CHAPTER 47 24 1 UNIFORM TRANSFERS to MINORS ACT X X X X

Understanding the CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT

The CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT is a legal framework designed to facilitate the transfer of assets to minors in a way that ensures their protection and proper management. This act allows adults to transfer property, money, or other assets to a minor without the need for a formal guardianship or trust arrangement. The assets are managed by a custodian until the minor reaches the age of majority, typically eighteen years old, at which point the minor gains full control over the assets. This act is crucial for parents and guardians who wish to provide for their children’s future while adhering to legal guidelines.

How to Utilize the CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT

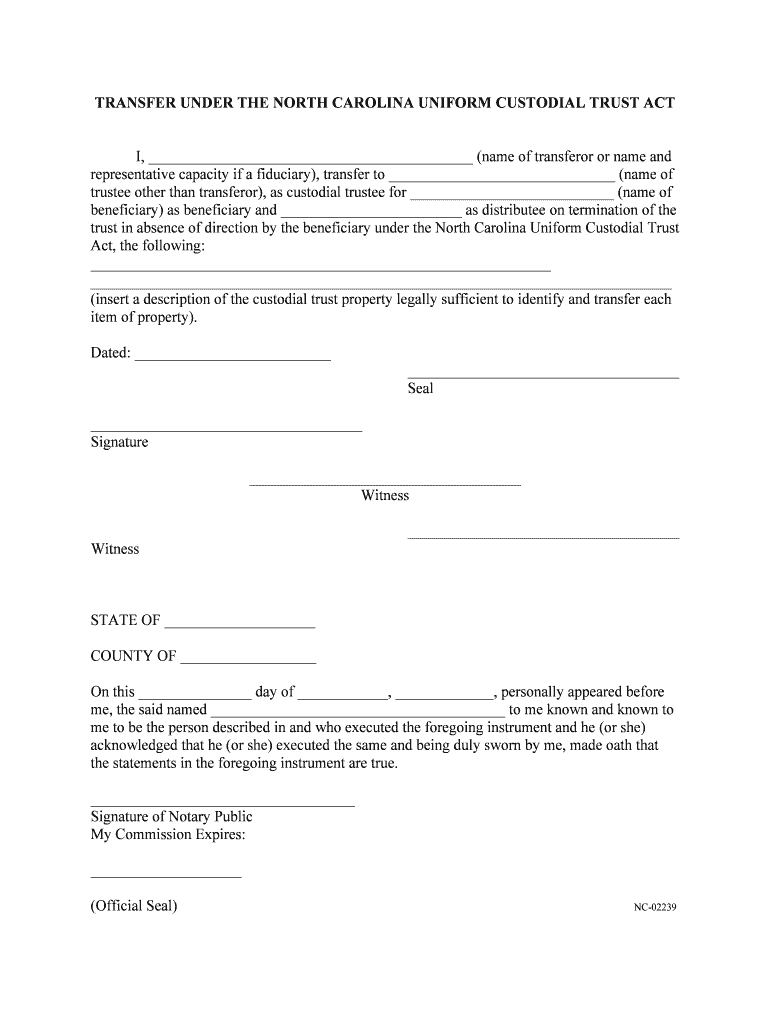

To effectively use the CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT, individuals must first identify the assets they wish to transfer. This can include cash, stocks, bonds, or real estate. Next, the adult transferring the assets must designate a custodian who will manage the assets on behalf of the minor. It is important to complete the necessary documentation, which typically includes a transfer form that specifies the details of the assets and the custodian's responsibilities. By following these steps, the transfer can be executed smoothly and in compliance with the law.

Key Components of the CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT

The key components of the CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT include the definition of a minor, the role of the custodian, and the types of property that can be transferred. A minor is generally defined as an individual under the age of eighteen. The custodian is responsible for managing the assets until the minor reaches the age of majority. Furthermore, the act outlines the permissible types of property that can be transferred, ensuring that the process is straightforward and legally sound. Understanding these components is essential for anyone considering asset transfers to minors.

Steps to Complete the CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT

Completing the CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT involves several key steps:

- Identify the assets to be transferred.

- Select a custodian who will manage the assets.

- Complete the transfer form, including details about the assets and the custodian.

- Submit the form to the relevant financial institutions or entities holding the assets.

- Maintain records of the transfer for future reference.

By following these steps, individuals can ensure that the transfer process is conducted legally and efficiently.

Legal Considerations for the CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT

When utilizing the CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT, it is important to be aware of the legal implications. The act provides a clear framework for transferring assets, but individuals must ensure compliance with state-specific regulations. Each state may have variations in how the act is implemented, including the age of majority and specific reporting requirements for custodians. Consulting with a legal professional can help clarify these aspects and ensure that all legal obligations are met.

Examples of Asset Transfers Under the CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT

Examples of asset transfers under the CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT include transferring a savings account, stocks, or bonds to a minor. For instance, a grandparent may wish to set up a savings account in the name of their grandchild, designating themselves as the custodian. Another example is a parent transferring ownership of a small investment portfolio to their child, ensuring the custodian manages it until the child is of age. These examples illustrate the flexibility and utility of the act in planning for a minor's financial future.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chapter 47 24 1 uniform transfers to minors act x x x x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT X x x x?

The CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT X x x x is a legal framework that allows for the transfer of assets to minors without the need for a guardian. This act simplifies the process of gifting or bequeathing assets to minors, ensuring they are managed responsibly until they signNow adulthood.

-

How can airSlate SignNow help with CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT X x x x documentation?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning documents related to the CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT X x x x. Our easy-to-use interface ensures that all necessary forms are completed accurately and efficiently, reducing the risk of errors.

-

What are the pricing options for using airSlate SignNow for CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT X x x x?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those dealing with the CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT X x x x. Our cost-effective solutions ensure that you can manage your document signing processes without breaking the bank.

-

What features does airSlate SignNow offer for managing CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT X x x x documents?

With airSlate SignNow, you gain access to features such as customizable templates, secure eSigning, and real-time tracking for documents related to the CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT X x x x. These tools enhance efficiency and ensure compliance with legal requirements.

-

Are there any integrations available with airSlate SignNow for CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT X x x x?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, making it easier to manage documents related to the CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT X x x x. This allows for a more cohesive workflow and improved productivity.

-

What benefits does airSlate SignNow provide for businesses dealing with CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT X x x x?

Using airSlate SignNow for CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT X x x x documentation offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. Our platform ensures that your documents are handled with the utmost care and compliance.

-

How secure is airSlate SignNow for handling CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT X x x x documents?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect documents related to the CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT X x x x. You can trust that your sensitive information is safe and secure throughout the signing process.

Get more for CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT X x x x

- Shelton state transcript form

- Biomedical waste packet form

- Planning cayman online form

- Verification worksheet for dependent students kean university kean form

- Depaul university office of student employmentprog form

- Johns hopkins athletic hall of fame form

- Depaul university human resources progressive disciplinary form

- Tarleton 1098 t form

Find out other CHAPTER 47 24 1 UNIFORM TRANSFERS TO MINORS ACT X x x x

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template