T5 Summary Fillable 2023

What is the T5 Summary Fillable

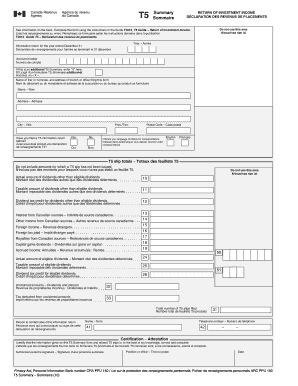

The T5 Summary Fillable is a tax form used in Canada to report various types of investment income, including dividends and interest earned by individuals and corporations. This form is essential for both payers and recipients of investment income, as it provides a summary of the amounts paid and ensures accurate reporting to the Canada Revenue Agency (CRA). The fillable format allows users to complete the form digitally, making it easier to input information and submit it electronically.

How to use the T5 Summary Fillable

Using the T5 Summary Fillable involves several straightforward steps. First, download the fillable form from an official source. Next, open the form in a compatible PDF reader that supports fillable fields. Enter the required information, including the payer's details, recipient's information, and the total amounts of income reported. Once completed, review the form for accuracy before saving it. The final step is to submit the form to the CRA along with any necessary supporting documents, ensuring compliance with tax regulations.

Steps to complete the T5 Summary Fillable

Completing the T5 Summary Fillable requires careful attention to detail. Follow these steps for successful completion:

- Download the T5 Summary Fillable form from a reliable source.

- Open the form in a PDF reader that allows editing.

- Fill in the payer's information, including name and address.

- Input the recipient's details, ensuring correct spelling and accuracy.

- Enter the total amounts of income distributed, categorized appropriately.

- Review all entries for any errors or omissions.

- Save the completed form and prepare it for submission.

Legal use of the T5 Summary Fillable

The T5 Summary Fillable must be used in accordance with Canadian tax laws. It is a legal requirement for any entity that pays investment income to report this income accurately to the CRA. Failure to file the T5 Summary can result in penalties for both the payer and the recipient. It is important to ensure that all information is complete and accurate to avoid complications during tax assessments.

Who Issues the Form

The T5 Summary Fillable is typically issued by financial institutions, corporations, and other entities that distribute investment income. These issuers are responsible for providing accurate information regarding the amounts paid to recipients. It is crucial for issuers to maintain records of all distributions to ensure compliance with reporting requirements.

Filing Deadlines / Important Dates

Filing deadlines for the T5 Summary Fillable are critical for compliance. Generally, the form must be filed with the CRA by the end of February following the tax year in which the income was paid. Recipients should also receive their copies by this deadline to ensure they can accurately report their income on their tax returns. It is advisable to verify specific deadlines each year, as they may vary.

Create this form in 5 minutes or less

Find and fill out the correct t5 summary fillable

Create this form in 5 minutes!

How to create an eSignature for the t5 summary fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a t5 summary fillable document?

A t5 summary fillable document is a digital form that allows users to input and submit information related to T5 slips. This format simplifies the process of reporting income from various sources, making it easier for businesses and individuals to manage their tax documentation efficiently.

-

How can airSlate SignNow help with t5 summary fillable forms?

airSlate SignNow provides a user-friendly platform for creating and managing t5 summary fillable forms. With our solution, you can easily customize templates, collect signatures, and ensure compliance, all while streamlining your document workflow.

-

Is there a cost associated with using airSlate SignNow for t5 summary fillable documents?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our cost-effective solution ensures that you can manage your t5 summary fillable documents without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for t5 summary fillable forms?

Our platform includes features such as customizable templates, electronic signatures, document tracking, and secure cloud storage. These features enhance the management of t5 summary fillable forms, making the process efficient and reliable.

-

Can I integrate airSlate SignNow with other applications for t5 summary fillable forms?

Absolutely! airSlate SignNow offers seamless integrations with various applications, including CRM systems and cloud storage services. This allows you to enhance your workflow when handling t5 summary fillable documents and ensures that all your tools work together efficiently.

-

What are the benefits of using airSlate SignNow for t5 summary fillable documents?

Using airSlate SignNow for t5 summary fillable documents provides numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy. Our platform helps you save time and resources while ensuring that your documents are processed securely and correctly.

-

Is it easy to create a t5 summary fillable form with airSlate SignNow?

Yes, creating a t5 summary fillable form with airSlate SignNow is straightforward. Our intuitive interface allows you to design and customize forms quickly, enabling you to focus on your business rather than the complexities of document management.

Get more for T5 Summary Fillable

Find out other T5 Summary Fillable

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe