiting from any applicable tax credits or deductions.

How to Use the Form 965 A Rev January Individual Report of Net 965 Tax Liability

To effectively use the Form 965 A, individuals must first gather all necessary financial information related to their foreign income. This includes details about the foreign corporations in which they have ownership and any distributions received. Once the relevant data is compiled, taxpayers can fill out the form, ensuring that all calculations are accurate. The form must then be submitted to the IRS as part of the individual's tax return, typically alongside Form 1040. It is important to keep a copy of the completed form for personal records and future reference.

Steps to Complete the Form 965 A Rev January Individual Report of Net 965 Tax Liability

Completing the Form 965 A involves several key steps:

- Gather all relevant financial documents, including details of foreign income and distributions.

- Carefully fill out each section of the form, ensuring that all calculations are precise.

- Review the completed form for accuracy and completeness.

- Submit the form along with your annual tax return to the IRS.

Following these steps will help ensure compliance with tax regulations and minimize the risk of errors that could lead to penalties.

Key Elements of the Form 965 A Rev January Individual Report of Net 965 Tax Liability

Key elements of the Form 965 A include sections for reporting the total amount of foreign income, any applicable deductions, and the calculated net tax liability. It also requires taxpayers to provide information about the foreign corporations involved, including their names, addresses, and tax identification numbers. Understanding these components is essential for accurate reporting and compliance with IRS guidelines.

Filing Deadlines / Important Dates

Timely filing of the Form 965 A is critical to avoid penalties. The form is typically due on the same date as the individual's tax return, which is usually April 15th of each year. If additional time is needed, taxpayers may file for an extension, but it is important to ensure that the form is submitted by the extended deadline to remain compliant with tax laws.

Penalties for Non-Compliance

Failure to file the Form 965 A or inaccuracies in reporting can result in significant penalties. The IRS may impose fines for late submissions, and taxpayers may also face interest charges on any unpaid taxes. Additionally, non-compliance can lead to audits or further scrutiny of an individual's tax affairs, making it essential to adhere to all filing requirements and deadlines.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 965 a rev january individual report of net 965 tax liability

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 965 a and how does it relate to airSlate SignNow?

965 a refers to a specific feature set within airSlate SignNow that enhances document management and eSigning capabilities. This feature allows users to streamline their workflows, making it easier to send, sign, and manage documents efficiently.

-

How much does airSlate SignNow cost for using the 965 a features?

The pricing for airSlate SignNow varies based on the plan you choose, but it includes access to the 965 a features. These plans are designed to be cost-effective, ensuring that businesses of all sizes can benefit from advanced eSigning and document management solutions.

-

What are the key benefits of using the 965 a features in airSlate SignNow?

Using the 965 a features in airSlate SignNow provides numerous benefits, including increased efficiency in document processing, enhanced security for sensitive information, and improved collaboration among team members. These advantages help businesses save time and reduce operational costs.

-

Can I integrate airSlate SignNow with other applications while using the 965 a features?

Yes, airSlate SignNow supports integrations with various applications, allowing you to leverage the 965 a features seamlessly. This capability ensures that you can connect your existing tools and workflows, enhancing productivity and streamlining processes.

-

Is it easy to use the 965 a features in airSlate SignNow?

Absolutely! The 965 a features in airSlate SignNow are designed with user-friendliness in mind. The intuitive interface allows users to quickly learn how to send and eSign documents, making it accessible for everyone, regardless of technical expertise.

-

What types of documents can I manage with the 965 a features?

With the 965 a features in airSlate SignNow, you can manage a wide variety of documents, including contracts, agreements, and forms. This versatility ensures that you can handle all your document needs in one place, simplifying your workflow.

-

Are there any security measures in place for the 965 a features?

Yes, airSlate SignNow prioritizes security, especially with the 965 a features. The platform employs advanced encryption and compliance with industry standards to protect your documents and sensitive information throughout the signing process.

Get more for Form 965 A Rev January Individual Report Of Net 965 Tax Liability

Find out other Form 965 A Rev January Individual Report Of Net 965 Tax Liability

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF