720xxcom Form

What is the 720xxcom Form

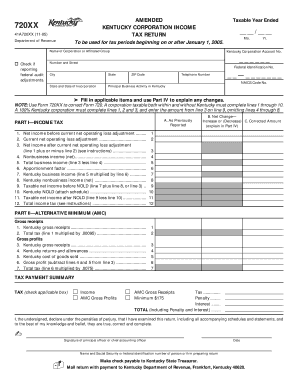

The 720xxcom Form is a specific document used primarily for tax purposes in the United States. It is designed to facilitate the reporting of certain financial activities and transactions to the Internal Revenue Service (IRS). This form is essential for individuals and businesses who need to comply with federal tax regulations. Understanding the purpose and requirements of the 720xxcom Form is crucial for accurate tax reporting and ensuring compliance with U.S. tax laws.

How to use the 720xxcom Form

Using the 720xxcom Form involves several straightforward steps. First, gather all necessary financial information relevant to the reporting period. This may include income details, deductions, and any applicable credits. Next, fill out the form accurately, ensuring that all sections are completed according to IRS guidelines. After completing the form, review it for any errors or omissions before submission. Proper use of the form helps avoid delays in processing and potential penalties.

Steps to complete the 720xxcom Form

Completing the 720xxcom Form requires careful attention to detail. Begin by downloading the latest version of the form from the IRS website. Follow these steps:

- Enter your personal information, including name, address, and Social Security number.

- Provide accurate financial data as required in the designated sections.

- Double-check all entries for accuracy and completeness.

- Sign and date the form to validate your submission.

Once completed, you can submit the form via mail or electronically, depending on IRS guidelines.

Legal use of the 720xxcom Form

The legal use of the 720xxcom Form is governed by IRS regulations, which outline who must file and under what circumstances. It is crucial for taxpayers to understand their obligations regarding this form to avoid any legal repercussions. Filing the form accurately and on time is essential for compliance with tax laws, and failure to do so can result in penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the 720xxcom Form vary depending on the specific tax year and the taxpayer's circumstances. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. However, extensions may be available under certain conditions. It is important to stay informed about any changes to deadlines to ensure timely submission and avoid penalties.

Required Documents

To complete the 720xxcom Form, certain documents are typically required. These may include:

- Previous tax returns for reference.

- Income statements such as W-2s or 1099s.

- Documentation for deductions and credits claimed.

- Any relevant financial statements or records.

Having these documents on hand can streamline the completion process and help ensure accuracy.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 720xxcom form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 720xxcom Form and how does it work?

The 720xxcom Form is a digital document that allows users to fill out and eSign forms online. With airSlate SignNow, you can easily create, send, and manage your 720xxcom Form, streamlining your workflow and ensuring secure document handling.

-

How much does it cost to use the 720xxcom Form with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs. The cost of using the 720xxcom Form depends on the plan you choose, with options for individuals, small businesses, and enterprises, ensuring you get the best value for your investment.

-

What features are included with the 720xxcom Form?

The 720xxcom Form includes features such as customizable templates, real-time tracking, and secure eSignature capabilities. These features enhance your document management process, making it easier to collect signatures and manage forms efficiently.

-

Can I integrate the 720xxcom Form with other applications?

Yes, airSlate SignNow allows seamless integration with various applications such as Google Drive, Salesforce, and Microsoft Office. This means you can easily incorporate the 720xxcom Form into your existing workflows and enhance productivity.

-

What are the benefits of using the 720xxcom Form for my business?

Using the 720xxcom Form can signNowly reduce the time spent on paperwork and improve accuracy. With airSlate SignNow, you can automate your document processes, leading to faster turnaround times and increased efficiency for your business.

-

Is the 720xxcom Form secure for sensitive information?

Absolutely! The 720xxcom Form is designed with security in mind, featuring encryption and compliance with industry standards. airSlate SignNow ensures that your sensitive information is protected throughout the signing process.

-

How can I get started with the 720xxcom Form?

Getting started with the 720xxcom Form is easy. Simply sign up for an airSlate SignNow account, choose your plan, and start creating your forms. Our user-friendly interface makes it simple to design and send your 720xxcom Form in no time.

Get more for 720xxcom Form

- San diego unified school district impact aid program survey form

- Company extract form

- British council romeo and juliet form

- Changing number plates nsw form

- Template hmrc tax declaration format

- Unit 5 photosynthesis and cellular respiration answers form

- Lehi youth football equipment agreement print version form

- Warthogs motorcycle club member transfer notification form

Find out other 720xxcom Form

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document