Snohomish County Property Exemption Form

What is the Snohomish County Property Exemption

The Snohomish County Property Exemption is a program designed to reduce property taxes for eligible homeowners within Snohomish County, Washington. This exemption can significantly lower the assessed value of a home, resulting in reduced tax liability. The program aims to assist low-income residents, senior citizens, and individuals with disabilities by providing financial relief through property tax exemptions. Understanding the specifics of this exemption is essential for homeowners looking to benefit from potential savings on their property taxes.

Eligibility Criteria

To qualify for the Snohomish County Property Exemption, applicants must meet specific criteria. Generally, eligibility includes:

- Being a resident of Snohomish County.

- Meeting income limits set by the county, which may vary annually.

- Being at least sixty-one years old, or being a person with a disability.

- Owning and occupying the property as the primary residence.

It is important for applicants to review the latest eligibility requirements to ensure compliance and maximize their chances of receiving the exemption.

How to Obtain the Snohomish County Property Exemption

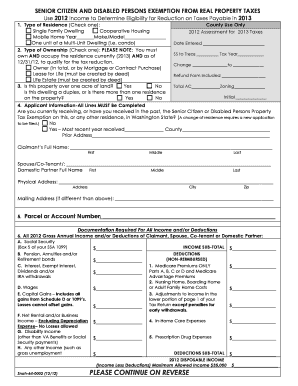

Obtaining the Snohomish County Property Exemption involves a straightforward application process. Homeowners must complete the required application form, which can typically be found on the Snohomish County Assessor's website or at their office. The application will require personal information, details about the property, and documentation supporting income and age or disability status. Once submitted, the application will be reviewed by the county assessor's office.

Steps to Complete the Snohomish County Property Exemption

Completing the Snohomish County Property Exemption application requires several steps:

- Gather necessary documents, including proof of income and age or disability.

- Obtain the application form from the Snohomish County Assessor's office or website.

- Fill out the application form accurately, ensuring all information is complete.

- Submit the application form along with the required documentation to the county assessor's office.

- Await notification regarding the status of your application.

Following these steps carefully can help ensure a smooth application process and timely approval.

Required Documents

When applying for the Snohomish County Property Exemption, certain documents are necessary to verify eligibility. Commonly required documents include:

- Proof of income, such as tax returns or pay stubs.

- Identification verifying age or disability, such as a driver's license or disability certificate.

- Documentation proving ownership and occupancy of the property, such as a deed or mortgage statement.

Having these documents ready can expedite the application process and help avoid delays.

Form Submission Methods

Homeowners can submit their Snohomish County Property Exemption application through various methods. The options typically include:

- Online submission via the Snohomish County Assessor's website, if available.

- Mailing the completed application to the county assessor's office.

- In-person submission at the county assessor's office during business hours.

Choosing the most convenient submission method can help ensure that the application is processed promptly.

Legal Use of the Snohomish County Property Exemption

The Snohomish County Property Exemption is governed by local and state laws that dictate its use and eligibility. It is crucial for applicants to understand that misuse of the exemption, such as applying for properties that do not qualify or providing false information, can lead to penalties. Homeowners should ensure compliance with all legal requirements to maintain their exemption status and avoid any legal repercussions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the snohomish county property exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the snohomish county property exemption?

The snohomish county property exemption is a program designed to reduce property taxes for eligible homeowners in Snohomish County. This exemption can signNowly lower your tax burden, making homeownership more affordable. To qualify, you must meet specific income and residency requirements.

-

How can I apply for the snohomish county property exemption?

To apply for the snohomish county property exemption, you need to complete an application form available on the Snohomish County Assessor's website. Ensure you gather all necessary documentation, such as proof of income and residency. The application process is straightforward and can often be completed online.

-

What are the eligibility requirements for the snohomish county property exemption?

Eligibility for the snohomish county property exemption typically includes being a homeowner, meeting certain income limits, and residing in the property as your primary residence. Additional criteria may apply, so it's essential to review the specific guidelines provided by the Snohomish County Assessor's office.

-

How does the snohomish county property exemption affect my property taxes?

The snohomish county property exemption can signNowly reduce your property taxes by lowering the assessed value of your home. This means you will pay taxes based on a reduced amount, which can lead to substantial savings each year. It's a valuable benefit for qualifying homeowners.

-

Are there any deadlines for applying for the snohomish county property exemption?

Yes, there are specific deadlines for applying for the snohomish county property exemption, typically set by the county's tax office. It's crucial to submit your application before the deadline to ensure you receive the exemption for the current tax year. Check the Snohomish County Assessor's website for the exact dates.

-

Can I receive assistance with my snohomish county property exemption application?

Yes, there are resources available to assist you with your snohomish county property exemption application. You can contact the Snohomish County Assessor's office for guidance or seek help from local community organizations that specialize in property tax assistance. They can provide valuable support throughout the application process.

-

What documents do I need to provide for the snohomish county property exemption?

When applying for the snohomish county property exemption, you will need to provide documents such as proof of income, residency verification, and any other relevant financial information. It's essential to gather these documents beforehand to ensure a smooth application process. Check the county's website for a complete list of required documents.

Get more for Snohomish County Property Exemption

Find out other Snohomish County Property Exemption

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple