California Probate Code, Section 6240 Calbar Ca 2010-2026

Understanding the California Probate Code, Section 6240

The California Probate Code, Section 6240, outlines the legal framework for statutory wills in California. This section is particularly important for individuals who wish to create a simple will without the need for extensive legal formalities. It provides a straightforward mechanism for individuals to express their testamentary intentions, ensuring that their assets are distributed according to their wishes upon death. The statutory will is designed to be user-friendly, making it accessible for those who may not have the resources to engage legal counsel.

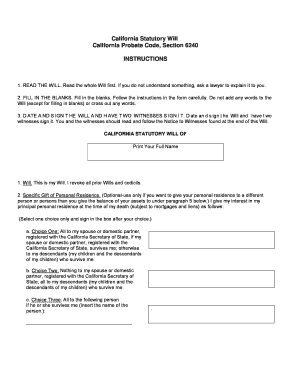

Steps to Complete the California Statutory Will Form

Completing the California statutory will form involves several clear steps. First, individuals must download the form, which is available through various legal resources. Once downloaded, the form needs to be filled out with personal information, including the testator's name, address, and details of beneficiaries. It's essential to clearly specify the distribution of assets to avoid any ambiguity. After completing the form, the testator must sign the document in the presence of at least two witnesses, who must also sign to validate the will. This process ensures that the will meets the legal requirements set forth in the California Probate Code.

Key Elements of the California Statutory Will

The statutory will form includes several key elements that must be addressed for it to be valid. These elements include the identification of the testator, the appointment of an executor to manage the estate, and the designation of beneficiaries who will inherit the assets. Additionally, the will must outline specific bequests, if any, and include a residuary clause to handle any remaining assets not specifically mentioned. Ensuring that all these elements are clearly articulated is crucial for the enforceability of the will.

Legal Use of the California Statutory Will Form

The California statutory will form is legally recognized under the California Probate Code, making it a valid option for estate planning. It is particularly useful for individuals with straightforward estate planning needs, such as those with limited assets or uncomplicated family situations. By utilizing this form, individuals can ensure their final wishes are documented and legally binding, reducing the risk of disputes among heirs after their passing. It is advisable to review the completed will periodically, especially after significant life events, to ensure it remains aligned with the testator's current intentions.

Obtaining the California Statutory Will Form

The California statutory will form can be obtained through various sources, including state government websites, legal aid organizations, and law libraries. It is essential to ensure that the version downloaded is the most current and complies with the latest legal standards. Individuals may also consult with legal professionals for guidance on completing the form correctly. Accessing the form online allows for easy downloading and printing, making it convenient for users to begin their estate planning process.

Form Submission Methods for the California Statutory Will

Once the California statutory will form is completed and signed, it does not need to be filed with the court unless a probate proceeding is initiated. However, it is crucial to store the document in a safe place and inform trusted individuals of its location. Some people choose to keep their wills in a safe deposit box or with their attorney. If the will is needed for probate, it can be submitted to the appropriate probate court in the county where the testator resided at the time of death.

Handy tips for filling out California Probate Code, Section 6240 Calbar Ca online

Quick steps to complete and e-sign California Probate Code, Section 6240 Calbar Ca online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Gain access to a GDPR and HIPAA compliant solution for optimum simpleness. Use signNow to electronically sign and send out California Probate Code, Section 6240 Calbar Ca for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct california probate code section 6240 calbar ca

Create this form in 5 minutes!

How to create an eSignature for the california probate code section 6240 calbar ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a California statutory will form download?

A California statutory will form download is a legally recognized document that allows individuals to outline their estate plans in compliance with California law. This form simplifies the process of creating a will, ensuring that your wishes are honored after your passing.

-

How can I obtain a California statutory will form download?

You can easily obtain a California statutory will form download through the airSlate SignNow platform. Our user-friendly interface allows you to access and download the form quickly, ensuring you have the necessary documents at your fingertips.

-

Is the California statutory will form download free?

While the California statutory will form download is available for free, airSlate SignNow offers additional features and services that may incur a fee. These premium options enhance your document management experience, making it easier to eSign and share your will securely.

-

What features does airSlate SignNow offer for the California statutory will form download?

airSlate SignNow provides a range of features for the California statutory will form download, including eSignature capabilities, document storage, and collaboration tools. These features streamline the process of creating and managing your will, ensuring a hassle-free experience.

-

Can I customize the California statutory will form download?

Yes, you can customize the California statutory will form download to fit your specific needs. airSlate SignNow allows you to add personal details and make necessary adjustments, ensuring that your will accurately reflects your wishes.

-

Is the California statutory will form download legally binding?

Yes, the California statutory will form download is legally binding when completed and signed according to California law. Using airSlate SignNow ensures that your document meets all legal requirements, providing peace of mind regarding your estate planning.

-

How does airSlate SignNow ensure the security of my California statutory will form download?

airSlate SignNow prioritizes the security of your documents, including the California statutory will form download. Our platform employs advanced encryption and secure storage solutions to protect your sensitive information from unauthorized access.

Get more for California Probate Code, Section 6240 Calbar Ca

Find out other California Probate Code, Section 6240 Calbar Ca

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile