P31202201W West Virginia Tax Division Form

Overview of the West Virginia Tax Form IT-140

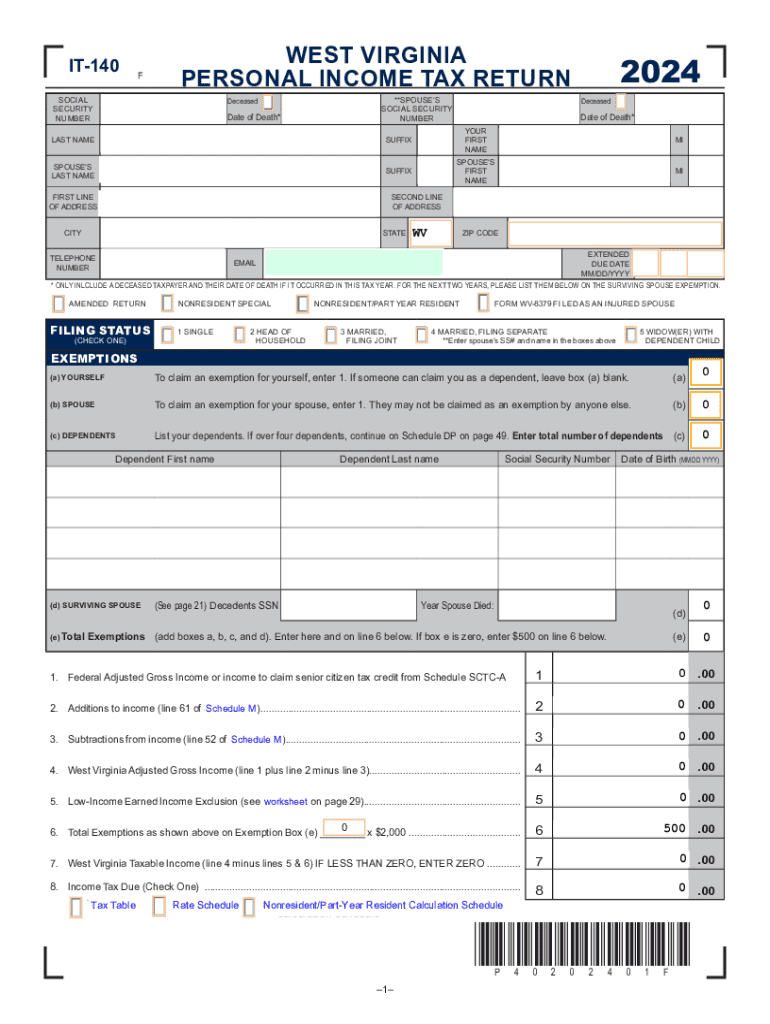

The West Virginia Tax Form IT-140 is a crucial document for residents filing their state income tax returns. This form is designed for individual taxpayers, including those who are self-employed or have other sources of income. It helps determine the amount of state tax owed based on income, deductions, and credits. Understanding this form is essential for accurate tax filing and compliance with state regulations.

Steps to Complete the West Virginia Tax Form IT-140

Filling out the IT-140 involves several key steps:

- Gather necessary documents: Collect your W-2s, 1099s, and any other relevant income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Input your total income from various sources as indicated on your documents.

- Claim deductions and credits: Identify any eligible deductions or credits that may reduce your taxable income.

- Calculate your tax: Use the provided tax tables to determine the amount owed based on your taxable income.

- Sign and date the form: Ensure you sign the form to validate your submission.

Filing Deadlines for the West Virginia Tax Form IT-140

It is important to be aware of the filing deadlines for the IT-140 to avoid penalties. Typically, the deadline for submitting your state tax return is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider requesting an extension if they are unable to file by the deadline.

Required Documents for the West Virginia Tax Form IT-140

To complete the IT-140 accurately, several documents are necessary:

- W-2 Forms: These are provided by employers and detail your earnings and tax withholdings.

- 1099 Forms: For self-employed individuals or those with freelance income, these forms report various types of income.

- Proof of deductions: Receipts or documentation for any deductions you plan to claim, such as medical expenses or charitable contributions.

- Previous year's tax return: This can help ensure consistency and accuracy in reporting your income and deductions.

Submission Methods for the West Virginia Tax Form IT-140

Taxpayers have several options for submitting their IT-140 forms:

- Online filing: Many taxpayers choose to file electronically through approved e-filing services, which can streamline the process.

- Mail: Completed forms can be sent to the West Virginia State Tax Department via postal service. Ensure you use the correct address based on your location.

- In-person submission: Taxpayers may also visit local tax offices to submit their forms directly.

Eligibility Criteria for the West Virginia Tax Form IT-140

To file the IT-140, taxpayers must meet certain eligibility criteria:

- Residency: You must be a resident of West Virginia for the tax year in question.

- Income level: The form is intended for individuals whose income exceeds the state's minimum filing requirement.

- Age: There are no specific age restrictions, but all individuals must have a valid Social Security number.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the p31202201w west virginia tax division

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the wv tax form it 140?

The wv tax form it 140 is the West Virginia Personal Income Tax Return form used by residents to report their income and calculate their tax liability. It is essential for individuals to complete this form accurately to ensure compliance with state tax laws.

-

How can airSlate SignNow help with the wv tax form it 140?

airSlate SignNow provides a seamless platform for eSigning and sending the wv tax form it 140. With our user-friendly interface, you can easily fill out, sign, and share your tax documents securely, ensuring a hassle-free filing process.

-

Is there a cost associated with using airSlate SignNow for the wv tax form it 140?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Our cost-effective solutions ensure that you can manage your wv tax form it 140 and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing the wv tax form it 140?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of the wv tax form it 140. These tools streamline the process, making it easier to handle your tax documents efficiently.

-

Can I integrate airSlate SignNow with other software for the wv tax form it 140?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage your wv tax form it 140 alongside your other business tools. This integration helps maintain workflow efficiency and keeps all your documents organized.

-

What are the benefits of using airSlate SignNow for the wv tax form it 140?

Using airSlate SignNow for the wv tax form it 140 offers numerous benefits, including enhanced security, ease of use, and time savings. Our platform ensures that your documents are signed and sent quickly, reducing the stress associated with tax filing.

-

Is airSlate SignNow compliant with tax regulations for the wv tax form it 140?

Yes, airSlate SignNow is designed to comply with all relevant tax regulations, ensuring that your wv tax form it 140 is handled in accordance with legal requirements. Our commitment to compliance helps you avoid potential issues during tax season.

Get more for P31202201W West Virginia Tax Division

- Special or limited power of attorney for real estate purchase transaction by purchaser vermont form

- Limited power of attorney where you specify powers with sample powers included vermont form

- Limited power of attorney for stock transactions and corporate powers vermont form

- Special durable power of attorney for bank account matters vermont form

- Vermont small business startup package vermont form

- Vermont property management package vermont form

- New resident guide vermont form

- Satisfaction release or cancellation of mortgage by corporation vermont form

Find out other P31202201W West Virginia Tax Division

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement