Dependent Care Receipt Form

What is the Dependent Care Receipt Form

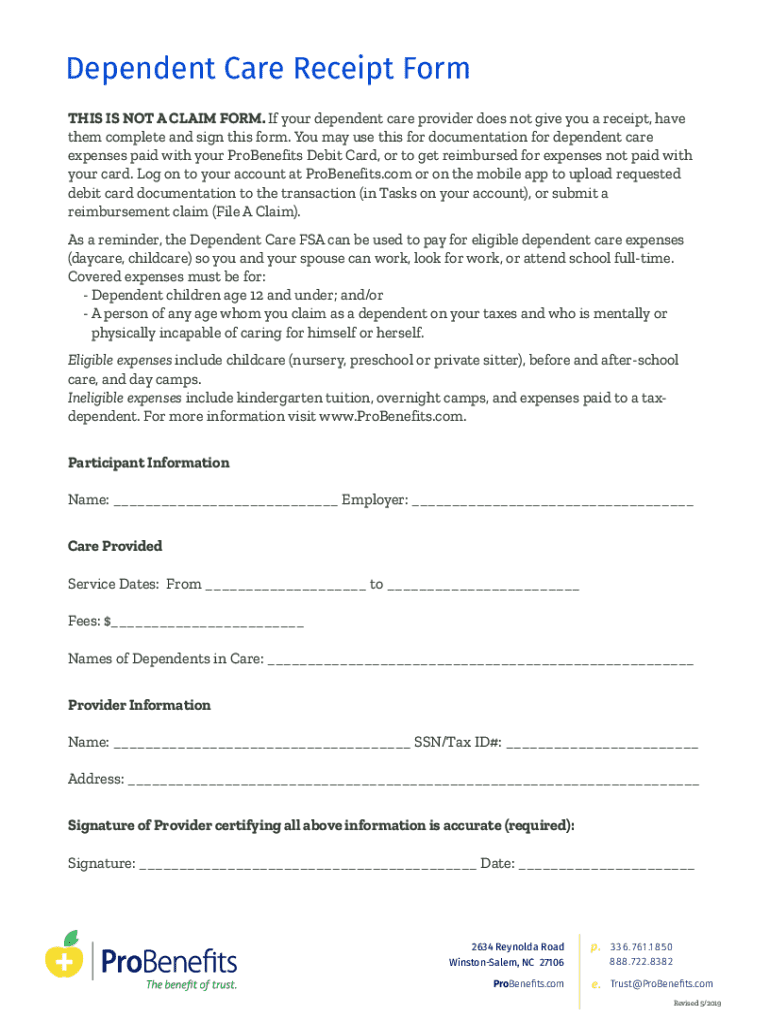

The Dependent Care Receipt Form is a crucial document used by individuals to claim tax deductions for dependent care expenses. This form provides a record of payments made for care services, enabling taxpayers to receive credits or deductions on their federal income tax returns. It is particularly relevant for parents or guardians who incur costs for childcare while they work or seek employment. The form helps ensure that taxpayers can accurately report their expenses and comply with IRS regulations.

How to use the Dependent Care Receipt Form

To effectively use the Dependent Care Receipt Form, individuals must first gather all relevant information regarding their dependent care expenses. This includes the names of the care providers, the amounts paid, and the dates of service. Once this information is compiled, taxpayers can fill out the form, ensuring that all details are accurate and complete. After completing the form, it should be attached to the tax return when filing, or kept for personal records if not immediately submitted.

Steps to complete the Dependent Care Receipt Form

Completing the Dependent Care Receipt Form involves several straightforward steps:

- Gather all necessary information, including provider details and payment records.

- Fill in the form with accurate details, ensuring all sections are completed.

- Review the information for accuracy to avoid potential issues with the IRS.

- Submit the form along with your tax return or keep it for your records.

Following these steps helps ensure that your claims for dependent care expenses are properly documented.

Key elements of the Dependent Care Receipt Form

The Dependent Care Receipt Form includes several key elements that are essential for accurate reporting. These elements typically consist of:

- Name and address of the care provider

- Tax identification number of the provider

- Dates of service

- Total amount paid for services rendered

- Information about the dependent receiving care

Including all these details is crucial for the form to be valid and for taxpayers to receive their eligible deductions.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Dependent Care Receipt Form. Taxpayers must ensure that the care provider meets certain criteria, such as being licensed or registered if required by state law. Additionally, the IRS stipulates that the care must be necessary for the taxpayer to work or look for work. Familiarizing oneself with these guidelines helps ensure compliance and maximizes potential tax benefits.

Eligibility Criteria

To qualify for deductions using the Dependent Care Receipt Form, taxpayers must meet certain eligibility criteria. Generally, the taxpayer must be working or actively seeking employment, and the care must be for a qualifying dependent under the age of thirteen. Moreover, the care must be provided in the taxpayer's home or at a daycare facility. Understanding these criteria is essential for determining eligibility for dependent care tax credits.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dependent care receipt form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Dependent Care Receipt Form?

A Dependent Care Receipt Form is a document used to provide proof of payment for dependent care services. This form is essential for individuals seeking reimbursement from flexible spending accounts or tax deductions. By using airSlate SignNow, you can easily create and eSign this form, ensuring a smooth process.

-

How can I create a Dependent Care Receipt Form using airSlate SignNow?

Creating a Dependent Care Receipt Form with airSlate SignNow is simple. You can start by selecting a template or creating a custom form tailored to your needs. Once your form is ready, you can easily eSign and send it to the necessary parties for processing.

-

Is there a cost associated with using the Dependent Care Receipt Form feature?

airSlate SignNow offers a cost-effective solution for creating and managing documents, including the Dependent Care Receipt Form. Pricing varies based on the plan you choose, but all plans provide access to essential features for document management and eSigning. You can explore our pricing page for detailed information.

-

What are the benefits of using airSlate SignNow for my Dependent Care Receipt Form?

Using airSlate SignNow for your Dependent Care Receipt Form streamlines the process of document creation and signing. It enhances efficiency, reduces paperwork, and ensures compliance with necessary regulations. Additionally, our platform provides secure storage and easy access to your forms whenever needed.

-

Can I integrate airSlate SignNow with other applications for managing my Dependent Care Receipt Form?

Yes, airSlate SignNow offers integrations with various applications to enhance your workflow. You can connect with tools like Google Drive, Dropbox, and more to manage your Dependent Care Receipt Form seamlessly. This integration allows for easy document sharing and collaboration.

-

How secure is my information when using the Dependent Care Receipt Form on airSlate SignNow?

Security is a top priority at airSlate SignNow. When using the Dependent Care Receipt Form, your information is protected with advanced encryption and secure access controls. We comply with industry standards to ensure that your data remains confidential and secure.

-

Can I customize my Dependent Care Receipt Form in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your Dependent Care Receipt Form to meet your specific requirements. You can add fields, adjust layouts, and include branding elements to ensure the form aligns with your business needs.

Get more for Dependent Care Receipt Form

- Dss 5016 form

- Service temperature log extension iastate form

- Prescription d prior authorization request form adoc

- Tr form

- Public housing and community development landlord reference form miamidade

- Model contract template form

- Model management contract template form

- Model photographer contract template form

Find out other Dependent Care Receipt Form

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF