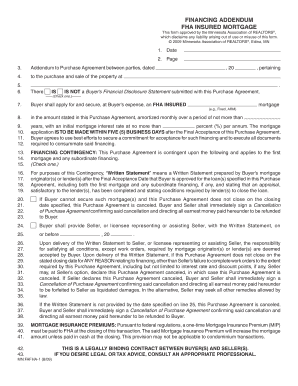

FINANCING ADDENDUM FHA INSURED MORTGAGE Form

What is the Financing Addendum FHA Insured Mortgage

The Financing Addendum FHA Insured Mortgage is a crucial document used in real estate transactions involving properties financed through the Federal Housing Administration (FHA). This addendum outlines specific terms and conditions related to the financing of the property, ensuring that both the buyer and the seller understand their obligations. It is particularly important for buyers who are using FHA loans, as these loans come with unique requirements and protections.

Key Elements of the Financing Addendum FHA Insured Mortgage

This addendum typically includes several key elements:

- Loan Amount: Specifies the total amount of the mortgage loan.

- Interest Rate: Details the interest rate applicable to the loan.

- Loan Terms: Outlines the duration of the loan and repayment schedule.

- Property Appraisal: Indicates that an FHA-approved appraisal must be completed.

- Mortgage Insurance: Explains the requirements for mortgage insurance premiums.

Steps to Complete the Financing Addendum FHA Insured Mortgage

Completing the Financing Addendum involves several important steps:

- Gather Necessary Information: Collect all relevant financial details, including income, credit history, and property information.

- Fill Out the Addendum: Accurately complete the addendum with all required information.

- Review Terms: Ensure that all terms align with the FHA loan requirements and the agreement between buyer and seller.

- Obtain Signatures: Both parties must sign the addendum to validate the agreement.

How to Use the Financing Addendum FHA Insured Mortgage

The Financing Addendum should be used in conjunction with the purchase agreement. It provides clarity on financing terms and protects both parties in the transaction. Buyers should present this addendum to their lender to ensure that all FHA guidelines are met. Sellers should also retain a copy for their records, as it confirms the financing details agreed upon during negotiations.

Eligibility Criteria for the Financing Addendum FHA Insured Mortgage

To utilize the Financing Addendum FHA Insured Mortgage, buyers must meet specific eligibility criteria set forth by the FHA, including:

- Credit Score: A minimum credit score requirement, typically around 580 for maximum financing.

- Debt-to-Income Ratio: The borrower's debt-to-income ratio must not exceed certain limits.

- Down Payment: A minimum down payment of three point five percent is generally required.

- Primary Residence: The property must be intended for use as the borrower's primary residence.

Required Documents for the Financing Addendum FHA Insured Mortgage

When preparing the Financing Addendum, several documents are typically required:

- Proof of Income: Recent pay stubs, tax returns, or other income verification.

- Credit Report: A current credit report showing the buyer's credit history.

- Property Information: Details about the property, including the address and legal description.

- FHA Loan Application: Completed application for the FHA loan.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the financing addendum fha insured mortgage

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Financing Addendum FHA Insured Mortgage?

A Financing Addendum FHA Insured Mortgage is a document that outlines the terms and conditions of an FHA-insured loan. It provides essential details about the financing arrangement, ensuring that both buyers and sellers understand their obligations. This addendum is crucial for securing FHA financing and protecting the interests of all parties involved.

-

How does airSlate SignNow facilitate the signing of a Financing Addendum FHA Insured Mortgage?

airSlate SignNow streamlines the process of signing a Financing Addendum FHA Insured Mortgage by allowing users to send and eSign documents electronically. This eliminates the need for physical paperwork and speeds up the transaction process. With our user-friendly interface, you can easily manage and track your documents in real-time.

-

What are the benefits of using airSlate SignNow for FHA mortgage documents?

Using airSlate SignNow for FHA mortgage documents, including the Financing Addendum FHA Insured Mortgage, offers numerous benefits. It enhances efficiency by reducing turnaround times and minimizes errors associated with manual signing. Additionally, our platform provides secure storage and easy access to all your important documents.

-

Is there a cost associated with using airSlate SignNow for Financing Addendum FHA Insured Mortgage?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans are flexible and cater to various needs, ensuring that you can find a solution that fits your budget while efficiently managing your Financing Addendum FHA Insured Mortgage documents.

-

Can airSlate SignNow integrate with other tools for managing FHA mortgage documents?

Absolutely! airSlate SignNow offers seamless integrations with various tools and platforms, enhancing your workflow for managing FHA mortgage documents. Whether you use CRM systems, cloud storage, or other business applications, our integrations ensure that your Financing Addendum FHA Insured Mortgage documents are easily accessible and manageable.

-

How secure is the signing process for Financing Addendum FHA Insured Mortgage with airSlate SignNow?

The signing process for Financing Addendum FHA Insured Mortgage with airSlate SignNow is highly secure. We utilize advanced encryption and authentication measures to protect your documents and personal information. You can trust that your sensitive data is safe while using our platform for electronic signatures.

-

What features does airSlate SignNow offer for managing FHA mortgage documents?

airSlate SignNow provides a range of features for managing FHA mortgage documents, including customizable templates, automated workflows, and real-time tracking. These features simplify the process of handling your Financing Addendum FHA Insured Mortgage, making it easier to collaborate with clients and stakeholders.

Get more for FINANCING ADDENDUM FHA INSURED MORTGAGE

Find out other FINANCING ADDENDUM FHA INSURED MORTGAGE

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple