Formulario 13844

What is the Formulario 13844

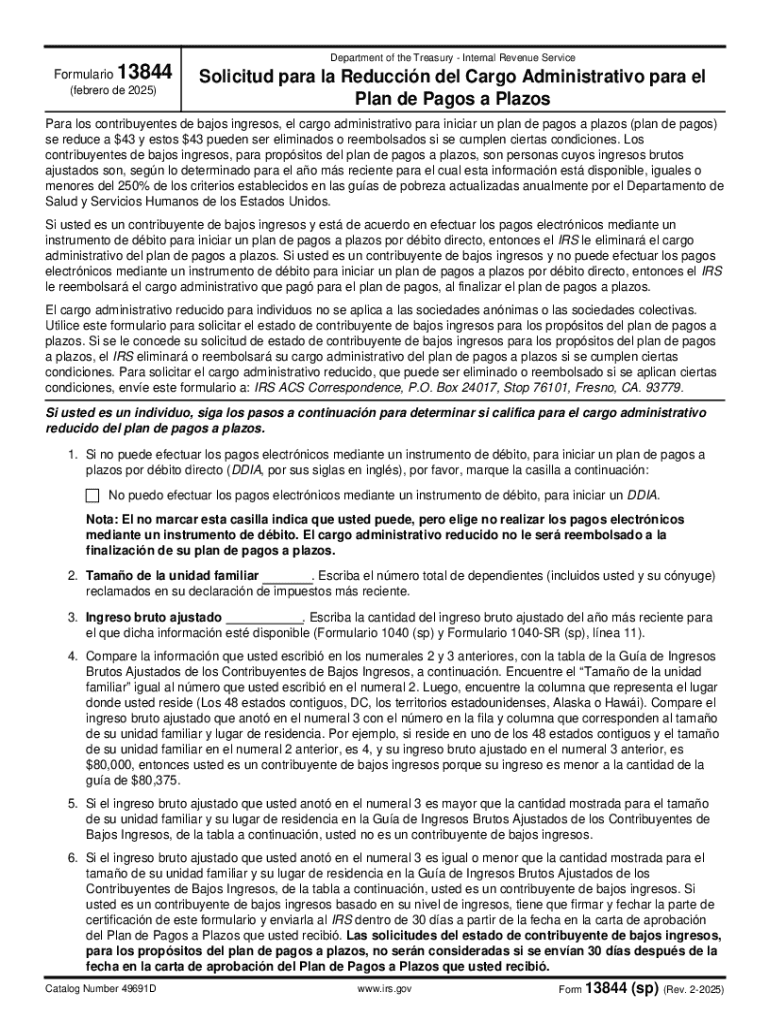

The Formulario 13844 is a specific tax form used in the United States, primarily for reporting certain types of income or deductions. This form is essential for individuals and businesses that need to provide information related to tax obligations. Understanding its purpose is crucial for ensuring compliance with tax regulations and for accurately reporting financial information to the IRS.

How to obtain the Formulario 13844

To obtain the Formulario 13844, individuals can visit the official IRS website, where the form is available for download in PDF format. Alternatively, physical copies may be requested by contacting the IRS directly. It is important to ensure that the most current version of the form is used, as tax forms are updated periodically to reflect changes in tax laws.

Steps to complete the Formulario 13844

Completing the Formulario 13844 involves several steps to ensure accuracy. First, gather all necessary documentation, including income statements and any relevant deductions. Next, carefully fill out the form, ensuring that all fields are completed accurately. Review the form for any errors before submission. Finally, submit the completed form according to the guidelines provided by the IRS, either electronically or by mail.

Key elements of the Formulario 13844

The Formulario 13844 includes several key elements that must be understood for proper completion. These elements typically consist of personal identification information, income details, and specific deductions or credits being claimed. Each section of the form is designed to capture essential information that the IRS needs to process tax returns accurately.

Filing Deadlines / Important Dates

Filing deadlines for the Formulario 13844 are critical to avoid penalties. Generally, tax forms must be submitted by April fifteenth of each year. However, specific circumstances, such as extensions or special situations, may alter these dates. It is advisable to keep track of any updates from the IRS regarding filing deadlines to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Formulario 13844 can be submitted through various methods. Individuals have the option to file online using approved tax software, which often streamlines the process and minimizes errors. Alternatively, the form can be mailed to the appropriate IRS address. In some cases, in-person submission may be possible at designated IRS offices. Each method has its own advantages, such as speed and convenience, which should be considered when deciding how to submit the form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 13844

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Formulario 13844?

Formulario 13844 is a specific document used for various administrative purposes. It is essential for businesses that need to comply with regulatory requirements. Understanding how to effectively use Formulario 13844 can streamline your document management process.

-

How can airSlate SignNow help with Formulario 13844?

airSlate SignNow provides an easy-to-use platform for sending and eSigning Formulario 13844. With its intuitive interface, you can quickly prepare and manage this document, ensuring compliance and efficiency. This solution simplifies the entire process, making it accessible for all users.

-

What are the pricing options for using airSlate SignNow with Formulario 13844?

airSlate SignNow offers flexible pricing plans that cater to different business needs when handling Formulario 13844. You can choose from monthly or annual subscriptions, allowing you to select a plan that fits your budget. Each plan includes features that enhance your document management experience.

-

What features does airSlate SignNow offer for Formulario 13844?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for Formulario 13844. These tools help you manage your documents efficiently and ensure that all signatures are collected promptly. Additionally, the platform supports collaboration among team members.

-

Are there any benefits to using airSlate SignNow for Formulario 13844?

Using airSlate SignNow for Formulario 13844 offers numerous benefits, including increased efficiency and reduced turnaround times. The platform's automation features minimize manual errors and enhance productivity. Furthermore, it provides a secure environment for handling sensitive documents.

-

Can I integrate airSlate SignNow with other applications for Formulario 13844?

Yes, airSlate SignNow allows seamless integration with various applications to enhance your workflow for Formulario 13844. You can connect it with CRM systems, cloud storage solutions, and other productivity tools. This integration helps streamline your document processes and improves overall efficiency.

-

Is airSlate SignNow secure for handling Formulario 13844?

Absolutely, airSlate SignNow prioritizes security when handling Formulario 13844. The platform employs advanced encryption and compliance measures to protect your documents. You can trust that your sensitive information is safe while using our eSigning solution.

Get more for Formulario 13844

- Th mcelvain oil ampampamp gas ltd pship v benson montin greer form

- Counties of practice form

- Instructions for completing the request for arbitration form

- Application for new car lemon law dispute resolution form

- Lemon law mediation attorney questionnaire form

- Arbitration litigation evaluation form lemon law arbitration litigation evaluation form arbitration

- Consent order for expedited jury trial law nj courts form

- Order for summary jury trial form

Find out other Formulario 13844

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later