4460, International Fuel Tax Agreement Request for Cancellation of 2022-2026

What is the 4460, International Fuel Tax Agreement Request For Cancellation Of

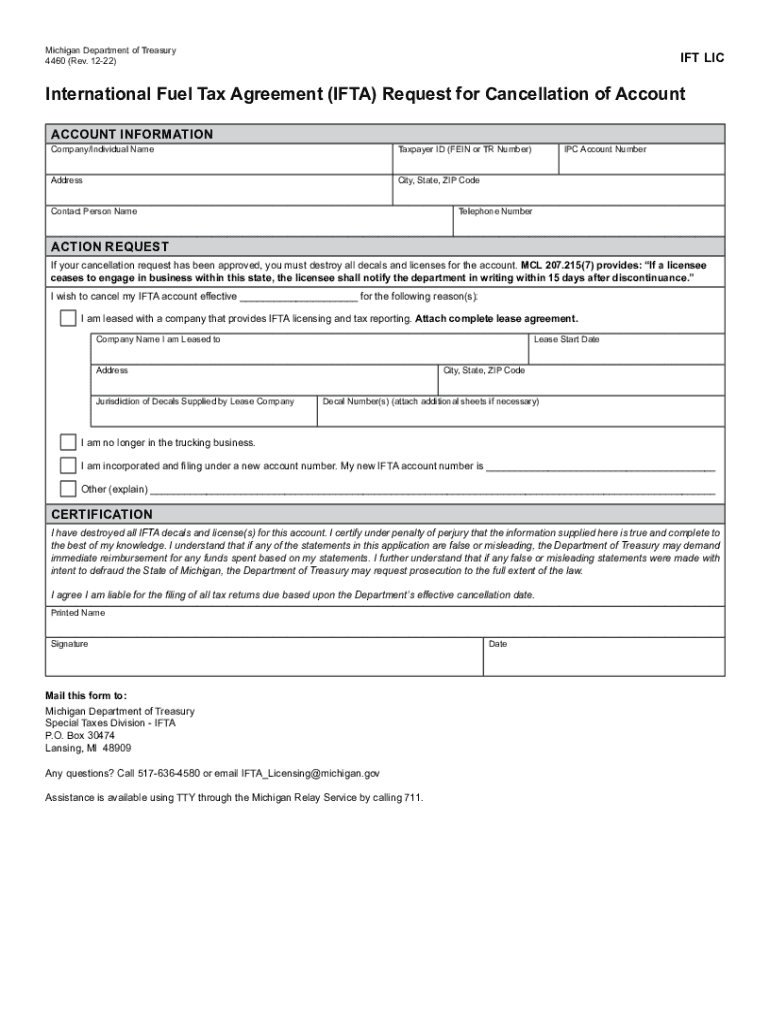

The 4460 form, known as the International Fuel Tax Agreement Request For Cancellation Of, is a document used by businesses to formally request the cancellation of their registration under the International Fuel Tax Agreement (IFTA). This agreement simplifies the reporting of fuel use by interstate motor carriers. The form serves as a means for carriers to notify the appropriate state authorities when they no longer wish to participate in IFTA, often due to changes in business operations or fleet composition.

How to use the 4460, International Fuel Tax Agreement Request For Cancellation Of

Using the 4460 form involves several straightforward steps. First, ensure that you have all necessary information, including your business details and IFTA account number. Complete the form by providing accurate information regarding the reasons for cancellation. After filling out the form, review it for any errors before submitting it to the appropriate state agency. It is essential to keep a copy of the submitted form for your records.

Steps to complete the 4460, International Fuel Tax Agreement Request For Cancellation Of

Completing the 4460 form requires careful attention to detail. Follow these steps:

- Gather necessary information, including your IFTA account number and business name.

- Clearly state the reason for cancellation in the designated section.

- Ensure all fields are filled out accurately to avoid processing delays.

- Sign and date the form to validate your request.

- Submit the completed form to your state’s IFTA office via the preferred submission method.

Key elements of the 4460, International Fuel Tax Agreement Request For Cancellation Of

The key elements of the 4460 form include the following:

- Business Information: Name, address, and IFTA account number.

- Reason for Cancellation: A clear explanation of why you are requesting cancellation.

- Signature: The form must be signed by an authorized representative of the business.

- Date: The date of submission should be included to track the request timeline.

Legal use of the 4460, International Fuel Tax Agreement Request For Cancellation Of

The 4460 form is a legally recognized document that allows businesses to formally cancel their participation in IFTA. It is important to use this form to ensure compliance with state regulations and to avoid potential penalties associated with maintaining an inactive IFTA account. Proper submission of the form protects your business from being liable for fuel taxes that are no longer applicable.

Filing Deadlines / Important Dates

When submitting the 4460 form, it is crucial to be aware of any filing deadlines. Each state may have its own specific timelines for processing cancellation requests. Generally, it is advisable to submit the form as soon as you determine that cancellation is necessary. Keeping track of important dates related to your IFTA filings can help prevent any compliance issues.

Create this form in 5 minutes or less

Find and fill out the correct 4460 international fuel tax agreement request for cancellation of

Create this form in 5 minutes!

How to create an eSignature for the 4460 international fuel tax agreement request for cancellation of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4460, International Fuel Tax Agreement Request For Cancellation Of?

The 4460, International Fuel Tax Agreement Request For Cancellation Of is a form used by businesses to formally request the cancellation of their IFTA account. This process is essential for companies that no longer operate under the IFTA regulations. Understanding this form can help streamline your compliance and reporting needs.

-

How can airSlate SignNow assist with the 4460, International Fuel Tax Agreement Request For Cancellation Of?

airSlate SignNow provides an efficient platform for completing and eSigning the 4460, International Fuel Tax Agreement Request For Cancellation Of. Our user-friendly interface allows you to fill out the form quickly and securely, ensuring that your request is submitted without delays.

-

Is there a cost associated with using airSlate SignNow for the 4460, International Fuel Tax Agreement Request For Cancellation Of?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, allowing you to manage your 4460, International Fuel Tax Agreement Request For Cancellation Of and other document needs without breaking the bank.

-

What features does airSlate SignNow offer for managing the 4460, International Fuel Tax Agreement Request For Cancellation Of?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the process of handling the 4460, International Fuel Tax Agreement Request For Cancellation Of. These tools help ensure that your documents are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for the 4460, International Fuel Tax Agreement Request For Cancellation Of?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, making it easy to manage your 4460, International Fuel Tax Agreement Request For Cancellation Of alongside your existing tools. This integration capability enhances workflow efficiency and document management.

-

What are the benefits of using airSlate SignNow for the 4460, International Fuel Tax Agreement Request For Cancellation Of?

Using airSlate SignNow for the 4460, International Fuel Tax Agreement Request For Cancellation Of provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform simplifies the eSigning process, allowing you to focus on your core business activities.

-

How secure is the airSlate SignNow platform for submitting the 4460, International Fuel Tax Agreement Request For Cancellation Of?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your sensitive information while submitting the 4460, International Fuel Tax Agreement Request For Cancellation Of. You can trust that your data is safe with us.

Get more for 4460, International Fuel Tax Agreement Request For Cancellation Of

Find out other 4460, International Fuel Tax Agreement Request For Cancellation Of

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe