Kansas Partnership Tax Return 2009

What is the Kansas Partnership Tax Return

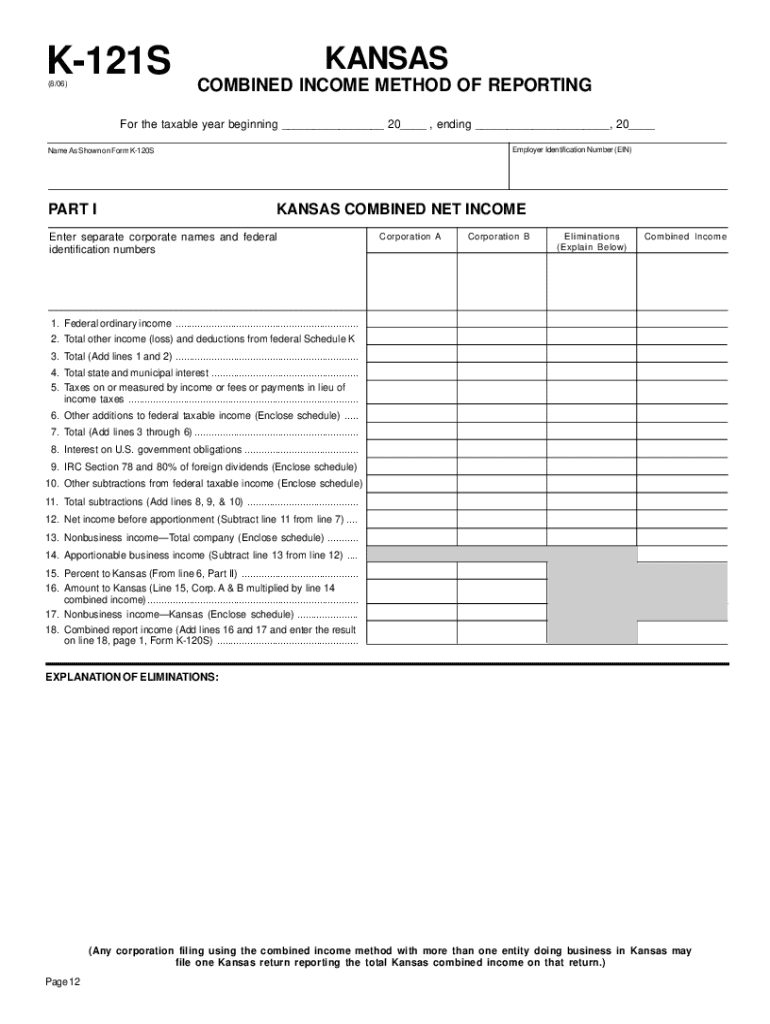

The Kansas Partnership Tax Return is a specific tax form used by partnerships operating within the state of Kansas. This form, officially known as the Kansas Form K-120S, is designed for partnerships to report their income, deductions, and credits to the state. Partnerships, which are business entities formed by two or more individuals, must file this return annually to comply with state tax regulations. It is essential for partnerships to accurately report their financial activities to ensure proper taxation and avoid penalties.

Steps to complete the Kansas Partnership Tax Return

Completing the Kansas Partnership Tax Return involves several key steps:

- Gather financial information: Collect all necessary financial documents, including income statements, expense reports, and previous tax returns.

- Obtain the form: Download the Kansas Form K-120S from the Kansas Department of Revenue website or access it through authorized tax software.

- Fill out the form: Enter the partnership's income, deductions, and credits accurately. Ensure that all calculations are correct to avoid discrepancies.

- Review the form: Double-check all entries for accuracy and completeness. It may be helpful to have another partner or a tax professional review the return.

- Submit the form: File the completed return by the deadline, either electronically or by mail, depending on your preference.

Filing Deadlines / Important Dates

Partnerships in Kansas must adhere to specific filing deadlines for the Kansas Partnership Tax Return. The standard due date for the Form K-120S is the 15th day of the fourth month following the end of the partnership's tax year. For partnerships that operate on a calendar year, this means the return is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Partnerships may also request an extension, but this does not extend the time to pay any tax due.

Required Documents

To successfully complete the Kansas Partnership Tax Return, partnerships need to gather several key documents:

- Income statements detailing all sources of revenue.

- Expense reports that outline all business-related costs.

- Previous tax returns for reference and consistency.

- Schedules K-1 for each partner to report individual income and deductions.

- Any additional documentation required by the Kansas Department of Revenue.

Form Submission Methods (Online / Mail / In-Person)

Partnerships can submit the Kansas Partnership Tax Return through various methods. The primary options include:

- Online submission: Partnerships can file electronically using approved tax software that supports the Kansas Form K-120S.

- Mail: Completed forms can be printed and mailed to the Kansas Department of Revenue. Ensure to send it to the correct address as specified in the form instructions.

- In-person: Partnerships may also choose to deliver the form directly to a local Kansas Department of Revenue office, if preferred.

Penalties for Non-Compliance

Failing to file the Kansas Partnership Tax Return on time or submitting inaccurate information can result in significant penalties. These may include:

- Late filing penalties, which can accumulate daily until the return is filed.

- Interest on any unpaid taxes, which is calculated from the original due date.

- Potential audits or further scrutiny from the Kansas Department of Revenue.

It is crucial for partnerships to adhere to all filing requirements to avoid these penalties and ensure compliance with state tax laws.

Create this form in 5 minutes or less

Find and fill out the correct kansas partnership tax return

Create this form in 5 minutes!

How to create an eSignature for the kansas partnership tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Kansas partnership tax return?

A Kansas partnership tax return is a tax document that partnerships in Kansas must file to report their income, deductions, and credits. This return is essential for ensuring compliance with state tax laws and helps determine the tax obligations of each partner. Understanding how to properly complete a Kansas partnership tax return can save time and reduce errors.

-

How can airSlate SignNow help with Kansas partnership tax returns?

airSlate SignNow provides an efficient platform for preparing and eSigning Kansas partnership tax returns. With its user-friendly interface, businesses can easily collaborate on documents, ensuring all partners can review and sign the return promptly. This streamlines the filing process and helps avoid delays.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small partnerships and larger firms. Each plan includes features that facilitate the preparation and signing of documents, including Kansas partnership tax returns. You can choose a plan that best fits your budget and requirements.

-

Are there any features specifically for Kansas partnership tax returns?

Yes, airSlate SignNow includes features tailored for Kansas partnership tax returns, such as customizable templates and automated workflows. These tools help ensure that all necessary information is included and that the return is completed accurately. Additionally, reminders can be set to ensure timely filing.

-

What benefits does airSlate SignNow offer for tax professionals?

For tax professionals, airSlate SignNow offers signNow benefits when handling Kansas partnership tax returns. The platform enhances collaboration with clients, allows for secure document sharing, and simplifies the eSigning process. This efficiency can lead to increased client satisfaction and retention.

-

Can airSlate SignNow integrate with accounting software for Kansas partnership tax returns?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage Kansas partnership tax returns. This integration allows for the automatic import of financial data, reducing manual entry and minimizing errors. It streamlines the entire tax preparation process.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that all sensitive documents, including Kansas partnership tax returns, are protected. The platform uses advanced encryption and secure storage solutions to safeguard your data. You can trust that your information is safe while using our services.

Get more for Kansas Partnership Tax Return

- Cleveland wheels and brakes manual form

- Fannie mae amendment form fillable

- Superior court of arizona in maricopa county us court forms

- Declaration of domicile broward form

- Mammomat inspiration service manual form

- K12 reader form

- Form st 810 new york state and local quarterly sales and use tax return for part quarterly filers revised 1124

- Sales and use tax on aircraft gt 800008 r 0724 i form

Find out other Kansas Partnership Tax Return

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile