Form 1099 LTC Rev April

Understanding Form 1099 LTC Rev April

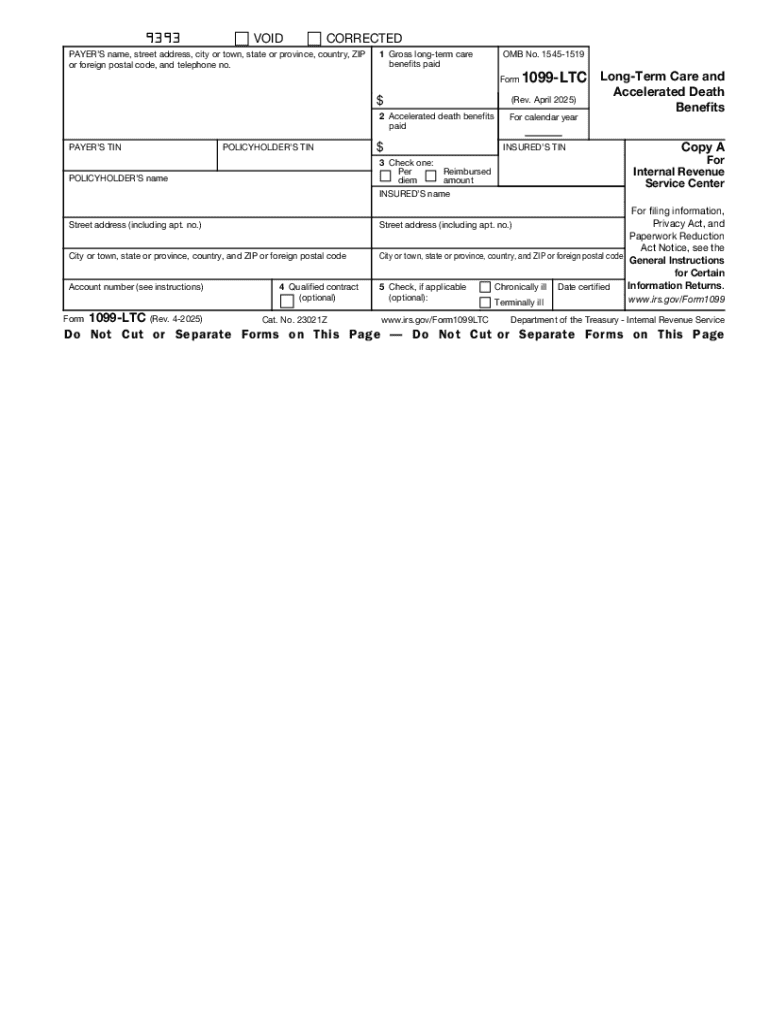

Form 1099 LTC Rev April is a tax document used in the United States to report long-term care benefits. This form is specifically designed for insurance companies and other payers who provide long-term care benefits to policyholders. It helps recipients understand the amounts they received and their tax implications. The form includes essential information such as the payer's details, the recipient's information, and the total amount of benefits paid during the tax year. Proper understanding of this form is crucial for accurate tax reporting.

Steps to Complete Form 1099 LTC Rev April

Completing Form 1099 LTC Rev April involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant information, including the recipient's name, address, and taxpayer identification number. Next, enter the payer's information, including the name and address of the insurance company or payer. In the designated fields, report the total amount of long-term care benefits paid to the recipient during the tax year. Ensure that all figures are accurate, as errors can lead to complications during tax filing. Finally, review the completed form for any mistakes before submission.

Obtaining Form 1099 LTC Rev April

To obtain Form 1099 LTC Rev April, individuals can visit the official IRS website or contact their long-term care insurance provider. Many insurance companies provide this form automatically to policyholders who received benefits during the year. If a recipient does not receive the form, they should reach out to their insurance provider to request a copy. Additionally, taxpayers can access the form through various tax preparation software or services that support IRS forms.

Key Elements of Form 1099 LTC Rev April

Form 1099 LTC Rev April contains several key elements that are important for both payers and recipients. These elements include:

- Payer Information: Name, address, and taxpayer identification number of the payer.

- Recipient Information: Name, address, and taxpayer identification number of the recipient.

- Benefit Amount: Total long-term care benefits paid during the tax year.

- Type of Benefits: Description of the type of long-term care benefits provided.

Understanding these elements helps ensure that both parties have the necessary information for accurate tax reporting.

IRS Guidelines for Form 1099 LTC Rev April

The IRS provides specific guidelines for completing and filing Form 1099 LTC Rev April. According to IRS regulations, payers must issue this form to recipients who received long-term care benefits exceeding a certain threshold. It is essential for payers to maintain accurate records of all benefits paid to ensure compliance with IRS requirements. Recipients should keep this form for their records, as it is necessary for reporting income on their tax returns. Familiarity with these guidelines helps avoid penalties and ensures proper tax compliance.

Filing Deadlines for Form 1099 LTC Rev April

Filing deadlines for Form 1099 LTC Rev April are crucial for compliance. Generally, payers must send the completed form to recipients by January thirty-first of the year following the tax year in which the benefits were paid. Additionally, the IRS requires that the form be filed electronically or mailed by the end of February for electronic submissions or the end of March for paper submissions. Adhering to these deadlines is essential to avoid penalties and ensure timely processing of tax returns.

Create this form in 5 minutes or less

Related searches to Form 1099 LTC Rev April

Create this form in 5 minutes!

How to create an eSignature for the form 1099 ltc rev april

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1099 LTC Rev April?

Form 1099 LTC Rev April is a tax form used to report long-term care benefits. It is essential for individuals receiving these benefits to accurately report them for tax purposes. Understanding this form can help ensure compliance and avoid potential penalties.

-

How can airSlate SignNow assist with Form 1099 LTC Rev April?

airSlate SignNow provides a streamlined solution for sending and eSigning Form 1099 LTC Rev April. Our platform simplifies the document management process, allowing users to easily create, send, and track their forms securely. This efficiency can save time and reduce errors in tax reporting.

-

What are the pricing options for using airSlate SignNow for Form 1099 LTC Rev April?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while providing the necessary features for managing Form 1099 LTC Rev April. Visit our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing Form 1099 LTC Rev April?

Our platform includes features such as customizable templates, secure eSigning, and real-time tracking for Form 1099 LTC Rev April. These tools enhance the efficiency of document handling and ensure that all parties can easily access and sign the necessary forms. Additionally, our user-friendly interface makes the process straightforward.

-

Are there any benefits to using airSlate SignNow for Form 1099 LTC Rev April?

Using airSlate SignNow for Form 1099 LTC Rev April offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our solution helps businesses streamline their document workflows, ensuring timely submissions and compliance with tax regulations. This can lead to signNow time savings and improved accuracy.

-

Can I integrate airSlate SignNow with other software for Form 1099 LTC Rev April?

Yes, airSlate SignNow supports integrations with various software applications, making it easy to manage Form 1099 LTC Rev April alongside your existing tools. This flexibility allows for seamless data transfer and improved workflow efficiency. Check our integrations page for a list of compatible applications.

-

Is airSlate SignNow secure for handling Form 1099 LTC Rev April?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information related to Form 1099 LTC Rev April. Our platform is designed to ensure that your documents are safe from unauthorized access while maintaining compliance with industry standards.

Get more for Form 1099 LTC Rev April

Find out other Form 1099 LTC Rev April

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF