Ppf Claim Form

What is the PPF Claim Form

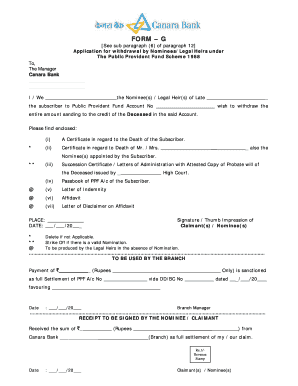

The PPF claim form is a document used to request the release of funds from a Public Provident Fund (PPF) account. This form is essential for account holders who wish to withdraw their accumulated savings or close their PPF account after the completion of the maturity period. The form captures vital information such as the account holder's details, the amount being claimed, and the purpose of the withdrawal. It serves as an official request to the financial institution managing the PPF account.

How to Obtain the PPF Claim Form

The PPF claim form can be obtained directly from the bank or financial institution where the PPF account is held. Many banks also provide the form on their official websites, allowing users to download and print it. Additionally, some institutions may offer the option to fill out the form electronically, facilitating a smoother submission process. It is important to ensure that the correct version of the form is used, as variations may exist depending on the institution.

Steps to Complete the PPF Claim Form

Completing the PPF claim form involves several key steps:

- Gather Required Information: Collect personal details, including your name, address, and PPF account number.

- Specify the Claim Amount: Clearly state the amount you wish to withdraw or claim.

- Provide Purpose of Withdrawal: Indicate the reason for the claim, such as maturity or partial withdrawal.

- Sign and Date the Form: Ensure the form is signed and dated to validate the request.

After completing the form, review it for accuracy before submission to avoid delays in processing.

Required Documents

When submitting the PPF claim form, certain documents may be required to support your request. These typically include:

- Identity Proof: A government-issued ID such as a driver's license or passport.

- Address Proof: Documents like utility bills or bank statements that confirm your current address.

- Account Passbook: The PPF account passbook may need to be presented to verify account details.

It is advisable to check with your bank for any additional documentation they may require.

Form Submission Methods

The PPF claim form can be submitted through various methods, depending on the policies of the financial institution:

- In-Person: Visit the bank branch where the PPF account is held and submit the form directly to a representative.

- By Mail: Some institutions allow for the claim form to be mailed to a designated address. Ensure that it is sent via a reliable postal service.

- Online Submission: If available, you may submit the form electronically through the bank's online portal, which can expedite the process.

Confirm the preferred submission method with your bank to ensure compliance with their procedures.

Legal Use of the PPF Claim Form

The PPF claim form is legally binding and must be filled out accurately to avoid any issues with fund disbursement. Misrepresentation of information or submission of false documents can lead to penalties or legal action. It is important to understand the terms and conditions associated with your PPF account, including withdrawal limits and timelines. Familiarizing yourself with these regulations ensures that your claim process is smooth and compliant with legal standards.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ppf claim form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PPF claim form?

A PPF claim form is a document used to initiate a claim under the Pension Protection Fund. It allows individuals to claim compensation for their pension benefits if their employer's pension scheme is underfunded or has failed. Understanding how to properly fill out the PPF claim form is crucial for ensuring a smooth claims process.

-

How can airSlate SignNow help with the PPF claim form?

airSlate SignNow provides an efficient platform for completing and eSigning your PPF claim form. With its user-friendly interface, you can easily upload, fill out, and send your claim form securely. This streamlines the process, ensuring that your claim is submitted quickly and accurately.

-

Is there a cost associated with using airSlate SignNow for the PPF claim form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. While there may be a fee for using the service, the cost is often outweighed by the time saved and the efficiency gained in managing your PPF claim form. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the PPF claim form?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easy to create, edit, and manage your PPF claim form. Additionally, you can track the status of your document in real-time, ensuring you never miss a step in the claims process.

-

Can I integrate airSlate SignNow with other applications for my PPF claim form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow. Whether you need to connect with CRM systems or document management tools, integrating airSlate SignNow can enhance your efficiency when handling the PPF claim form.

-

What are the benefits of using airSlate SignNow for the PPF claim form?

Using airSlate SignNow for your PPF claim form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows you to complete and submit your claim form electronically, minimizing delays and ensuring that your information is protected. This can lead to faster processing of your claim.

-

Is airSlate SignNow secure for submitting my PPF claim form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your PPF claim form and personal information are protected. The platform uses advanced encryption and secure data storage practices to safeguard your documents. You can confidently submit your claim form knowing that your data is secure.

Get more for Ppf Claim Form

Find out other Ppf Claim Form

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document