Form DD1 Tax Relief in Relation to Vehicles Purchased for Use by People with Disabilities Tax Relief in Relation to Vehicles Pur 2012

Understanding Form DD1 for Tax Relief Related to Vehicles for People with Disabilities

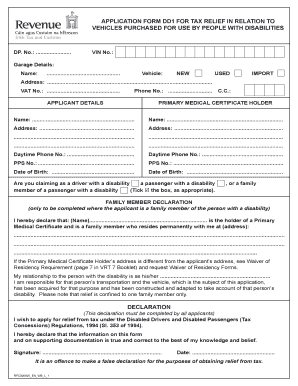

Form DD1 is designed to provide tax relief for individuals who purchase vehicles specifically for use by people with disabilities. This form is essential for claiming deductions or credits that can significantly reduce the financial burden associated with such purchases. The tax relief aims to support mobility and independence for individuals with disabilities, ensuring they have access to necessary transportation options.

How to Use Form DD1

To effectively use Form DD1, individuals must first ensure they meet the eligibility criteria for tax relief. After confirming eligibility, the form should be filled out accurately, providing all required information regarding the vehicle and the individual with disabilities. Once completed, the form can be submitted to the appropriate tax authority, either online or via mail, depending on local regulations.

Obtaining Form DD1

Form DD1 can typically be obtained from the official website of the tax authority or through local government offices that handle tax-related matters. It is important to ensure that you are using the most current version of the form to avoid any issues during the submission process. Check for any updates or changes in the form's requirements before downloading or printing it.

Steps to Complete Form DD1

Completing Form DD1 involves several key steps:

- Gather necessary documentation, including proof of disability and vehicle purchase details.

- Fill out personal information accurately, including your name, address, and Social Security number.

- Provide details about the vehicle, such as make, model, and purchase date.

- Indicate the nature of the disability and how the vehicle will be used to assist the individual.

- Review the form for accuracy before submission.

Legal Use of Form DD1

Form DD1 is legally recognized for claiming tax relief related to vehicles purchased for individuals with disabilities. It is crucial to use the form in accordance with the guidelines set forth by the tax authority to ensure compliance and avoid penalties. Misuse of the form or providing false information can lead to legal repercussions, including fines or denial of tax relief claims.

Eligibility Criteria for Form DD1

To qualify for tax relief using Form DD1, applicants must meet specific eligibility criteria. These typically include having a documented disability and purchasing a vehicle that is adapted or specifically used for the transportation of individuals with disabilities. It is advisable to review the detailed eligibility requirements provided by the tax authority to ensure compliance.

Important Filing Deadlines

Filing deadlines for Form DD1 may vary based on local tax regulations. It is essential to be aware of these deadlines to ensure that your application for tax relief is submitted on time. Missing the deadline could result in the loss of potential tax benefits. Always check the latest information from the tax authority regarding important dates related to Form DD1 submissions.

Create this form in 5 minutes or less

Find and fill out the correct form dd1 tax relief in relation to vehicles purchased for use by people with disabilities tax relief in relation to vehicles

Create this form in 5 minutes!

How to create an eSignature for the form dd1 tax relief in relation to vehicles purchased for use by people with disabilities tax relief in relation to vehicles

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form DD1 Tax Relief In Relation To Vehicles Purchased For Use By People With Disabilities?

Form DD1 is a tax relief application for individuals who have purchased vehicles specifically for use by people with disabilities. This form allows eligible applicants to claim tax relief, making vehicle ownership more affordable for those who need it most. Understanding how to properly fill out Form DD1 is crucial for maximizing your benefits.

-

How can airSlate SignNow assist with the Form DD1 submission process?

airSlate SignNow simplifies the submission of Form DD1 by providing an easy-to-use platform for eSigning and sending documents. Our solution ensures that all necessary forms are completed accurately and submitted on time, reducing the risk of errors. With airSlate SignNow, you can manage your tax relief documents efficiently.

-

What are the benefits of using airSlate SignNow for Form DD1?

Using airSlate SignNow for Form DD1 offers numerous benefits, including streamlined document management and secure eSigning capabilities. Our platform is designed to save you time and reduce paperwork, allowing you to focus on what matters most. Additionally, our cost-effective solution makes it accessible for everyone needing tax relief.

-

Is there a cost associated with using airSlate SignNow for Form DD1?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Our pricing is competitive and designed to provide value, especially for those seeking tax relief through Form DD1. You can choose a plan that best fits your requirements.

-

What features does airSlate SignNow offer for managing Form DD1?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for your Form DD1 submissions. These tools enhance your document workflow, ensuring that you can manage your tax relief applications efficiently. Our platform is user-friendly, making it easy for anyone to navigate.

-

Can I integrate airSlate SignNow with other applications for Form DD1?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling Form DD1. Whether you use CRM systems or document management tools, our platform can connect seamlessly to enhance your productivity. This integration capability is essential for efficient tax relief management.

-

How secure is the information submitted through airSlate SignNow for Form DD1?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect all information submitted through our platform, including Form DD1. You can trust that your sensitive data is safe while you apply for tax relief in relation to vehicles purchased for use by people with disabilities.

Get more for Form DD1 Tax Relief In Relation To Vehicles Purchased For Use By People With Disabilities Tax Relief In Relation To Vehicles Pur

- Legal last will and testament form for a married person with no children california

- Ca married form

- California codicil form

- Mutual wills package with last wills and testaments for married couple with adult children california form

- California married couple form

- Wills married couple 497299650 form

- California married marriage 497299651 form

- Legal last will and testament form for domestic partner with adult and minor children from prior marriage california

Find out other Form DD1 Tax Relief In Relation To Vehicles Purchased For Use By People With Disabilities Tax Relief In Relation To Vehicles Pur

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure