, Decedent XXX XX Form

What is the , Decedent XXX XX

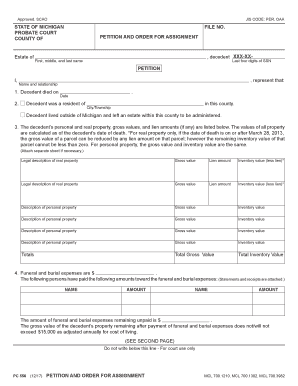

The , Decedent XXX XX is a legal document used in the United States to address matters related to the estate of a deceased individual. This form serves to facilitate the transfer of assets, settle debts, and ensure that the wishes of the decedent are honored according to their estate plan or applicable laws. Understanding the purpose of this form is crucial for executors, heirs, and beneficiaries involved in the estate settlement process.

How to use the , Decedent XXX XX

Utilizing the , Decedent XXX XX involves several key steps. First, gather all necessary information about the decedent's assets, debts, and beneficiaries. Next, fill out the form accurately, ensuring that all details reflect the decedent's intentions and comply with state laws. Once completed, the form must be submitted to the appropriate authorities, which may include probate court or other relevant entities, depending on the jurisdiction.

Steps to complete the , Decedent XXX XX

Completing the , Decedent XXX XX requires careful attention to detail. Begin by obtaining the form from the appropriate source, such as a legal professional or official state website. Follow these steps:

- Gather all necessary documents, including the death certificate and any existing wills.

- Fill out the form, providing accurate information about the decedent's assets and liabilities.

- Review the completed form for accuracy and completeness.

- Submit the form to the relevant authority, ensuring it is filed within any applicable deadlines.

Legal use of the , Decedent XXX XX

The , Decedent XXX XX has specific legal implications and must be used in accordance with state laws governing estate administration. It is essential to understand the legal requirements surrounding the form, including who is authorized to file it and the consequences of failing to do so. Proper legal use helps to ensure that the decedent's estate is settled efficiently and in compliance with applicable regulations.

Required Documents

To complete the , Decedent XXX XX, certain documents are typically required. These may include:

- The decedent's death certificate

- Any existing wills or trusts

- Documentation of the decedent's assets and debts

- Identification of the executor or personal representative

Having these documents ready can streamline the process and reduce the likelihood of errors.

State-specific rules for the , Decedent XXX XX

Each state in the U.S. has its own regulations regarding the , Decedent XXX XX. It is important to familiarize yourself with the specific rules that apply in your state, as these can affect the filing process, deadlines, and required documentation. Consulting with a local attorney or estate professional can provide valuable guidance tailored to your situation.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the decedent xxx xx

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Decedent XXX XX?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. With features tailored for managing documents related to Decedent XXX XX, it simplifies the process of obtaining signatures on important legal documents.

-

How much does airSlate SignNow cost for handling Decedent XXX XX documents?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those dealing with Decedent XXX XX documentation. You can choose from monthly or annual subscriptions, ensuring you get the best value for your specific requirements.

-

What features does airSlate SignNow provide for Decedent XXX XX management?

airSlate SignNow includes features such as customizable templates, secure storage, and real-time tracking, which are essential for managing Decedent XXX XX documents. These tools help streamline the signing process and ensure compliance with legal standards.

-

Can airSlate SignNow integrate with other software for Decedent XXX XX processes?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow for Decedent XXX XX documentation. This includes popular tools like Google Drive, Salesforce, and more, allowing for a cohesive document management experience.

-

What are the benefits of using airSlate SignNow for Decedent XXX XX?

Using airSlate SignNow for Decedent XXX XX offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that all documents are signed quickly and securely, which is crucial in sensitive situations.

-

Is airSlate SignNow secure for handling Decedent XXX XX documents?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that all Decedent XXX XX documents are protected, giving you peace of mind when managing sensitive information.

-

How can I get started with airSlate SignNow for Decedent XXX XX?

Getting started with airSlate SignNow for Decedent XXX XX is easy. Simply sign up for a free trial on our website, explore the features, and start uploading your documents to experience the benefits firsthand.

Get more for , Decedent XXX XX

Find out other , Decedent XXX XX

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast