Heath Individual Return 24 2024-2026

What is the Heath Individual Return 24

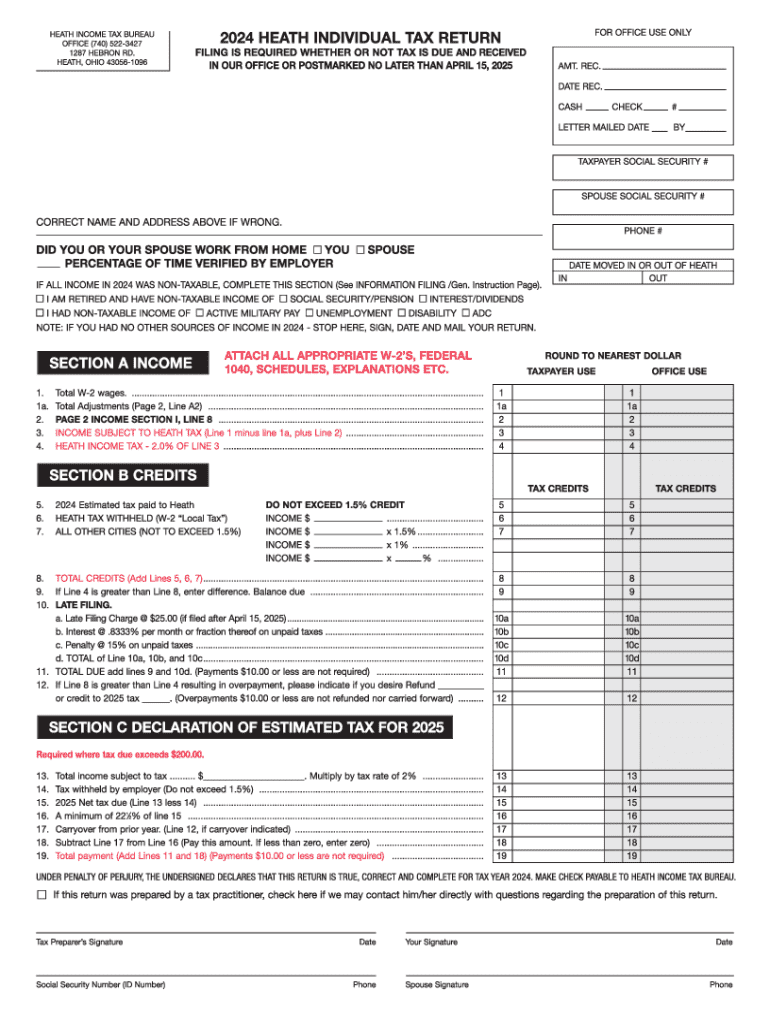

The Heath Individual Return 24 is a specific tax form used by individuals to report their income and calculate their tax liabilities for a given tax year. This form is essential for ensuring compliance with federal tax regulations and is typically required for various income types, including wages, investments, and self-employment earnings. Understanding the purpose of this form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Heath Individual Return 24

To effectively use the Heath Individual Return 24, individuals must gather all necessary financial information, including income statements, deduction records, and any applicable tax credits. The form is structured to guide users through various sections, allowing for clear reporting of income and deductions. It is important to follow the instructions carefully, ensuring that all information is accurate and complete to facilitate a smooth filing process.

Steps to complete the Heath Individual Return 24

Completing the Heath Individual Return 24 involves several key steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and records of deductions.

- Carefully read the instructions provided with the form to understand each section.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Claim deductions and credits as applicable, ensuring to follow guidelines for eligibility.

- Review the completed form for accuracy before submission.

Legal use of the Heath Individual Return 24

The Heath Individual Return 24 must be used in accordance with IRS regulations. It is legally binding, meaning that any inaccuracies or omissions can lead to penalties or audits. Individuals are responsible for ensuring that the information provided is truthful and complete. Understanding the legal implications of filing this form is essential for maintaining compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Heath Individual Return 24 typically align with the annual tax season in the United States. Generally, the deadline for submission is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to these dates to avoid late fees or penalties.

Required Documents

Before completing the Heath Individual Return 24, individuals must collect several key documents:

- W-2 forms from employers for reporting wages.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation for deductions, including mortgage interest statements and medical expenses.

- Tax credit documentation, if applicable.

Who Issues the Form

The Heath Individual Return 24 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement of tax laws in the United States. This form is part of the IRS's efforts to standardize tax reporting and ensure compliance across various income types and taxpayer situations.

Create this form in 5 minutes or less

Find and fill out the correct heath individual return 24

Create this form in 5 minutes!

How to create an eSignature for the heath individual return 24

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Heath Individual Return 24?

The Heath Individual Return 24 is a comprehensive solution designed to streamline the process of filing individual tax returns. It simplifies the documentation required and ensures compliance with tax regulations, making it easier for users to manage their tax obligations.

-

How much does the Heath Individual Return 24 cost?

The pricing for the Heath Individual Return 24 is competitive and designed to provide value for users. You can choose from various subscription plans that cater to different needs, ensuring you only pay for what you require.

-

What features does the Heath Individual Return 24 offer?

The Heath Individual Return 24 includes features such as eSignature capabilities, document tracking, and secure storage. These features enhance the user experience by making the filing process more efficient and organized.

-

How can the Heath Individual Return 24 benefit my business?

Using the Heath Individual Return 24 can signNowly reduce the time and effort spent on tax filing. It allows businesses to focus on their core operations while ensuring that tax returns are filed accurately and on time.

-

Is the Heath Individual Return 24 easy to integrate with other tools?

Yes, the Heath Individual Return 24 is designed to seamlessly integrate with various business tools and software. This ensures that you can easily incorporate it into your existing workflows without any disruptions.

-

Can I use the Heath Individual Return 24 for multiple users?

Absolutely! The Heath Individual Return 24 supports multiple users, making it ideal for businesses with several employees needing to file individual returns. This feature enhances collaboration and efficiency within your team.

-

What security measures are in place for the Heath Individual Return 24?

The Heath Individual Return 24 prioritizes user security with advanced encryption and secure data storage. This ensures that all sensitive information is protected, giving users peace of mind while managing their tax returns.

Get more for Heath Individual Return 24

- Character defects list 434558573 form

- Faa form 8060 11

- Niqs probationer form

- Cif number emirates nbd form

- Printable blank bill of lading pdf form

- Bark for life registration form relay for life relay acsevents

- Qbcc level 1 renovation extension and repair contract form

- Medical necessity review form for hospital beds pdf mass gov mass

Find out other Heath Individual Return 24

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast