Application for Residence Homestead Exemption 2023-2026

What is the Application for Residence Homestead Exemption

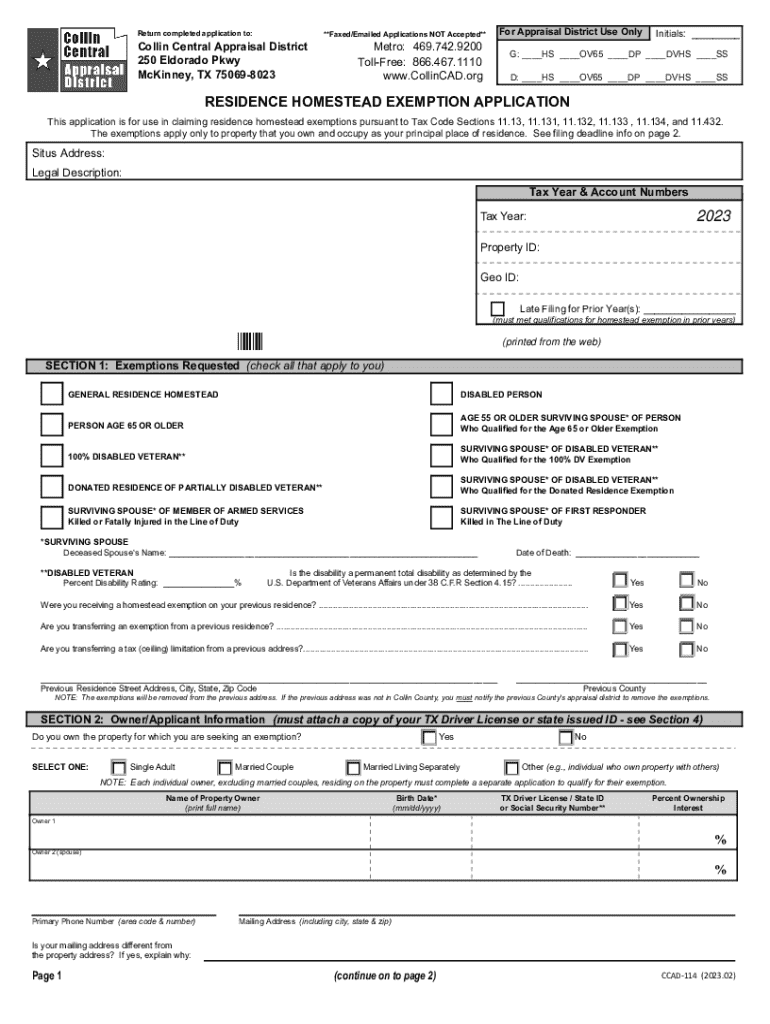

The application for residence homestead exemption is a formal request made by homeowners to reduce the property taxes on their primary residence. This exemption allows eligible homeowners to lower their taxable property value, resulting in decreased tax liabilities. Each state in the U.S. has specific criteria and guidelines for qualifying for this exemption, which often include factors such as ownership status and residency duration.

Eligibility Criteria

To qualify for the residence homestead exemption, homeowners generally need to meet certain eligibility criteria. These may include:

- Ownership of the property as the primary residence.

- Residency in the home for a specified duration, usually for the entire tax year.

- Meeting income limits or other financial requirements in some states.

- Not claiming the exemption on another property.

It is essential for applicants to check their state’s specific rules to ensure compliance with all eligibility requirements.

Steps to Complete the Application for Residence Homestead Exemption

Completing the application for residence homestead exemption involves several steps to ensure accurate submission. Homeowners typically need to:

- Obtain the correct application form from the local appraisal district.

- Provide necessary personal information, including name, address, and property details.

- Attach any required documentation, such as proof of residency or ownership.

- Review the application for completeness and accuracy.

- Submit the application by the specified deadline, either online, by mail, or in person.

Required Documents

When applying for the residence homestead exemption, homeowners may need to provide various documents to support their application. Commonly required documents include:

- Proof of identity, such as a driver's license or state ID.

- Documentation proving residency, like utility bills or bank statements.

- Property deed or mortgage documents to verify ownership.

- Any additional forms or affidavits as required by the state or local appraisal district.

Form Submission Methods

Homeowners can typically submit their application for residence homestead exemption through several methods, depending on their local appraisal district's policies. Common submission methods include:

- Online submission via the appraisal district's website, if available.

- Mailing the completed form and supporting documents to the appropriate office.

- In-person submission at the local appraisal district office.

It is advisable to confirm the preferred submission method with the local authority to ensure timely processing.

Legal Use of the Application for Residence Homestead Exemption

The application for residence homestead exemption is governed by state laws that dictate its use and eligibility. Homeowners must adhere to these regulations to avoid penalties. Misrepresentation or failure to comply with the requirements can lead to legal consequences, including loss of the exemption and potential fines. Understanding the legal framework surrounding this application is crucial for homeowners seeking to benefit from tax reductions.

Create this form in 5 minutes or less

Find and fill out the correct application for residence homestead exemption 745796271

Create this form in 5 minutes!

How to create an eSignature for the application for residence homestead exemption 745796271

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the appraisal district residence homestead exemption?

The appraisal district residence homestead exemption is a tax benefit that reduces the taxable value of your primary residence. This exemption can lead to signNow savings on property taxes, making it essential for homeowners to understand and apply for it. By utilizing this exemption, you can ensure that you are not overpaying on your property taxes.

-

How can I apply for the appraisal district residence homestead exemption?

To apply for the appraisal district residence homestead exemption, you typically need to submit an application to your local appraisal district. This process may vary by location, so it's important to check the specific requirements for your area. Ensure you have the necessary documentation, such as proof of residency, to facilitate a smooth application process.

-

What are the benefits of the appraisal district residence homestead exemption?

The primary benefit of the appraisal district residence homestead exemption is the reduction in property taxes, which can lead to substantial savings. Additionally, this exemption can provide protection against increases in property value assessments, ensuring that your tax burden remains manageable. Homeowners can enjoy peace of mind knowing they are maximizing their tax benefits.

-

Are there any eligibility requirements for the appraisal district residence homestead exemption?

Yes, eligibility for the appraisal district residence homestead exemption typically requires that the property be your primary residence. Other requirements may include ownership of the property and meeting specific deadlines for application submission. It's crucial to review your local appraisal district's guidelines to ensure you qualify.

-

How does the appraisal district residence homestead exemption affect my property taxes?

The appraisal district residence homestead exemption directly reduces the assessed value of your home, which in turn lowers your property tax bill. This exemption can signNowly decrease the amount you owe each year, making homeownership more affordable. Understanding how this exemption works can help you budget effectively for your property expenses.

-

Can I combine the appraisal district residence homestead exemption with other exemptions?

Yes, in many cases, you can combine the appraisal district residence homestead exemption with other exemptions, such as those for seniors or disabled individuals. This combination can further reduce your property tax liability, maximizing your savings. It's advisable to consult with your local appraisal district to explore all available options.

-

What documents do I need to provide for the appraisal district residence homestead exemption application?

When applying for the appraisal district residence homestead exemption, you will typically need to provide proof of residency, such as a utility bill or driver's license. Additionally, you may need to submit a completed application form specific to your local appraisal district. Gathering these documents in advance can streamline the application process.

Get more for Application For Residence Homestead Exemption

- Dc 30 day notice vacate form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497301588 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement district of columbia form

- Letter from tenant to landlord about insufficient notice of change in rental agreement for other than rent increase district of form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants district of columbia form

- Tenant landlord utility 497301592 form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat district of columbia form

- 30 day notice to terminate month to month lease residential from landlord to tenant district of columbia form

Find out other Application For Residence Homestead Exemption

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free