El101b Maryland 2005

What is the El101b Maryland

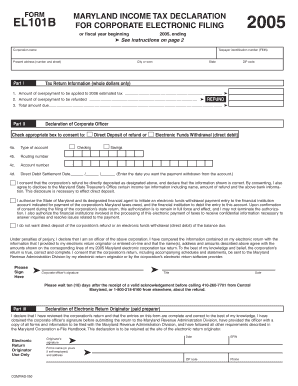

The El101b Maryland form is a crucial document used for specific legal and administrative purposes within the state of Maryland. This form is often associated with various applications, including business registrations and compliance requirements. Understanding the purpose of the El101b is essential for individuals and businesses to ensure they meet all necessary legal obligations.

How to use the El101b Maryland

Using the El101b Maryland form involves completing the document accurately and submitting it to the appropriate state authority. Users should first gather all required information, including personal details and any relevant business information. Once completed, the form can be submitted either online or through traditional mail, depending on the specific instructions provided for the form's use.

Steps to complete the El101b Maryland

Completing the El101b Maryland form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including identification and business details.

- Download the El101b form from the official Maryland state website or obtain a physical copy.

- Fill out the form completely, ensuring all fields are accurate and up-to-date.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission methods.

Legal use of the El101b Maryland

The El101b Maryland form serves a specific legal function within the state. It is essential for compliance with state regulations, and failure to use the form correctly can lead to legal complications. Understanding the legal implications of the El101b is vital for both individuals and businesses to avoid potential penalties.

Key elements of the El101b Maryland

Several key elements are essential to the El101b Maryland form. These include:

- Identification information of the individual or business submitting the form.

- Specific details regarding the purpose of the form.

- Signature and date fields to validate the submission.

- Instructions for submission and any additional documentation required.

Required Documents

When submitting the El101b Maryland form, certain documents may be required to accompany the form. These documents can include:

- Proof of identity, such as a driver's license or state ID.

- Business registration documents, if applicable.

- Any additional forms that support the purpose of the El101b.

Form Submission Methods

The El101b Maryland form can be submitted through various methods, ensuring convenience for users. Options typically include:

- Online submission via the Maryland state government website.

- Mailing the completed form to the designated state office.

- In-person submission at local government offices, if available.

Create this form in 5 minutes or less

Find and fill out the correct el101b maryland

Create this form in 5 minutes!

How to create an eSignature for the el101b maryland

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is el101b and how does it benefit my business?

el101b is a powerful feature of airSlate SignNow that allows businesses to streamline their document signing process. By utilizing el101b, you can enhance efficiency, reduce turnaround times, and ensure secure electronic signatures. This ultimately leads to improved productivity and customer satisfaction.

-

How much does el101b cost?

The pricing for el101b is competitive and designed to fit various business needs. airSlate SignNow offers flexible subscription plans that include access to el101b features. You can choose a plan that best suits your budget and requirements, ensuring you get the most value for your investment.

-

What features are included with el101b?

el101b includes a range of features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to simplify the document signing process and enhance collaboration among team members. With el101b, you can manage your documents efficiently and securely.

-

Can I integrate el101b with other software?

Yes, el101b seamlessly integrates with various third-party applications, enhancing its functionality. Whether you use CRM systems, project management tools, or cloud storage services, airSlate SignNow ensures that el101b can work alongside your existing software. This integration capability helps streamline your workflow.

-

Is el101b suitable for small businesses?

Absolutely! el101b is designed to cater to businesses of all sizes, including small enterprises. Its user-friendly interface and cost-effective pricing make it an ideal solution for small businesses looking to improve their document management processes without breaking the bank.

-

How secure is el101b for document signing?

Security is a top priority for airSlate SignNow, and el101b is no exception. It employs advanced encryption protocols and complies with industry standards to ensure that your documents are safe and secure. You can trust el101b to protect sensitive information during the signing process.

-

What are the benefits of using el101b for eSigning?

Using el101b for eSigning offers numerous benefits, including faster turnaround times and reduced paper usage. It allows for a more efficient workflow, enabling you to send, sign, and manage documents from anywhere. With el101b, you can enhance your business operations and improve overall efficiency.

Get more for El101b Maryland

- Certificate of tax exemption affidavit form

- Kniffel vorlage pdf form

- Prior auth for meritus medication form

- Stop 6525 sp cis kansas city mo form

- San gorgonio permit availability form

- Protest form harris county appraisal district

- Preference formapplication

- Johns hopkins stony brook ncaa men39s lacrosse notes form

Find out other El101b Maryland

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter