Form #4460 IFTA Cancellation of Account State of Michigan Michigan 2009

What is the Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan

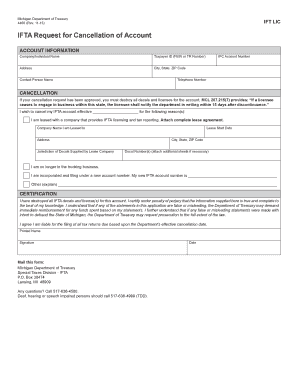

The Form #4460 IFTA Cancellation Of Account is a document used by businesses and individuals in Michigan to officially cancel their International Fuel Tax Agreement (IFTA) account. This form is essential for those who no longer operate vehicles that travel between states and require IFTA reporting. By submitting this form, taxpayers inform the Michigan Department of Treasury that they wish to terminate their IFTA account, which helps avoid any future tax obligations associated with fuel use in multiple jurisdictions.

Steps to complete the Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan

Completing the Form #4460 IFTA Cancellation Of Account involves several straightforward steps:

- Obtain the form from the Michigan Department of Treasury's website or through authorized channels.

- Fill in the required information, including your IFTA account number, business name, and contact details.

- Indicate the reason for cancellation and provide any necessary supporting documentation.

- Review the form for accuracy and completeness to ensure all required fields are filled out.

- Sign and date the form to validate your request.

- Submit the completed form to the appropriate office as indicated on the form instructions.

How to obtain the Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan

The Form #4460 IFTA Cancellation Of Account can be obtained through several methods. You can download it directly from the Michigan Department of Treasury's official website. Additionally, you may request a physical copy by contacting their office. It is advisable to ensure that you have the most current version of the form, as updates may occur periodically.

Legal use of the Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan

The legal use of Form #4460 IFTA Cancellation Of Account is grounded in compliance with state tax regulations. When properly completed and submitted, this form serves as a formal notification to the Michigan Department of Treasury regarding the cancellation of your IFTA account. This action helps prevent any future tax liabilities and ensures that your account is closed in accordance with state laws. It is important to retain a copy of the submitted form for your records, as it may be required for future reference.

State-specific rules for the Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan

In Michigan, specific rules apply to the cancellation of an IFTA account through Form #4460. Taxpayers must ensure that all outstanding taxes and fees are settled before submitting the cancellation request. Additionally, the form must be submitted within a designated timeframe to avoid penalties. Familiarizing yourself with these state-specific regulations is crucial for a smooth cancellation process.

Form Submission Methods (Online / Mail / In-Person)

The Form #4460 IFTA Cancellation Of Account can be submitted through various methods, depending on your preference and convenience. You may choose to submit the form online through the Michigan Department of Treasury's e-filing system, if available. Alternatively, you can mail the completed form to the designated address provided on the form. For those who prefer in-person submissions, visiting a local treasury office is also an option. Each method has its own processing times, so consider this when deciding how to submit your form.

Quick guide on how to complete form 4460 ifta cancellation of account state of michigan michigan

Complete Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan smoothly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your files swiftly without delays. Manage Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and eSign Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan effortlessly

- Find Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight pertinent areas of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4460 ifta cancellation of account state of michigan michigan

Create this form in 5 minutes!

How to create an eSignature for the form 4460 ifta cancellation of account state of michigan michigan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan?

Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan is a necessary document for businesses that wish to cancel their International Fuel Tax Agreement (IFTA) account in Michigan. This form helps ensure that your account is properly closed, preventing any future tax liabilities.

-

How can airSlate SignNow help with the Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan?

AirSlate SignNow provides an efficient platform to complete and eSign the Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan. Our user-friendly interface allows for quick document preparation and electronic signatures, expediting the cancellation process.

-

Is there a cost associated with using airSlate SignNow for Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan?

Yes, airSlate SignNow offers a competitive pricing model that varies depending on your needs and the number of users. Subscribing gives you access to all features necessary for completing the Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan efficiently.

-

What features does airSlate SignNow offer for completing Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan?

AirSlate SignNow includes various features such as document templates, real-time collaboration, and secure electronic signatures, all designed to facilitate the completion of Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan. These tools streamlines the process and ensures compliance.

-

Can I track the status of my Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan submission?

Absolutely! With airSlate SignNow, you can track the status of your Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan submission in real-time. This feature allows you to stay informed about when your document has been viewed or signed, ensuring peace of mind.

-

What integrations does airSlate SignNow offer for users preparing Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan?

AirSlate SignNow integrates with various applications, including Google Drive, Dropbox, and other cloud services, making it easier to import and export the Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan. These integrations enhance workflow efficiency and collaboration.

-

Is airSlate SignNow secure for eSigning Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan?

Yes, airSlate SignNow prioritizes security with advanced encryption and authentication measures, ensuring that your eSignature on Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan is safe and legally binding. Your documents are protected against unauthorized access.

Get more for Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan

- Including strike any that are inappropriate form

- Plumbing does this disposal appear to be leaking home form

- Full text of ampquotpunch vol 91ampquot internet archive form

- Chapter 283 telephone gas power and water companies form

- Notice to landlord floors stairways railing not in good repair repair requested form

- The premises are not clean in that there are piles of trash or garbage and no form

- Notice to landlord failure to provide garbage bins unsanitary condition form

- The obligation of tenant form

Find out other Form #4460 IFTA Cancellation Of Account State Of Michigan Michigan

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe