Form 8857 from Irs 2007

What is the Form 8857 From Irs

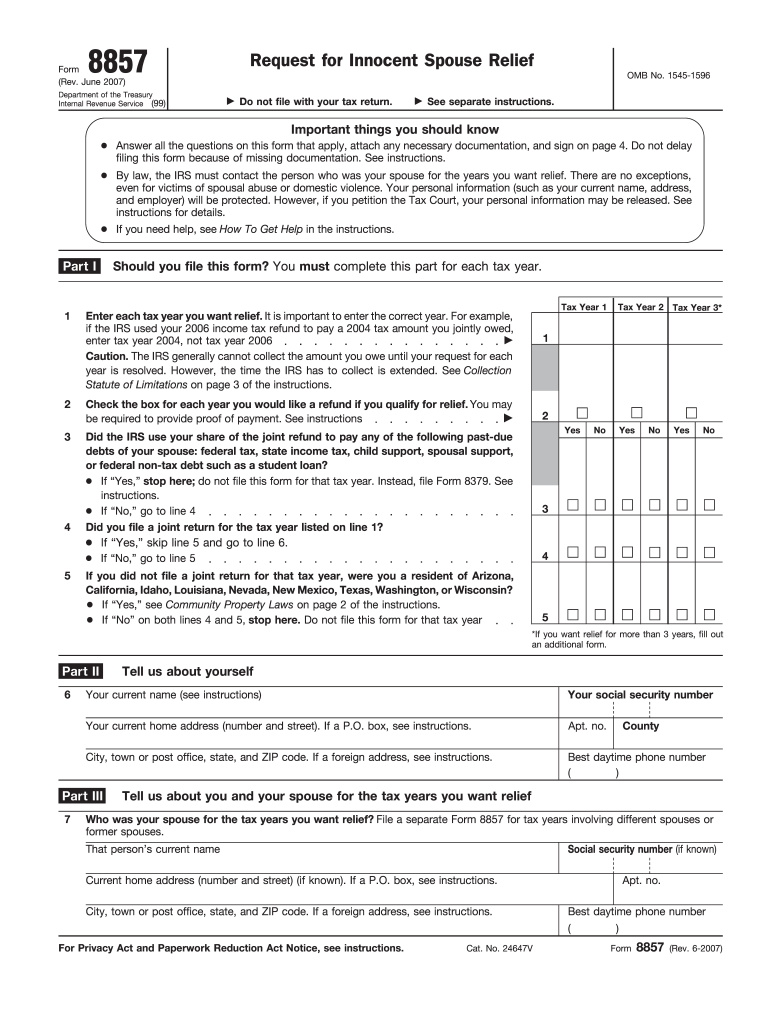

The Form 8857, also known as the Request for Innocent Spouse Relief, is a document used by individuals to request relief from joint tax liability. This form is particularly relevant for taxpayers who filed a joint return but believe they should not be held responsible for the tax due because of their spouse's actions, such as underreporting income or claiming improper deductions. By submitting this form, individuals can seek to have their share of the tax liability reduced or eliminated.

How to use the Form 8857 From Irs

Using the Form 8857 involves several steps. First, you need to gather relevant information, including your tax return, details about your spouse, and any documentation supporting your claim for relief. Next, complete the form accurately, ensuring all sections are filled out. After completing the form, review it for errors before submitting it to the IRS. It is essential to keep a copy for your records. The IRS will review your request and notify you of their decision, which may take several months.

Steps to complete the Form 8857 From Irs

Completing the Form 8857 requires careful attention to detail. Follow these steps:

- Begin by providing your personal information, including your name, address, and Social Security number.

- Indicate your spouse's information in the designated section.

- Clearly explain the reasons you believe you qualify for innocent spouse relief, providing any necessary details.

- Attach supporting documents that substantiate your claim, such as tax returns or correspondence from the IRS.

- Sign and date the form before submitting it to ensure it is valid.

Legal use of the Form 8857 From Irs

The legal use of Form 8857 is governed by IRS regulations. To be eligible for relief, you must meet specific criteria, such as proving that you did not know, and had no reason to know, that your spouse was underreporting income or claiming deductions improperly. The form must be submitted within two years of the IRS's first collection activity against you. Understanding these legal requirements is crucial for a successful application.

Filing Deadlines / Important Dates

When filing Form 8857, it is important to be aware of deadlines. You must submit the form within two years of the date the IRS first attempted to collect the tax owed. This timeframe is critical to ensure your request for relief is considered. Keep track of any correspondence from the IRS regarding your tax liability, as this will help you determine the appropriate filing date for your Form 8857.

Required Documents

To support your Form 8857, certain documents are typically required. These may include:

- Copies of your joint tax returns for the years in question.

- Any correspondence from the IRS regarding the tax liability.

- Documentation that demonstrates your financial situation, such as pay stubs or bank statements.

- Evidence of any claims made by your spouse that you were unaware of, such as receipts or invoices.

Eligibility Criteria

To qualify for relief under Form 8857, you must meet specific eligibility criteria. These include:

- You filed a joint tax return with your spouse.

- You can prove that you did not know, and had no reason to know, about the tax issues.

- You must not have benefited significantly from the tax underpayment.

- The request must be made within the required timeframe after the IRS begins collection actions.

Quick guide on how to complete form 8857 from irs 2007

Effortlessly Prepare Form 8857 From Irs on Any Device

The management of online documents has gained popularity among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed papers, as you can locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle Form 8857 From Irs on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and Electronically Sign Form 8857 From Irs with Ease

- Find Form 8857 From Irs and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to share your form, by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, the hassle of tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 8857 From Irs to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8857 from irs 2007

Create this form in 5 minutes!

How to create an eSignature for the form 8857 from irs 2007

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is Form 8857 From Irs?

Form 8857 From Irs is a request for innocent spouse relief. It allows individuals to request relief from joint tax liability under certain circumstances, providing a way to separate their tax obligations from their spouse's actions.

-

How can airSlate SignNow help me with Form 8857 From Irs?

airSlate SignNow streamlines the process of completing and signing Form 8857 From Irs by allowing users to electronically fill out the form and securely sign it. This makes it easier to submit your request and ensures that all necessary information is included.

-

Is there a cost associated with using airSlate SignNow for Form 8857 From Irs?

Yes, airSlate SignNow offers competitive pricing plans based on features and usage. These plans provide cost-effective solutions for businesses and individuals who need to manage documents, including Form 8857 From Irs.

-

What features does airSlate SignNow provide for managing Form 8857 From Irs?

airSlate SignNow offers features such as eSignature capabilities, document templates, and secure cloud storage to manage Form 8857 From Irs. These tools make it convenient to track your submission and keep all documentation organized.

-

Can I integrate airSlate SignNow with other tools for my Form 8857 From Irs?

Absolutely! airSlate SignNow supports integrations with popular apps and services, allowing users to enhance their workflow while handling Form 8857 From Irs. This integration capability ensures a seamless experience in managing your documents.

-

What are the benefits of using airSlate SignNow for Form 8857 From Irs?

Using airSlate SignNow for Form 8857 From Irs offers benefits like improved efficiency, reduced turnaround time, and enhanced security. By digitizing the signing process, you can easily track your form and expedite communication with relevant parties.

-

Is airSlate SignNow user-friendly for completing Form 8857 From Irs?

Yes, airSlate SignNow is designed to be intuitive and user-friendly. Whether you're tech-savvy or not, the straightforward interface allows anyone to easily fill out and eSign Form 8857 From Irs without difficulty.

Get more for Form 8857 From Irs

- Il disclosure form

- Il lease form

- Sample cover letter for filing of llc articles or certificate with secretary of state illinois form

- Supplemental residential lease forms package illinois

- Illinois landlord form

- Name change instructions and forms package for an adult cook county only illinois

- Name change instructions and forms package for a minor cook county only illinois

- Illinois change form

Find out other Form 8857 From Irs

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online