Details of Income Stream Product Form SA330 Services Australia 2024-2026

Understanding the Details of Income Stream Product Form SA330

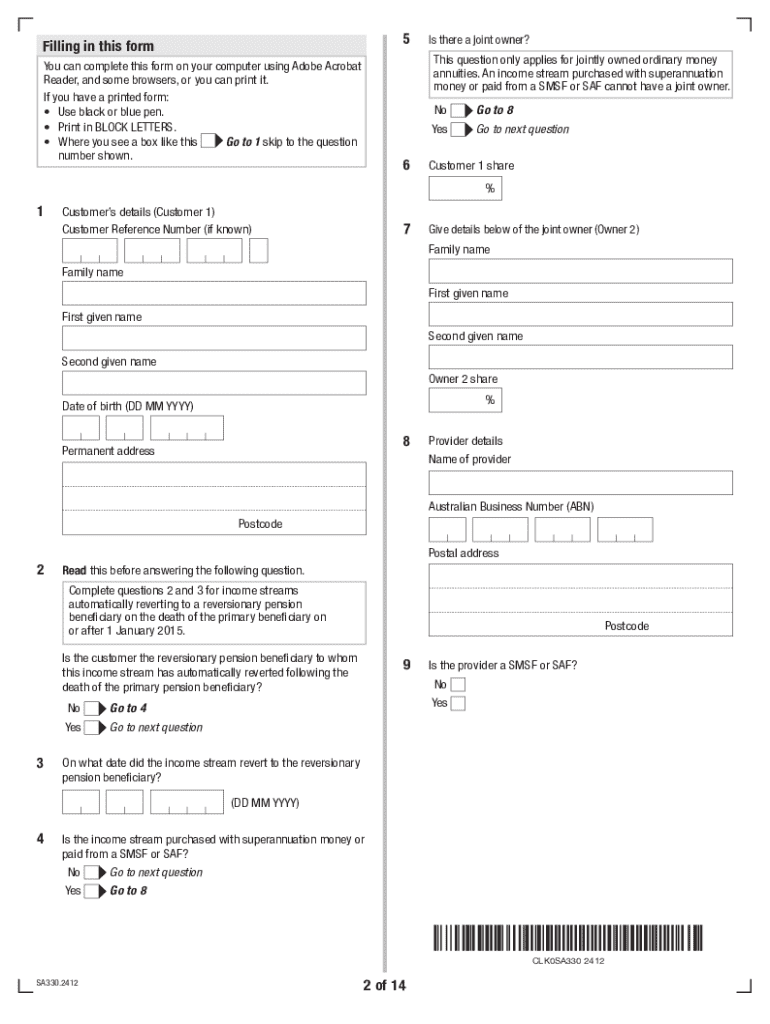

The Details of Income Stream Product Form SA330 is a crucial document issued by Services Australia. This form is primarily used to report income from various income stream products, such as pensions or annuities, that may affect your eligibility for government benefits. Understanding the purpose and requirements of this form is essential for ensuring compliance with Australian regulations related to income reporting.

The SA330 form collects information about the type of income stream you receive, its frequency, and any relevant details required by Services Australia. Completing this form accurately is vital to avoid any potential issues with your government benefits.

Steps to Complete the Details of Income Stream Product Form SA330

Filling out the SA330 form requires careful attention to detail. Here are the steps to ensure you complete it correctly:

- Gather all necessary information about your income stream products, including the provider's details and the amount received.

- Download the SA330 form from the official Services Australia website or obtain a printed copy if necessary.

- Fill in your personal details, including your name, address, and contact information.

- Provide specific information about each income stream product, such as the type, amount, and payment frequency.

- Review the completed form for accuracy and completeness before submission.

How to Obtain the Details of Income Stream Product Form SA330

The SA330 form can be obtained through several means to ensure accessibility for all users. You can download the form directly from the Services Australia website in PDF format. This allows you to fill it out digitally or print it for manual completion. Additionally, physical copies of the form may be available at local Services Australia offices or community centers, ensuring you have options that suit your preferences.

Legal Use of the Details of Income Stream Product Form SA330

The SA330 form serves a legal purpose in the context of income reporting for government benefits. It is essential to submit this form accurately to comply with the regulations set forth by Services Australia. Failing to report income correctly can lead to penalties or loss of benefits, highlighting the importance of understanding the legal implications associated with this form.

Ensure that all information provided is truthful and complete, as any discrepancies may result in legal consequences. It is advisable to keep a copy of the submitted form for your records.

Key Elements of the Details of Income Stream Product Form SA330

Several key elements are essential when completing the SA330 form. These include:

- Personal Information: Your name, address, and contact details.

- Income Stream Details: Information about the type of income stream, such as pensions or annuities.

- Payment Frequency: How often you receive payments from the income stream product.

- Provider Information: Name and contact details of the financial institution or entity providing the income stream.

Examples of Using the Details of Income Stream Product Form SA330

The SA330 form is utilized in various scenarios, particularly for individuals receiving income from retirement funds or investment products. For instance, if you receive a monthly pension from a superannuation fund, you would need to report this income using the SA330 form to ensure your benefits are calculated accurately. Similarly, if you have an annuity that pays out quarterly, this income must also be reported using the same form. Understanding these examples can help clarify when and how to use the SA330 form effectively.

Handy tips for filling out Details Of Income Stream Product Form SA330 Services Australia online

Quick steps to complete and e-sign Details Of Income Stream Product Form SA330 Services Australia online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Gain access to a GDPR and HIPAA compliant platform for optimum efficiency. Use signNow to e-sign and share Details Of Income Stream Product Form SA330 Services Australia for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct details of income stream product form sa330 services australia

Create this form in 5 minutes!

How to create an eSignature for the details of income stream product form sa330 services australia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the centrelink form sa330 download?

The centrelink form sa330 download is a specific document required for certain Centrelink services in Australia. It allows users to provide necessary information to Centrelink efficiently. By using airSlate SignNow, you can easily download and complete this form digitally.

-

How can I download the centrelink form sa330?

You can download the centrelink form sa330 directly from the airSlate SignNow platform. Simply navigate to the forms section, search for the SA330 form, and click on the download option. This process ensures you have the most up-to-date version of the form.

-

Is there a cost associated with the centrelink form sa330 download?

Downloading the centrelink form sa330 through airSlate SignNow is free of charge. Our platform provides cost-effective solutions for document management, ensuring you can access necessary forms without any hidden fees. Enjoy seamless downloads and eSigning at no cost.

-

What features does airSlate SignNow offer for the centrelink form sa330?

airSlate SignNow offers a range of features for the centrelink form sa330, including eSigning, document sharing, and secure storage. These features streamline the process of completing and submitting your form, making it easier to manage your Centrelink requirements. Experience a user-friendly interface designed for efficiency.

-

Can I integrate airSlate SignNow with other applications for the centrelink form sa330?

Yes, airSlate SignNow allows for seamless integration with various applications, enhancing your experience with the centrelink form sa330. You can connect with tools like Google Drive, Dropbox, and more to manage your documents effectively. This integration simplifies your workflow and keeps everything organized.

-

What are the benefits of using airSlate SignNow for the centrelink form sa330?

Using airSlate SignNow for the centrelink form sa330 provides numerous benefits, including time savings and increased accuracy. The platform's eSigning feature eliminates the need for printing and scanning, making the process faster. Additionally, you can track the status of your form in real-time.

-

Is the centrelink form sa330 download secure?

Absolutely! The centrelink form sa330 download through airSlate SignNow is secure and compliant with industry standards. We prioritize your data protection, ensuring that all documents are encrypted and safely stored. You can trust us to handle your sensitive information with care.

Get more for Details Of Income Stream Product Form SA330 Services Australia

- Independent contractor contract form

- Self employed instrument repair technician services contract form

- Commercial services contract form

- Phlebotomist agreement self employed independent contractor form

- Representative agreement form

- Public relations agreement form

- Worker independent form

- Physicians assistant agreement self employed independent contractor 497337192 form

Find out other Details Of Income Stream Product Form SA330 Services Australia

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now