It Aff3 Form

What is the IT Aff3?

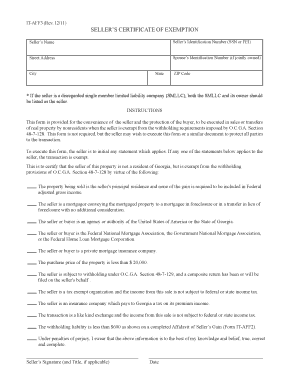

The IT Aff3 is a specific form utilized in the United States for reporting certain tax-related information. It is primarily used by businesses and individuals to provide the Internal Revenue Service (IRS) with necessary details regarding income, deductions, and other financial transactions. Understanding the purpose and requirements of the IT Aff3 is essential for ensuring compliance with federal tax regulations.

How to Use the IT Aff3

Using the IT Aff3 involves several straightforward steps. First, gather all necessary financial documents that pertain to the information you will report. This may include income statements, receipts for deductions, and any other relevant financial records. Next, complete the form accurately, ensuring that all fields are filled out correctly to avoid delays or issues with processing. After completing the form, review it for accuracy before submission.

Steps to Complete the IT Aff3

Completing the IT Aff3 requires attention to detail. Follow these steps:

- Obtain the latest version of the IT Aff3 from the IRS website or relevant tax authority.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details regarding your income sources and any applicable deductions.

- Double-check all entries for accuracy and completeness.

- Sign and date the form to validate it.

Legal Use of the IT Aff3

The IT Aff3 must be used in accordance with IRS guidelines to ensure its legal validity. This includes adhering to deadlines for submission and providing accurate information. Failure to comply with these legal requirements can result in penalties or audits. It is advisable to keep a copy of the completed form for your records, as it may be required for future reference or verification.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial when working with the IT Aff3. Typically, the form must be submitted by a specific date each tax year, often coinciding with the general tax filing deadline. It is important to check the IRS website for any updates or changes to these dates, as they can vary annually.

Required Documents

When preparing to complete the IT Aff3, ensure you have all required documents on hand. This may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Any previous tax returns that may provide context or necessary information.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the IT Aff3. These guidelines cover everything from eligibility criteria to the proper format for reporting information. Familiarizing yourself with these guidelines can help ensure that your submission is compliant and processed without issues.

Quick guide on how to complete it aff3

Complete It Aff3 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can acquire the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly and without interruptions. Manage It Aff3 across any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign It Aff3 with ease

- Find It Aff3 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight signNow portions of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhaustive form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you choose. Edit and eSign It Aff3 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it aff3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is it aff3 and how does it relate to airSlate SignNow?

It aff3 is a comprehensive solution that facilitates document management through electronic signatures and easy sharing. With airSlate SignNow, businesses can leverage it aff3 to streamline their workflows and manage documents effortlessly.

-

What pricing plans are available for it aff3 with airSlate SignNow?

airSlate SignNow offers various pricing plans for it aff3, catering to the needs of different business sizes. Each plan is designed to provide the necessary features for efficient document management and e-signature capabilities, ensuring cost-effectiveness.

-

What features does airSlate SignNow offer that enhance it aff3?

airSlate SignNow includes features like customizable templates, advanced security measures, and real-time tracking to enhance it aff3. These features allow users to create, send, and manage documents seamlessly while ensuring compliance and security.

-

How can it aff3 improve my business processes?

Implementing it aff3 with airSlate SignNow can signNowly improve your business processes by reducing the time involved in document handling. With automated workflows and electronic signatures, businesses can speed up approvals and enhance collaboration.

-

What are the benefits of using airSlate SignNow for it aff3?

The benefits of using airSlate SignNow for it aff3 include increased efficiency, reduced operational costs, and enhanced security for sensitive documents. Users can also enjoy a user-friendly interface that simplifies the e-signature process.

-

Is it aff3 compatible with other software applications?

Yes, airSlate SignNow integrates seamlessly with various software applications, making it aff3 a versatile choice for businesses. This interoperability allows users to streamline their workflows by connecting it aff3 with their existing tools and platforms.

-

How secure is it aff3 when using airSlate SignNow?

Security is a top priority for airSlate SignNow, and it aff3 is designed with advanced encryption and compliance features. Your documents and signatures are protected, ensuring that sensitive information remains confidential throughout the process.

Get more for It Aff3

Find out other It Aff3

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe