Fair Market Valuation Form EVANTAGE Equity Trust Company

Understanding the Fair Market Valuation Form EVANTAGE Equity Trust Company

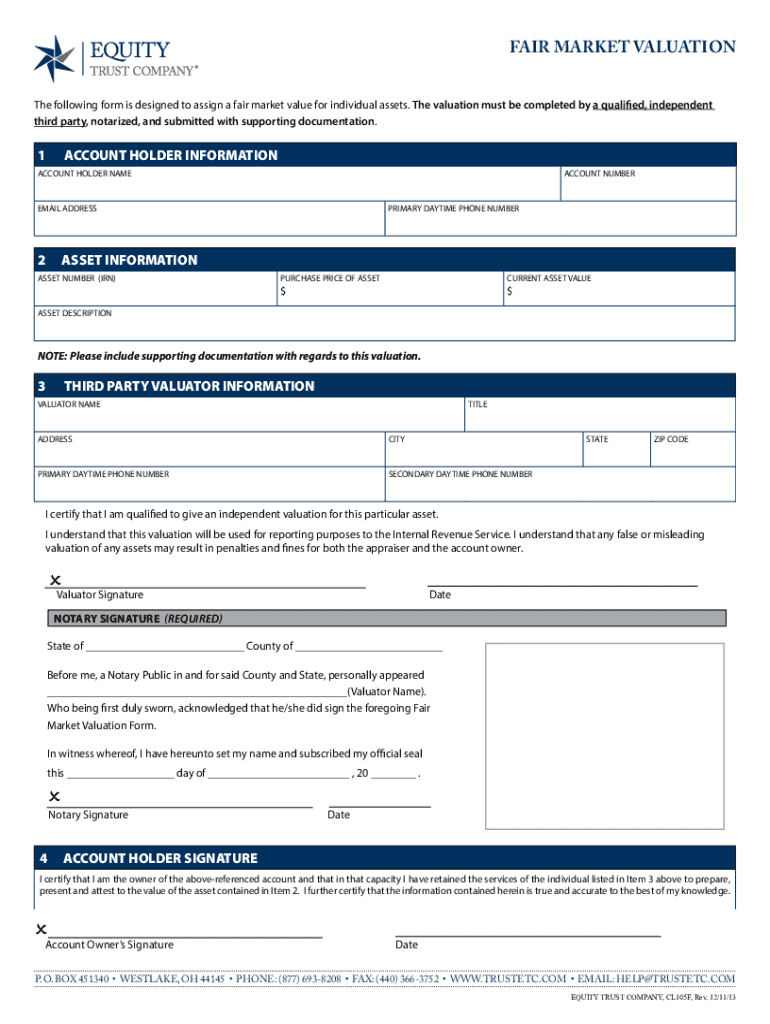

The Fair Market Valuation Form EVANTAGE Equity Trust Company is a specialized document used to determine the fair market value of assets held within an equity trust. This form is essential for ensuring compliance with IRS regulations and for accurately reporting asset values for tax purposes. By providing a standardized method for valuation, the form helps both individuals and businesses maintain transparency and accountability in their financial dealings.

Steps to Complete the Fair Market Valuation Form EVANTAGE Equity Trust Company

Completing the Fair Market Valuation Form involves several key steps:

- Gather all relevant documentation regarding the assets in question, including purchase agreements, appraisals, and any previous valuations.

- Fill out the form with accurate information about each asset, including descriptions, current market conditions, and any pertinent financial data.

- Review the completed form for accuracy and completeness to ensure all required fields are filled out correctly.

- Submit the form as instructed, either electronically or via traditional mail, depending on the requirements of the Equity Trust Company.

Legal Use of the Fair Market Valuation Form EVANTAGE Equity Trust Company

The Fair Market Valuation Form serves a critical legal function in asset valuation. It is used to establish a fair market value that can be relied upon for tax reporting and compliance with federal regulations. Proper use of this form can help mitigate legal risks associated with undervaluation or overvaluation of assets. It is advisable to consult with a legal or financial advisor to ensure that the form is completed correctly and in accordance with applicable laws.

Key Elements of the Fair Market Valuation Form EVANTAGE Equity Trust Company

Several key elements are essential when filling out the Fair Market Valuation Form:

- Asset Description: A detailed description of each asset, including its type, location, and any unique identifiers.

- Current Market Value: An estimation of the asset's current market value based on recent sales or appraisals.

- Supporting Documentation: Any documents that support the valuation, such as appraisals, purchase agreements, or market analysis reports.

- Signature and Date: The form must be signed and dated by the individual or authorized representative completing it.

How to Obtain the Fair Market Valuation Form EVANTAGE Equity Trust Company

The Fair Market Valuation Form can typically be obtained directly from the Equity Trust Company's website or by contacting their customer service department. It is important to ensure that you are using the most current version of the form to comply with the latest regulations. Additionally, some financial institutions may provide access to the form through their online platforms or customer portals.

Examples of Using the Fair Market Valuation Form EVANTAGE Equity Trust Company

There are various scenarios in which the Fair Market Valuation Form may be utilized:

- When transferring assets into an equity trust for investment purposes.

- During estate planning to ensure accurate asset valuation for beneficiaries.

- For tax reporting purposes, particularly when claiming deductions or reporting capital gains.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fair market valuation form evantage equity trust company

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fair Market Valuation Form EVANTAGE Equity Trust Company?

The Fair Market Valuation Form EVANTAGE Equity Trust Company is a document used to determine the fair market value of assets held in a trust. This form is essential for compliance and accurate reporting, ensuring that all valuations are conducted in accordance with IRS guidelines.

-

How can I access the Fair Market Valuation Form EVANTAGE Equity Trust Company?

You can easily access the Fair Market Valuation Form EVANTAGE Equity Trust Company through the airSlate SignNow platform. Simply log in to your account, navigate to the forms section, and you will find the form available for download and electronic signing.

-

What are the benefits of using the Fair Market Valuation Form EVANTAGE Equity Trust Company?

Using the Fair Market Valuation Form EVANTAGE Equity Trust Company streamlines the valuation process, ensuring accuracy and compliance. It also facilitates faster transactions and enhances the overall efficiency of managing trust assets, making it a valuable tool for both trustees and beneficiaries.

-

Is there a cost associated with the Fair Market Valuation Form EVANTAGE Equity Trust Company?

The Fair Market Valuation Form EVANTAGE Equity Trust Company is included in the airSlate SignNow subscription plans, which are designed to be cost-effective. Depending on your chosen plan, you may have access to additional features that enhance your document management experience.

-

Can I integrate the Fair Market Valuation Form EVANTAGE Equity Trust Company with other software?

Yes, airSlate SignNow allows for seamless integration with various software applications, enhancing the functionality of the Fair Market Valuation Form EVANTAGE Equity Trust Company. This integration capability ensures that you can manage your documents efficiently across different platforms.

-

How does airSlate SignNow ensure the security of the Fair Market Valuation Form EVANTAGE Equity Trust Company?

airSlate SignNow prioritizes security by implementing advanced encryption and authentication measures for the Fair Market Valuation Form EVANTAGE Equity Trust Company. This ensures that your sensitive information remains protected throughout the signing and storage process.

-

What features does airSlate SignNow offer for the Fair Market Valuation Form EVANTAGE Equity Trust Company?

airSlate SignNow provides a range of features for the Fair Market Valuation Form EVANTAGE Equity Trust Company, including electronic signatures, document tracking, and customizable templates. These features enhance user experience and streamline the document management process.

Get more for Fair Market Valuation Form EVANTAGE Equity Trust Company

- Sample roommate agreement eis eis housing resource center form

- Name the pattern block to cover half the rhombus form

- Omega psi phi form 53

- Equine bill of sale form 680450

- Horizon blue cross blue shield prior authorization form

- Application form new york state department of correctional doccs ny

- Maine judicial branch fm 070 rev 0820 page 1 of form

- Personal family loan agreement template form

Find out other Fair Market Valuation Form EVANTAGE Equity Trust Company

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer