Form 14039Internal Revenue Service 2016-2026

Understanding the DTF 275 Form

The DTF 275 form is a crucial document used for tax purposes in the state of New York. It is primarily utilized to claim a refund of sales tax paid on purchases. This form is particularly relevant for individuals and businesses that have overpaid sales tax or are eligible for certain exemptions. Understanding the specifics of the DTF 275 form can help ensure that taxpayers receive the refunds they are entitled to, thereby promoting compliance with state tax regulations.

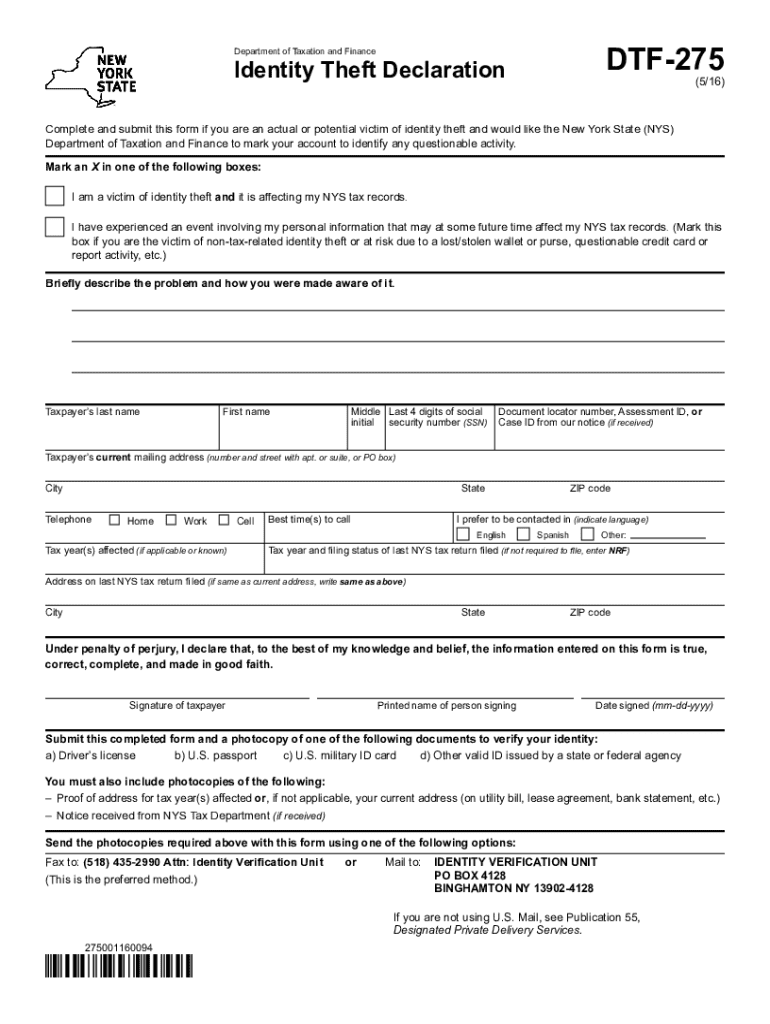

Steps to Complete the DTF 275 Form

Completing the DTF 275 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including receipts and proof of payment for the sales tax in question. Next, accurately fill out the form, providing detailed information about the purchases and the reasons for the refund claim. It is essential to double-check all entries for correctness before submission. Finally, submit the completed form to the appropriate New York State tax authority, either by mail or electronically, depending on the options available.

Eligibility Criteria for the DTF 275 Form

To qualify for filing the DTF 275 form, certain eligibility criteria must be met. Taxpayers must have incurred sales tax on eligible purchases and have documentation to support their claims. Additionally, the purchases must not fall under any exemptions that would negate the need for a refund. Understanding these criteria can help taxpayers determine if they are eligible to file the DTF 275 form, ensuring that they do not miss out on potential refunds.

Required Documents for the DTF 275 Form

When preparing to file the DTF 275 form, it is important to gather all required documents to support your claim. This typically includes receipts for the purchases made, proof of payment of the sales tax, and any other relevant documentation that substantiates the refund request. Having these documents organized and readily available will streamline the process and help avoid delays in processing the refund.

Form Submission Methods for the DTF 275 Form

Taxpayers have several options for submitting the DTF 275 form. The form can be submitted by mail to the designated New York State tax office. Additionally, electronic submission may be available, allowing for a quicker and more efficient process. It is important to check the latest guidelines from the New York State Department of Taxation and Finance to determine the most suitable submission method and any associated deadlines.

IRS Guidelines Related to the DTF 275 Form

While the DTF 275 form is specific to New York State, it is essential to be aware of IRS guidelines that may impact its use. Understanding how state tax regulations align with federal tax laws can provide clarity on filing requirements and potential implications for taxpayers. Staying informed about these guidelines helps ensure compliance and maximizes the chances of a successful refund claim.

Common Scenarios for Using the DTF 275 Form

There are various scenarios in which individuals and businesses may find the DTF 275 form applicable. For example, a business that purchased equipment and paid sales tax may seek a refund if the equipment is later returned. Similarly, individuals who made purchases for which they qualify for sales tax exemptions may also use this form to reclaim overpaid taxes. Recognizing these scenarios can assist taxpayers in identifying when to utilize the DTF 275 form effectively.

Create this form in 5 minutes or less

Find and fill out the correct form 14039internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 14039internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DTF 275 form and why is it important?

The DTF 275 form is a crucial document used for tax purposes in various jurisdictions. It helps businesses report specific financial information accurately. Understanding how to fill out the DTF 275 form can streamline your tax filing process and ensure compliance with local regulations.

-

How can airSlate SignNow help with the DTF 275 form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the DTF 275 form. Our solution simplifies the document management process, allowing you to complete and share the form quickly and securely. This efficiency can save you time and reduce the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the DTF 275 form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our plans are cost-effective, ensuring you get the best value while managing documents like the DTF 275 form. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the DTF 275 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for forms like the DTF 275. These features enhance your workflow, making it easier to manage and store important documents. Additionally, our platform is user-friendly, ensuring a smooth experience.

-

Can I integrate airSlate SignNow with other software for the DTF 275 form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the DTF 275 form. Whether you use CRM systems or accounting software, our integrations help you manage documents more efficiently.

-

What are the benefits of using airSlate SignNow for the DTF 275 form?

Using airSlate SignNow for the DTF 275 form provides numerous benefits, including enhanced security, faster processing times, and reduced paper usage. Our platform ensures that your documents are stored securely and can be accessed anytime. This not only saves time but also contributes to a more sustainable business practice.

-

How secure is airSlate SignNow when handling the DTF 275 form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your DTF 275 form and other sensitive documents. You can trust that your information is safe while using our platform for eSigning and document management.

Get more for Form 14039Internal Revenue Service

- Day trip application girl scouts of eastern pennsylvania gsep form

- Atcs proficiency manager request form form 8000 44 faa faa

- Cbct referral form conebeam ct centre conebeamctcentre co

- It 11 form

- Stray animal intake form 20087626

- Irs f8871 form

- Eastern band cherokee enrollment form

- B2b contract template form

Find out other Form 14039Internal Revenue Service

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online