, or Tax Year Beginning , 20 , and Ending , 20 2012-2026

Understanding the Tax Year Beginning and Ending

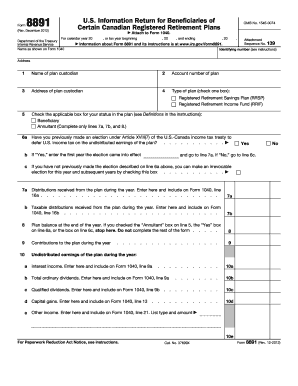

The form for the tax year beginning and ending is essential for taxpayers to report their income and expenses accurately. This form specifies the start and end dates of the tax year, which can vary based on the individual or business's accounting methods. Understanding these dates is crucial as they determine the period for which income and deductions will be reported to the Internal Revenue Service (IRS).

Steps to Complete the Tax Year Form

Filling out the tax year beginning and ending form involves several steps:

- Identify the tax year you are reporting for, ensuring the correct start and end dates are noted.

- Gather all necessary financial documents, including income statements and expense receipts.

- Follow the instructions provided on the form carefully to ensure all sections are completed accurately.

- Review the completed form for any errors or omissions before submission.

Legal Use of the Tax Year Form

This form is legally required for individuals and businesses to report their income to the IRS. Accurate completion is vital to comply with federal tax laws and avoid potential penalties. Misreporting or failing to file can lead to legal consequences, including fines or audits.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the tax year form. Generally, the deadline for submitting this form is April fifteenth of the following year. However, if the deadline falls on a weekend or holiday, it may be extended. Keeping track of these dates helps ensure timely compliance with tax obligations.

Required Documents for Filing

To complete the tax year beginning and ending form, you will need several documents:

- W-2 forms from employers, if applicable.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses.

- Any other relevant financial statements that reflect your income and expenses during the tax year.

Examples of Using the Tax Year Form

Consider a self-employed individual who needs to report income from their business. They would use the tax year form to indicate the period during which they earned income and incurred expenses. By accurately reflecting these dates, they can ensure that their tax calculations are correct and that they claim all eligible deductions.

IRS Guidelines for the Tax Year Form

The IRS provides specific guidelines on how to fill out the tax year beginning and ending form. These guidelines include instructions on what information to include, how to report various types of income, and the importance of maintaining accurate records. Following these guidelines helps ensure compliance and reduces the risk of errors in tax reporting.

Create this form in 5 minutes or less

Find and fill out the correct or tax year beginning 20 and ending 20

Create this form in 5 minutes!

How to create an eSignature for the or tax year beginning 20 and ending 20

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to ', Or Tax Year Beginning , 20 , And Ending , 20'?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. It streamlines the signing process, making it easier to manage documents related to ', Or Tax Year Beginning , 20 , And Ending , 20'. This ensures that your tax-related documents are handled efficiently and securely.

-

How does airSlate SignNow help with tax document management for ', Or Tax Year Beginning , 20 , And Ending , 20'?

With airSlate SignNow, you can easily create, send, and store tax documents for ', Or Tax Year Beginning , 20 , And Ending , 20'. The platform allows for quick access to signed documents, ensuring compliance and organization during tax season. This helps businesses stay on top of their tax obligations.

-

What pricing plans does airSlate SignNow offer for businesses dealing with ', Or Tax Year Beginning , 20 , And Ending , 20'?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses managing documents for ', Or Tax Year Beginning , 20 , And Ending , 20'. Whether you are a small business or a large enterprise, there is a plan that fits your budget and requirements. You can choose from monthly or annual subscriptions.

-

What features does airSlate SignNow provide for handling tax documents?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, all of which are essential for managing tax documents for ', Or Tax Year Beginning , 20 , And Ending , 20'. These features enhance productivity and ensure that your documents are always accessible and compliant.

-

Can airSlate SignNow integrate with other software for tax preparation?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easier to manage documents related to ', Or Tax Year Beginning , 20 , And Ending , 20'. This integration allows for a smoother workflow, reducing the time spent on document management and increasing efficiency.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including enhanced security, faster turnaround times, and improved organization. For ', Or Tax Year Beginning , 20 , And Ending , 20', these advantages can lead to a more streamlined tax filing process, helping businesses avoid delays and penalties.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to send and sign documents, even if they are unfamiliar with eSigning. This is particularly beneficial for managing tax documents for ', Or Tax Year Beginning , 20 , And Ending , 20', as it simplifies the process for all users.

Get more for , Or Tax Year Beginning , 20 , And Ending , 20

- Demand to produce copy of will from heir to executor or person in possession of will michigan form

- Minnesota affidavit form

- Affidavit service mail form

- Affidavit of personal service minnesota form

- Mn service mail form

- Affidavit of personal service minnesota 497311813 form

- Affidavits of service minnesota form

- Mn service mail 497311815 form

Find out other , Or Tax Year Beginning , 20 , And Ending , 20

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form