Irs 8891 Form 2006

What is the IRS 8891 Form

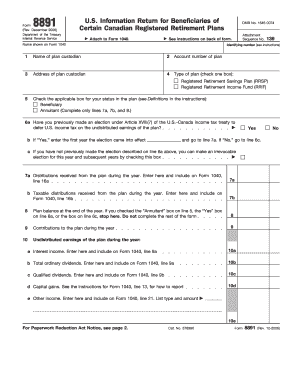

The IRS 8891 Form, officially known as the "U.S. Information Return for Beneficiaries of Certain Canadian Retirement Plans," is a tax form used by U.S. citizens and residents who are beneficiaries of Canadian registered retirement plans. This form is essential for reporting income from these plans to the Internal Revenue Service (IRS) and ensuring compliance with U.S. tax laws. The IRS 8891 Form helps individuals avoid double taxation on their retirement income by providing necessary information about their Canadian retirement accounts.

How to use the IRS 8891 Form

Using the IRS 8891 Form involves several key steps. First, individuals must gather information about their Canadian retirement plans, including account details and the amounts received during the tax year. Next, the form must be filled out accurately, detailing the income received and any applicable deductions. Once completed, the form should be submitted along with the individual's annual tax return. It is crucial to ensure that all information is correct to avoid potential penalties or issues with the IRS.

Steps to complete the IRS 8891 Form

Completing the IRS 8891 Form requires a systematic approach:

- Gather necessary documents, including tax statements from your Canadian retirement plans.

- Provide personal information, including your name, address, and Social Security number.

- Report the total income received from the Canadian plans for the tax year.

- Include any adjustments or deductions that apply to your situation.

- Review the form for accuracy before submission.

After completing the form, it should be attached to your tax return when filing. Ensure you keep a copy for your records.

Legal use of the IRS 8891 Form

The IRS 8891 Form is legally required for U.S. citizens and residents who receive income from Canadian retirement plans. Filing this form helps ensure compliance with U.S. tax laws and avoids potential penalties for failing to report foreign income. It is important to understand that using this form correctly can also aid in claiming any tax treaty benefits available under the U.S.-Canada tax treaty, which can reduce the tax burden on retirement income.

Filing Deadlines / Important Dates

Filing deadlines for the IRS 8891 Form align with the standard tax return deadlines. Typically, individuals must submit their tax returns, including the IRS 8891 Form, by April 15 of each year. If additional time is needed, individuals can file for an extension, allowing them until October 15 to submit their returns. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To complete the IRS 8891 Form, several documents are necessary:

- Tax statements from Canadian retirement accounts, detailing income received.

- Personal identification, including your Social Security number.

- Any relevant tax treaty documentation that may apply.

Having these documents ready will facilitate a smoother filing process and help ensure that all information reported is accurate and complete.

Create this form in 5 minutes or less

Find and fill out the correct irs 8891 form

Create this form in 5 minutes!

How to create an eSignature for the irs 8891 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Irs 8891 Form and why is it important?

The Irs 8891 Form is used by U.S. citizens and residents to report their foreign financial accounts. It is crucial for compliance with U.S. tax laws and helps avoid penalties. Understanding how to properly fill out the Irs 8891 Form can save you time and ensure you meet all legal requirements.

-

How can airSlate SignNow help with the Irs 8891 Form?

airSlate SignNow provides an efficient platform for electronically signing and sending the Irs 8891 Form. Our user-friendly interface simplifies the process, allowing you to complete and submit your form quickly. With airSlate SignNow, you can ensure that your documents are securely signed and stored.

-

What are the pricing options for using airSlate SignNow for the Irs 8891 Form?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you can manage documents like the Irs 8891 Form effectively. Visit our pricing page for detailed information.

-

Are there any features specifically designed for handling the Irs 8891 Form?

Yes, airSlate SignNow includes features that streamline the process of handling the Irs 8891 Form. These features include customizable templates, automated reminders, and secure storage options. This ensures that your form is completed accurately and submitted on time.

-

Can I integrate airSlate SignNow with other software for the Irs 8891 Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for the Irs 8891 Form. Whether you use accounting software or document management systems, our integrations help you manage your forms more efficiently.

-

What are the benefits of using airSlate SignNow for the Irs 8891 Form?

Using airSlate SignNow for the Irs 8891 Form offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform allows you to eSign documents quickly, reducing the hassle of traditional paperwork. Additionally, you can track the status of your forms in real-time.

-

Is airSlate SignNow secure for submitting the Irs 8891 Form?

Yes, airSlate SignNow prioritizes security, ensuring that your Irs 8891 Form and other documents are protected. We use advanced encryption and secure cloud storage to keep your information safe. You can trust that your sensitive data is handled with the utmost care.

Get more for Irs 8891 Form

- Suzanneamp39s application for employment homemades by suzanne form

- Room rental agreement 4doc form

- Certificate of occupancy waiver city of spring lake park slpmn form

- Lease transfer letter form

- Homeowners affidavit form

- Www spokeo commspearlwho lives at 2420 old brandon rd pearl ms 39208spokeo form

- Bank draft authorization tenant brussellpmbbcomb form

- Current rental residents russell property management form

Find out other Irs 8891 Form

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy