Sit522 2024-2026

What is the Sit522

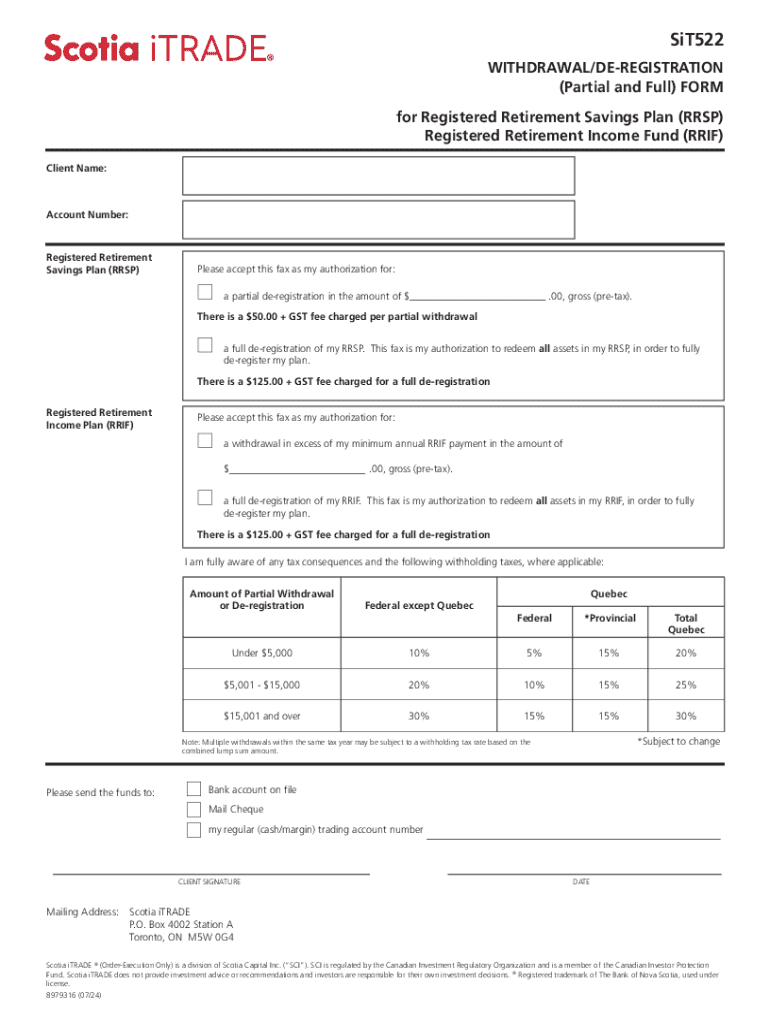

The Sit522 is a specific form utilized in the United States for reporting certain tax-related information. It is essential for individuals and businesses to understand its purpose and implications, as it plays a crucial role in maintaining compliance with federal tax regulations. The form is primarily used to document income, deductions, and credits, ensuring that taxpayers accurately report their financial activities to the Internal Revenue Service (IRS).

How to use the Sit522

Using the Sit522 involves several key steps. First, gather all necessary financial documents, such as income statements, receipts for deductions, and any relevant tax forms. Next, carefully fill out the Sit522, ensuring that all information is accurate and complete. It is important to double-check calculations and verify that all required fields are filled. Once completed, the form can be submitted electronically or via mail, depending on the preferred submission method.

Steps to complete the Sit522

Completing the Sit522 requires attention to detail. Begin by entering your personal information, including your name, address, and Social Security number. Next, report your income sources, detailing each type of income earned during the tax year. Follow this by listing any deductions you qualify for, such as business expenses or educational credits. After filling in all sections, review the form for accuracy before submitting it to the IRS.

Legal use of the Sit522

The Sit522 must be used in accordance with IRS regulations. It is legally binding and should reflect truthful and accurate information. Misrepresentation or errors can lead to penalties, including fines or audits. Taxpayers are encouraged to familiarize themselves with IRS guidelines to ensure compliance and avoid any legal repercussions associated with improper use of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Sit522 are crucial for compliance. Typically, the form must be submitted by April fifteenth of the following tax year. However, specific circumstances, such as extensions or special provisions, may alter this date. It is important to stay informed about any changes to deadlines to avoid late filing penalties.

Required Documents

To successfully complete the Sit522, certain documents are required. These may include W-2 forms, 1099 forms, receipts for deductible expenses, and any prior year tax returns. Having these documents organized and readily available can streamline the process and ensure that all necessary information is accurately reported.

Examples of using the Sit522

There are various scenarios in which the Sit522 may be utilized. For instance, a self-employed individual may use the form to report income from freelance work, while a business owner may document earnings and expenses related to their company. Understanding these examples can help taxpayers recognize when and how to apply the Sit522 in their financial reporting.

Create this form in 5 minutes or less

Find and fill out the correct sit522

Create this form in 5 minutes!

How to create an eSignature for the sit522

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Sit522 and how does it relate to airSlate SignNow?

Sit522 is a key feature of airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, making it easier to send and sign documents securely. By utilizing Sit522, businesses can improve efficiency and reduce turnaround times for important documents.

-

How much does airSlate SignNow cost with the Sit522 feature?

The pricing for airSlate SignNow with the Sit522 feature is competitive and designed to fit various business needs. Plans start at an affordable monthly rate, allowing businesses of all sizes to access powerful eSigning tools. For detailed pricing information, visit our pricing page or contact our sales team.

-

What are the main features of Sit522 in airSlate SignNow?

Sit522 includes features such as customizable templates, real-time tracking, and secure cloud storage for documents. These features enable users to manage their eSigning processes efficiently. Additionally, Sit522 supports multiple file formats, ensuring compatibility with various document types.

-

What benefits does Sit522 offer to businesses using airSlate SignNow?

By implementing Sit522, businesses can signNowly reduce the time spent on document processing. This feature enhances collaboration among team members and clients, leading to faster decision-making. Furthermore, Sit522 ensures compliance with legal standards, providing peace of mind for users.

-

Can Sit522 integrate with other software applications?

Yes, Sit522 is designed to integrate seamlessly with various software applications, including CRM and project management tools. This integration allows for a more cohesive workflow, enabling users to manage documents directly from their preferred platforms. Check our integrations page for a full list of compatible applications.

-

Is Sit522 secure for handling sensitive documents?

Absolutely, Sit522 prioritizes security by employing advanced encryption and authentication measures. This ensures that all documents signed and stored through airSlate SignNow are protected against unauthorized access. Users can confidently handle sensitive information knowing that Sit522 meets industry security standards.

-

How can I get started with Sit522 on airSlate SignNow?

Getting started with Sit522 is simple. You can sign up for a free trial on our website to explore its features and benefits. Once registered, you’ll have access to all the tools needed to streamline your document signing process with Sit522.

Get more for Sit522

- Chapter 27 section 2 imperialism case study nigeria form

- Fr 500 combined business tax registration application otr cfo dc form

- Ups service failure claim filing form

- Tenancy application form single property applying for

- Attending dentist s statement macalester college macalester form

- Fmcsa dot forms

- Middle school reading literary terms form

- Securities lending agreement template form

Find out other Sit522

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple