Eftps Business Phone Worksheet Printable Form

What is the EFTPS Business Phone Worksheet Printable

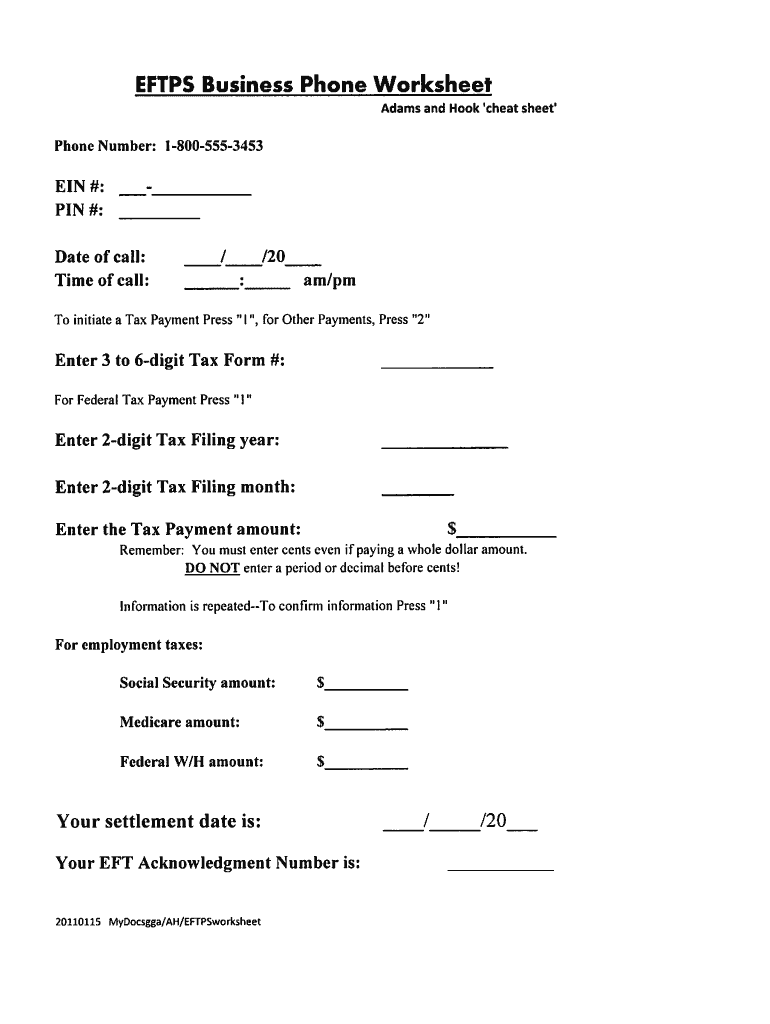

The EFTPS Business Phone Worksheet Printable is a crucial document designed for businesses to manage their electronic federal tax payment system (EFTPS) interactions efficiently. This worksheet serves as a reference tool, helping users keep track of important information related to their tax payments. It typically includes fields for business identification, payment amounts, due dates, and contact information. By utilizing this worksheet, businesses can ensure they stay organized and compliant with federal tax requirements.

How to Use the EFTPS Business Phone Worksheet Printable

Using the EFTPS Business Phone Worksheet Printable involves a straightforward process. First, download and print the worksheet from a reliable source. Next, fill in your business details, including the Employer Identification Number (EIN) and the contact number. As you process payments, record the payment amounts and dates on the worksheet. This will help you track your payment history and prepare for future tax obligations. Regularly updating this worksheet can assist in maintaining accurate records for your business.

Steps to Complete the EFTPS Business Phone Worksheet Printable

Completing the EFTPS Business Phone Worksheet Printable requires careful attention to detail. Follow these steps:

- Begin by entering your business name and EIN at the top of the worksheet.

- Fill in the contact phone number for your business.

- Record the payment amounts and corresponding due dates in the designated sections.

- Make note of any confirmations received from EFTPS after submitting payments.

- Review the completed worksheet for accuracy and keep it in a secure location for future reference.

Key Elements of the EFTPS Business Phone Worksheet Printable

The EFTPS Business Phone Worksheet Printable includes several key elements that are essential for effective tax management. These elements typically consist of:

- Business Information: Name, EIN, and contact details.

- Payment Details: Amounts, due dates, and payment methods used.

- Confirmation Numbers: For tracking and verification of payments.

- Notes Section: For any additional comments or reminders related to tax payments.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the EFTPS system, which are important to understand when using the EFTPS Business Phone Worksheet Printable. According to IRS regulations, businesses must ensure timely payments to avoid penalties. The worksheet can help businesses adhere to these guidelines by keeping accurate records of payment schedules and amounts. Regular consultation of IRS resources can provide updates on any changes to payment procedures or requirements.

Penalties for Non-Compliance

Failure to comply with EFTPS payment schedules can result in significant penalties for businesses. The IRS imposes fines for late payments, which can accumulate quickly. By utilizing the EFTPS Business Phone Worksheet Printable, businesses can track their payment obligations and avoid these penalties. Maintaining accurate records helps ensure that all payments are made on time, thereby reducing the risk of incurring additional costs.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the eftps business phone worksheet printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the eftps business phone worksheet?

The eftps business phone worksheet is a tool designed to help businesses manage their electronic federal tax payment system (EFTPS) information efficiently. It allows users to organize their business phone details and streamline communication with the IRS. By utilizing this worksheet, businesses can ensure they have all necessary information at their fingertips.

-

How can the eftps business phone worksheet benefit my business?

Using the eftps business phone worksheet can signNowly enhance your business's efficiency in managing tax payments. It helps in keeping track of important phone numbers and deadlines, reducing the risk of missed payments. This organized approach can lead to better compliance and peace of mind for business owners.

-

Is the eftps business phone worksheet easy to use?

Yes, the eftps business phone worksheet is designed to be user-friendly and straightforward. With clear sections for entering relevant information, users can quickly fill out the worksheet without any hassle. This ease of use makes it accessible for businesses of all sizes.

-

What features does the eftps business phone worksheet offer?

The eftps business phone worksheet includes features such as customizable fields for entering business phone numbers, reminders for payment deadlines, and a section for tracking payment history. These features help businesses stay organized and ensure timely tax payments. Overall, it serves as a comprehensive tool for managing EFTPS-related tasks.

-

Are there any costs associated with the eftps business phone worksheet?

The eftps business phone worksheet is typically offered as part of a broader service package, which may include additional features and tools. Pricing can vary based on the specific services chosen, but it is designed to be a cost-effective solution for businesses. For detailed pricing information, it's best to consult the service provider directly.

-

Can I integrate the eftps business phone worksheet with other tools?

Yes, the eftps business phone worksheet can often be integrated with various accounting and tax software solutions. This integration allows for seamless data transfer and improved workflow efficiency. By connecting it with other tools, businesses can enhance their overall tax management process.

-

Who can benefit from using the eftps business phone worksheet?

The eftps business phone worksheet is beneficial for any business that needs to manage its tax payments effectively. Small businesses, freelancers, and larger corporations alike can utilize this tool to streamline their EFTPS processes. It is particularly useful for those who want to ensure compliance and avoid penalties.

Get more for Eftps Business Phone Worksheet Printable

- Consent to publish release form emerald

- Application for roof guarantee siplast form

- Mediation statement form

- Sss r 3 form

- Medical mutual of ohio claim form 1500 manual

- Form ft 943897 quarterly inventory report by tax ny gov

- Contact secured futures to establish a trust fund form

- Solicitud de internet para el uso exclusivo de aeela favor de llenar form

Find out other Eftps Business Phone Worksheet Printable

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast