Residential Homestead Exemption Application Central Appraisal 2012

What is the Residential Homestead Exemption Application Central Appraisal

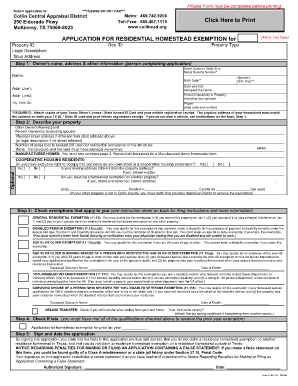

The Residential Homestead Exemption Application is a crucial form used in the United States to apply for property tax exemptions for primary residences. This application allows homeowners to reduce their property tax burden by qualifying for exemptions based on specific criteria, such as ownership status and residency duration. The Central Appraisal district manages this application, ensuring that eligible homeowners receive the benefits associated with homestead exemptions.

Eligibility Criteria

To qualify for the Residential Homestead Exemption, applicants must meet several criteria. Generally, the homeowner must occupy the property as their primary residence as of January first of the tax year. Additionally, the applicant must be the owner of the property and cannot claim homestead exemptions on any other property. Some states may have additional requirements, such as income limits or age restrictions for senior citizens.

Steps to Complete the Residential Homestead Exemption Application Central Appraisal

Completing the Residential Homestead Exemption Application involves several key steps:

- Gather necessary information, including proof of ownership and residency.

- Obtain the application form from the Central Appraisal district, either online or in person.

- Fill out the application form accurately, providing all required details.

- Attach any supporting documents, such as identification or proof of residency.

- Submit the completed application by the specified deadline, either online, by mail, or in person.

Required Documents

When submitting the Residential Homestead Exemption Application, homeowners typically need to provide specific documents to support their application. These may include:

- Proof of ownership, such as a deed or title.

- Identification, such as a driver's license or state ID.

- Utility bills or other documents that verify residency at the property.

Form Submission Methods

Homeowners can submit the Residential Homestead Exemption Application through various methods, depending on the Central Appraisal district's guidelines. Common submission methods include:

- Online submission via the Central Appraisal district's website.

- Mailing the completed application to the designated address.

- In-person submission at the local appraisal office.

Filing Deadlines / Important Dates

It is essential for homeowners to be aware of the filing deadlines for the Residential Homestead Exemption Application. Typically, the application must be submitted by April fifteenth of the tax year to qualify for that year’s exemption. Some states may have different deadlines, so checking with the local Central Appraisal district for specific dates is advisable.

Create this form in 5 minutes or less

Find and fill out the correct residential homestead exemption application central appraisal

Create this form in 5 minutes!

How to create an eSignature for the residential homestead exemption application central appraisal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Residential Homestead Exemption Application Central Appraisal?

The Residential Homestead Exemption Application Central Appraisal is a form that homeowners can submit to their local appraisal district to claim a homestead exemption. This exemption can reduce the amount of property taxes owed, making it a valuable benefit for eligible homeowners.

-

How can airSlate SignNow help with the Residential Homestead Exemption Application Central Appraisal?

airSlate SignNow provides an efficient platform for completing and eSigning the Residential Homestead Exemption Application Central Appraisal. With its user-friendly interface, you can easily fill out the application and submit it electronically, saving time and ensuring accuracy.

-

Is there a cost associated with using airSlate SignNow for the Residential Homestead Exemption Application Central Appraisal?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. The cost is generally affordable, especially considering the time and resources saved when managing the Residential Homestead Exemption Application Central Appraisal electronically.

-

What features does airSlate SignNow offer for the Residential Homestead Exemption Application Central Appraisal?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These features streamline the process of completing the Residential Homestead Exemption Application Central Appraisal, making it easier for users to manage their documents.

-

Can I integrate airSlate SignNow with other applications for the Residential Homestead Exemption Application Central Appraisal?

Yes, airSlate SignNow offers integrations with various applications, enhancing your workflow. This means you can easily connect it with your existing systems to manage the Residential Homestead Exemption Application Central Appraisal alongside other important documents.

-

What are the benefits of using airSlate SignNow for the Residential Homestead Exemption Application Central Appraisal?

Using airSlate SignNow for the Residential Homestead Exemption Application Central Appraisal provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. This solution allows you to focus on what matters most while ensuring your application is processed smoothly.

-

How secure is the airSlate SignNow platform for the Residential Homestead Exemption Application Central Appraisal?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents. When submitting the Residential Homestead Exemption Application Central Appraisal, you can trust that your information is safe and secure.

Get more for Residential Homestead Exemption Application Central Appraisal

- Application for sublease florida form

- Inventory and condition of leased premises for pre lease and post lease florida form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out florida form

- Property manager agreement florida form

- Agreement for delayed or partial rent payments florida form

- Tenants maintenance repair request form florida

- Guaranty attachment to lease for guarantor or cosigner florida form

- Amendment to lease or rental agreement florida form

Find out other Residential Homestead Exemption Application Central Appraisal

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement