the T5 Statement of Investment Income Tax Form Explained 2023-2026

What is the T5 Statement of Investment Income Tax Form?

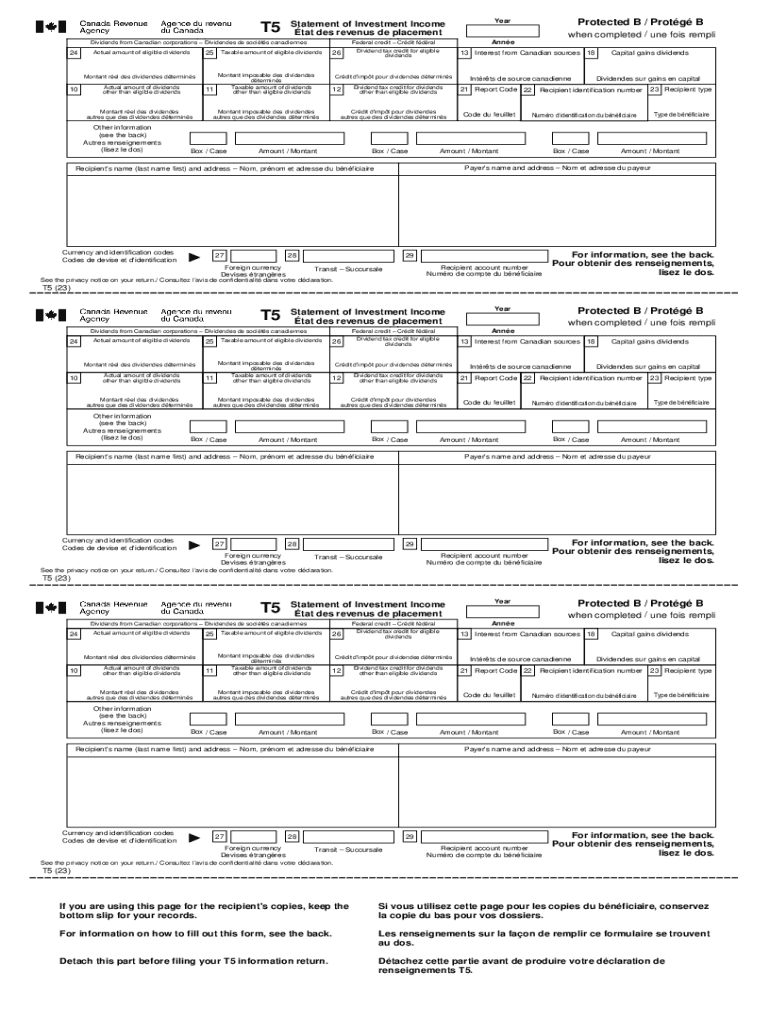

The T5 Statement of Investment Income Tax Form is a tax document used in Canada to report various types of investment income, including dividends, interest, and certain other earnings. While this form is primarily utilized in Canada, understanding its function can be beneficial for U.S. taxpayers who may have cross-border investments. The form provides a summary of income earned from investments, which is essential for accurate tax reporting.

How to Obtain the T5 Statement of Investment Income Tax Form

To obtain the T5 Statement of Investment Income Tax Form, individuals can typically request it from the financial institution or investment firm that issued the income. Many institutions provide this form automatically to account holders who have earned qualifying income. Additionally, the form may be available on the official Canada Revenue Agency (CRA) website for reference. U.S. taxpayers should ensure they have the correct version of the form if they are reporting Canadian income.

Key Elements of the T5 Statement of Investment Income Tax Form

The T5 Statement includes several key elements that are important for accurate reporting. These elements typically include:

- Payer Information: The name and address of the financial institution or entity that issued the income.

- Recipient Information: The name and address of the taxpayer receiving the income.

- Income Types: Specific boxes indicating the type of income earned, such as dividends or interest.

- Amounts: The total amounts of income earned, which must be reported on the taxpayer's income tax return.

Steps to Complete the T5 Statement of Investment Income Tax Form

Completing the T5 Statement involves several straightforward steps:

- Gather all relevant investment income documents and records.

- Fill in the payer and recipient information accurately.

- Identify the types of income earned and enter the corresponding amounts in the appropriate boxes.

- Review the completed form for accuracy before submission.

Filing Deadlines and Important Dates

For U.S. taxpayers with Canadian investments, it is crucial to be aware of the filing deadlines associated with the T5 Statement. Generally, the T5 form must be issued to recipients by the end of February for the previous tax year. U.S. taxpayers should also consider their own tax filing deadlines when reporting this income on their tax returns.

Penalties for Non-Compliance

Failure to report income from the T5 Statement can lead to penalties. U.S. taxpayers who do not include this income on their tax returns may face fines or interest on unpaid taxes. It is essential to ensure that all investment income is accurately reported to avoid potential legal issues.

Quick guide on how to complete the t5 statement of investment income tax form explained

Effortlessly Prepare The T5 Statement Of Investment Income Tax Form Explained on Any Device

Managing documents online has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents quickly and without hold-ups. Manage The T5 Statement Of Investment Income Tax Form Explained on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Alter and Electronically Sign The T5 Statement Of Investment Income Tax Form Explained with Ease

- Obtain The T5 Statement Of Investment Income Tax Form Explained and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign The T5 Statement Of Investment Income Tax Form Explained to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct the t5 statement of investment income tax form explained

Create this form in 5 minutes!

How to create an eSignature for the the t5 statement of investment income tax form explained

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is The T5 Statement Of Investment Income Tax Form Explained?

The T5 Statement Of Investment Income Tax Form Explained provides a detailed summary of investment income earned during the tax year. It includes information such as dividends, interest, and other types of income, making it essential for income reporting. Understanding this form helps individuals accurately report their earnings to avoid any tax issues.

-

How can I access The T5 Statement Of Investment Income Tax Form Explained?

You can access The T5 Statement Of Investment Income Tax Form Explained online through your financial institution or tax software. Many banks provide digital copies of the form in your account. Additionally, airSlate SignNow allows for easy document sharing and signing, making it convenient to obtain and complete these forms.

-

What features does airSlate SignNow offer for handling The T5 Statement Of Investment Income Tax Form Explained?

airSlate SignNow offers various features such as eSigning, document templates, and secure sharing options for The T5 Statement Of Investment Income Tax Form Explained. These capabilities streamline the process of obtaining signatures and ensure compliance with tax regulations. Users can also track document status in real-time.

-

Is there a cost associated with using airSlate SignNow for The T5 Statement Of Investment Income Tax Form Explained?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features suitable for managing The T5 Statement Of Investment Income Tax Form Explained, making it a cost-effective solution for businesses of all sizes. They also provide a free trial for you to explore the offerings.

-

Can I integrate airSlate SignNow with other software to manage The T5 Statement Of Investment Income Tax Form Explained?

Absolutely! airSlate SignNow supports integrations with numerous applications like CRM systems, accounting software, and email platforms. This makes it easy to manage The T5 Statement Of Investment Income Tax Form Explained alongside other financial documents, enhancing productivity and workflow.

-

What are the benefits of using airSlate SignNow for The T5 Statement Of Investment Income Tax Form Explained?

Using airSlate SignNow for The T5 Statement Of Investment Income Tax Form Explained offers several benefits, including improved efficiency and reduced turnaround times for document processing. It allows businesses to automate workflows, ensures document security, and provides an intuitive interface for managing investment income forms effectively.

-

How does airSlate SignNow ensure the security of The T5 Statement Of Investment Income Tax Form Explained?

airSlate SignNow takes document security seriously, employing industry-standard encryption and secure servers to protect your sensitive information. When handling The T5 Statement Of Investment Income Tax Form Explained, users can confidently share and sign documents without the worry of data bsignNowes.

Get more for The T5 Statement Of Investment Income Tax Form Explained

Find out other The T5 Statement Of Investment Income Tax Form Explained

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now