Instructions for Annual Transmittal of State 1099 Forms 2020-2026

Understanding the Instructions for Annual Transmittal of State 1099 Forms

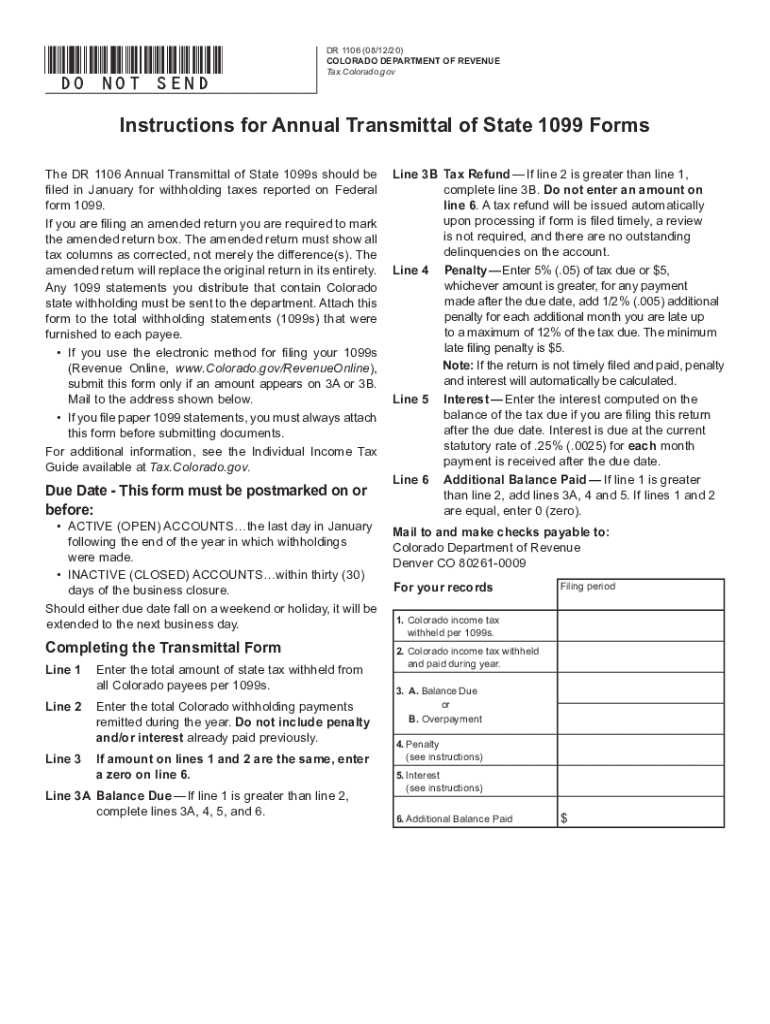

The Instructions for Annual Transmittal of State 1099 Forms provide essential guidelines for businesses and individuals required to report various types of income to state tax authorities. These forms are typically used to report payments made to independent contractors, freelancers, and other non-employees. Each state may have specific requirements regarding the format and submission of these forms, making it crucial to understand the instructions thoroughly.

Steps to Complete the Instructions for Annual Transmittal of State 1099 Forms

Completing the Instructions for Annual Transmittal of State 1099 Forms involves a series of methodical steps:

- Gather all necessary information, including the recipient's name, address, and Taxpayer Identification Number (TIN).

- Determine the type of income being reported and select the appropriate 1099 form.

- Fill out the form accurately, ensuring all details are correct to avoid penalties.

- Review the completed form for any errors or omissions.

- Submit the form according to your state’s guidelines, either electronically or via mail.

Filing Deadlines and Important Dates

Filing deadlines for the Instructions for Annual Transmittal of State 1099 Forms can vary by state. Generally, forms must be submitted by January thirty-first for the previous calendar year. It is essential to check your specific state’s deadlines to ensure compliance and avoid late fees.

State-Specific Rules for the Instructions for Annual Transmittal of State 1099 Forms

Each state may have unique rules regarding the transmittal of 1099 forms. Some states require additional forms or specific information not mandated by the IRS. Familiarizing yourself with these state-specific requirements is vital to ensure accurate reporting and compliance with local tax laws.

Legal Use of the Instructions for Annual Transmittal of State 1099 Forms

The Instructions for Annual Transmittal of State 1099 Forms serve a legal purpose in reporting income to state tax authorities. Accurate completion and timely submission of these forms are necessary to fulfill legal obligations and avoid potential penalties for non-compliance.

Examples of Using the Instructions for Annual Transmittal of State 1099 Forms

Practical examples of using the Instructions for Annual Transmittal of State 1099 Forms include:

- A small business hiring a freelance graphic designer and needing to report payments made.

- An individual receiving rental income from a property and reporting it to the state.

- A contractor working with multiple subcontractors and needing to file 1099 forms for each.

Create this form in 5 minutes or less

Find and fill out the correct instructions for annual transmittal of state 1099 forms

Create this form in 5 minutes!

How to create an eSignature for the instructions for annual transmittal of state 1099 forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Annual Transmittal Of State 1099 Forms?

The Instructions For Annual Transmittal Of State 1099 Forms provide detailed guidelines on how to properly submit 1099 forms to state tax authorities. These instructions ensure compliance with state regulations and help avoid penalties. It's essential for businesses to follow these guidelines to maintain accurate records and fulfill their tax obligations.

-

How can airSlate SignNow assist with the Instructions For Annual Transmittal Of State 1099 Forms?

airSlate SignNow simplifies the process of preparing and sending the Instructions For Annual Transmittal Of State 1099 Forms. Our platform allows users to easily eSign and send documents securely, ensuring that all forms are submitted on time. This streamlines the workflow and reduces the risk of errors in the transmittal process.

-

What features does airSlate SignNow offer for managing 1099 forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are crucial for managing 1099 forms. These tools help users efficiently prepare and send the Instructions For Annual Transmittal Of State 1099 Forms. Additionally, our platform integrates with various accounting software to enhance productivity.

-

Is there a cost associated with using airSlate SignNow for 1099 forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that facilitate the Instructions For Annual Transmittal Of State 1099 Forms. We recommend reviewing our pricing page to find the best option for your organization.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage the Instructions For Annual Transmittal Of State 1099 Forms. This integration allows for automatic data transfer, reducing manual entry and minimizing errors in your financial documentation.

-

What are the benefits of using airSlate SignNow for 1099 form submissions?

Using airSlate SignNow for 1099 form submissions offers numerous benefits, including increased efficiency, enhanced security, and compliance with state regulations. By following the Instructions For Annual Transmittal Of State 1099 Forms through our platform, businesses can ensure timely submissions and reduce the risk of penalties.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow prioritizes document security by employing advanced encryption and secure access protocols. This ensures that all documents, including those related to the Instructions For Annual Transmittal Of State 1099 Forms, are protected from unauthorized access. Our commitment to security helps businesses maintain confidentiality and trust.

Get more for Instructions For Annual Transmittal Of State 1099 Forms

Find out other Instructions For Annual Transmittal Of State 1099 Forms

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now