FORM 31 103F1 CALCULATION of EXCESS WORKING CAPITAL 2011

Understanding the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL

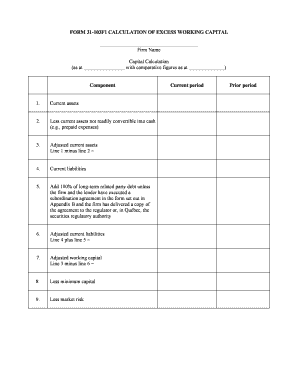

The FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL is a financial document used primarily by businesses to assess their working capital needs. This form helps organizations determine the excess working capital they possess, which can be crucial for making informed financial decisions. Understanding this form is essential for business owners and financial managers as it provides insights into liquidity and operational efficiency.

Steps to Complete the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL

Completing the FORM 31 103F1 involves several key steps. First, gather all necessary financial data, including current assets and current liabilities. Next, calculate the working capital by subtracting current liabilities from current assets. This figure will help you identify whether you have excess working capital. Follow the specific instructions provided on the form to ensure accurate completion. Finally, review the form for any errors before submission.

Legal Use of the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL

The FORM 31 103F1 is legally recognized and must be completed accurately to comply with financial reporting requirements. Businesses may be required to submit this form to regulatory bodies or for internal assessments. Failure to comply with the legal stipulations associated with this form can lead to penalties or issues with financial audits.

Key Elements of the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL

Several key elements are essential when filling out the FORM 31 103F1. These include:

- Current Assets: This includes cash, accounts receivable, inventory, and other short-term assets.

- Current Liabilities: This encompasses accounts payable, short-term debt, and other obligations due within one year.

- Working Capital Calculation: The formula is Current Assets minus Current Liabilities.

- Excess Working Capital: This is the amount left after determining the necessary working capital for operations.

How to Obtain the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL

The FORM 31 103F1 can be obtained through various channels. Typically, businesses can download the form from official state or federal websites. Additionally, financial institutions or accounting firms may provide copies of the form. It is important to ensure that you are using the most current version to comply with regulations.

Examples of Using the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL

Businesses may use the FORM 31 103F1 in various scenarios. For instance, a company seeking to expand may assess its excess working capital to determine how much additional funding it can secure. Another example is during annual financial reviews, where businesses evaluate their liquidity position to ensure they can meet short-term obligations. These examples illustrate the form's practical application in real-world financial planning.

Create this form in 5 minutes or less

Find and fill out the correct form 31 103f1 calculation of excess working capital

Create this form in 5 minutes!

How to create an eSignature for the form 31 103f1 calculation of excess working capital

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL?

The FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL is a financial document used to determine the excess working capital of a business. This calculation helps businesses assess their liquidity and operational efficiency, ensuring they have sufficient resources to meet short-term obligations.

-

How can airSlate SignNow assist with the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign documents related to the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL. Our solution simplifies the documentation process, allowing for quick and secure transactions that enhance operational efficiency.

-

What features does airSlate SignNow offer for managing the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL?

With airSlate SignNow, you can easily create templates for the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL, automate workflows, and track document status in real-time. These features ensure that your financial documentation is accurate and efficiently managed.

-

Is airSlate SignNow cost-effective for businesses needing the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By reducing the time and resources spent on document management, our platform helps you save money while ensuring compliance with the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL requirements.

-

Can I integrate airSlate SignNow with other tools for the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL?

Absolutely! airSlate SignNow offers seamless integrations with various business tools and software, enhancing your ability to manage the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL. This integration capability allows for a more cohesive workflow across your organization.

-

What are the benefits of using airSlate SignNow for the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL?

Using airSlate SignNow for the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL provides numerous benefits, including improved accuracy, faster processing times, and enhanced security. Our platform ensures that your financial documents are handled efficiently and securely.

-

How does airSlate SignNow ensure the security of the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL?

airSlate SignNow prioritizes security by implementing advanced encryption and authentication measures for all documents, including the FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL. This ensures that your sensitive financial information remains protected throughout the signing process.

Get more for FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL

- Supliment la diplom diploma supplement ugbro form

- Www viega comcontentdamsafety data sheet in accordance with 1907ec viega com form

- Cell organelles worksheet form

- Britcay bmedb group insurance applicationindd cayman islands form

- Hubbard gym schedule form

- Cia awbp application for admission ciachef form

- William j feingold scholarship program form

- Emb0118embryo transfer enrollment for overnight form

Find out other FORM 31 103F1 CALCULATION OF EXCESS WORKING CAPITAL

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template