F8857 2021

What is the F8857

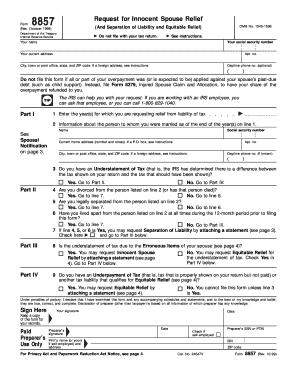

The F8857 is a tax form used by individuals and businesses in the United States to request a refund of overpaid taxes. This form is integral for taxpayers who believe they have paid more than their actual tax liability. The F8857 serves as an official request to the Internal Revenue Service (IRS) for a review and potential refund of the excess amount.

How to use the F8857

Using the F8857 involves several steps to ensure accurate completion and submission. First, gather all relevant tax documents, including W-2s, 1099s, and any previous tax returns that support your claim. Next, fill out the form carefully, ensuring all information is correct. Once completed, submit the F8857 to the IRS, either electronically or via mail, depending on your preference and the IRS guidelines.

Steps to complete the F8857

Completing the F8857 requires careful attention to detail. Follow these steps:

- Collect all necessary tax documents.

- Download the F8857 form from the IRS website.

- Fill in your personal information, including your name, address, and Social Security number.

- Detail the reasons for your refund request, citing specific overpayments.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the F8857

The F8857 is legally recognized by the IRS as a formal request for a tax refund. It is essential to use this form in accordance with IRS regulations to avoid complications. Submitting the form without valid claims or supporting documentation may lead to delays or denials. Taxpayers should ensure they are fully compliant with all federal tax laws when using the F8857.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the F8857. Taxpayers should refer to the IRS instructions for the F8857 to understand the eligibility criteria, required documentation, and submission methods. Following these guidelines is crucial for a successful refund request and to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the F8857 can vary based on individual circumstances. Generally, taxpayers should submit their requests within three years from the date they filed their original return or within two years from the date they paid the tax. Staying aware of these deadlines is vital to ensure eligibility for a refund.

Create this form in 5 minutes or less

Find and fill out the correct f8857

Create this form in 5 minutes!

How to create an eSignature for the f8857

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is f8857 and how does it relate to airSlate SignNow?

The f8857 form is a crucial document for businesses that need to manage electronic signatures efficiently. airSlate SignNow simplifies the process of sending and eSigning f8857 forms, ensuring compliance and security. With our platform, you can easily create, send, and track f8857 documents in a user-friendly environment.

-

How much does airSlate SignNow cost for handling f8857 forms?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our pricing for managing f8857 forms is designed to be cost-effective, allowing you to choose a plan that fits your budget while providing all necessary features. You can start with a free trial to explore our offerings before committing.

-

What features does airSlate SignNow provide for f8857 document management?

airSlate SignNow includes a variety of features tailored for f8857 document management, such as customizable templates, automated workflows, and real-time tracking. These features enhance efficiency and ensure that your f8857 forms are processed quickly and accurately. Additionally, our platform supports multiple file formats for added convenience.

-

How can airSlate SignNow benefit my business when dealing with f8857 forms?

Using airSlate SignNow for f8857 forms can signNowly streamline your document workflow, saving time and reducing errors. Our platform enhances collaboration by allowing multiple users to sign and manage documents simultaneously. This leads to faster turnaround times and improved productivity for your business.

-

Does airSlate SignNow integrate with other software for f8857 processing?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to manage f8857 forms alongside your existing tools. Whether you use CRM systems, cloud storage, or project management software, our integrations ensure a smooth workflow. This connectivity enhances your overall document management process.

-

Is airSlate SignNow secure for handling sensitive f8857 documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your f8857 documents. Our platform adheres to industry standards, ensuring that your sensitive information remains confidential and secure throughout the signing process. You can trust us to safeguard your data.

-

Can I customize my f8857 forms using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your f8857 forms to meet your specific needs. You can add your branding, modify fields, and create templates that suit your business requirements. This level of customization ensures that your f8857 documents reflect your brand identity and meet compliance standards.

Get more for F8857

- Bill of sale of automobile and odometer statement for as is sale iowa form

- Construction contract cost plus or fixed fee iowa form

- Painting contract for contractor iowa form

- Trim carpenter form

- Fencing contract for contractor iowa form

- Hvac contract for contractor iowa form

- Landscape contract for contractor iowa form

- Commercial contract for contractor iowa form

Find out other F8857

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease