Sample Clergy Annual Housing Allowance Declaration Form

What is the Sample Clergy Annual Housing Allowance Declaration

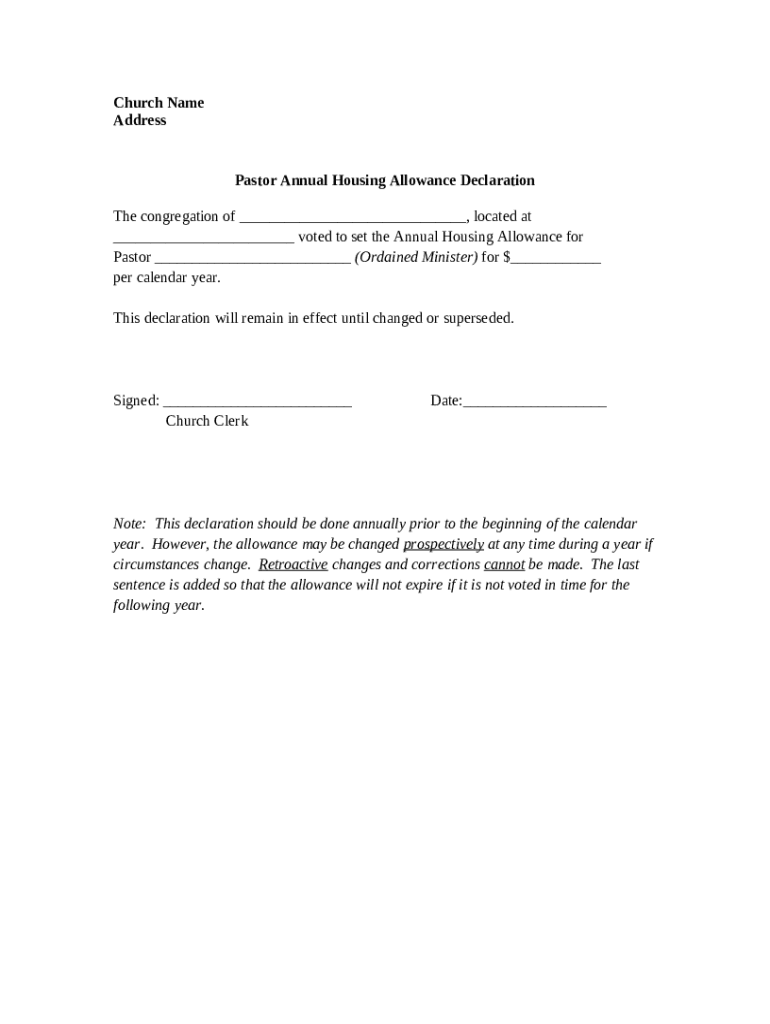

The Sample Clergy Annual Housing Allowance Declaration is a document used by clergy members in the United States to declare their housing allowance for tax purposes. This declaration allows eligible clergy to exclude a portion of their income from federal income tax, specifically related to housing expenses. It is essential for clergy to accurately report their housing allowance to ensure compliance with IRS regulations and to maximize their tax benefits.

How to use the Sample Clergy Annual Housing Allowance Declaration

To use the Sample Clergy Annual Housing Allowance Declaration, clergy members should first review IRS guidelines regarding housing allowances. Once familiar with the requirements, they can complete the declaration by specifying the amount designated as a housing allowance for the year. It is advisable to keep a copy of the completed declaration for personal records and tax filing purposes. This form should be provided to the church or organization that employs the clergy member, as it may be necessary for their financial records and tax filings.

Steps to complete the Sample Clergy Annual Housing Allowance Declaration

Completing the Sample Clergy Annual Housing Allowance Declaration involves several important steps:

- Gather necessary information, including total housing expenses and income.

- Fill out the declaration form, specifying the amount of housing allowance requested.

- Ensure that the amount does not exceed actual housing costs to comply with IRS guidelines.

- Sign and date the declaration to validate it.

- Submit the completed form to the church or organization for their records.

Key elements of the Sample Clergy Annual Housing Allowance Declaration

Key elements of the Sample Clergy Annual Housing Allowance Declaration include:

- The name and contact information of the clergy member.

- The specific amount designated as a housing allowance.

- A breakdown of housing expenses, such as rent or mortgage payments, utilities, and maintenance costs.

- Signatures from both the clergy member and an authorized representative from the church or organization.

Legal use of the Sample Clergy Annual Housing Allowance Declaration

The legal use of the Sample Clergy Annual Housing Allowance Declaration is crucial for ensuring compliance with IRS regulations. Clergy members must accurately report their housing allowance to avoid potential penalties. The declaration serves as a formal record that supports the tax-exempt status of the housing allowance, provided it adheres to IRS guidelines. It is important for clergy to consult with tax professionals to ensure that their declarations are legally sound and properly filed.

Eligibility Criteria

Eligibility criteria for the Sample Clergy Annual Housing Allowance Declaration typically include:

- Being a licensed or ordained minister.

- Providing services as a clergy member for a recognized religious organization.

- Having a designated housing allowance approved by the church or organization.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample clergy annual housing allowance declaration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Sample Clergy Annual Housing Allowance Declaration?

A Sample Clergy Annual Housing Allowance Declaration is a document that allows clergy members to declare their housing allowance for tax purposes. This declaration helps ensure that the housing allowance is excluded from taxable income, providing signNow tax benefits. Using airSlate SignNow, you can easily create and manage this declaration digitally.

-

How can airSlate SignNow help with the Sample Clergy Annual Housing Allowance Declaration?

airSlate SignNow streamlines the process of creating and signing the Sample Clergy Annual Housing Allowance Declaration. With our user-friendly interface, you can quickly fill out the necessary fields, eSign, and send the document securely. This saves time and reduces the hassle of paperwork.

-

Is there a cost associated with using airSlate SignNow for the Sample Clergy Annual Housing Allowance Declaration?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and organizations. The cost is competitive and reflects the value of our easy-to-use platform for managing documents like the Sample Clergy Annual Housing Allowance Declaration. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the Sample Clergy Annual Housing Allowance Declaration?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the Sample Clergy Annual Housing Allowance Declaration. These features enhance efficiency and ensure that your documents are handled securely and professionally. Additionally, you can collaborate with others in real-time.

-

Can I integrate airSlate SignNow with other software for managing the Sample Clergy Annual Housing Allowance Declaration?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when managing the Sample Clergy Annual Housing Allowance Declaration. Whether you use accounting software or CRM systems, our platform can connect seamlessly to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the Sample Clergy Annual Housing Allowance Declaration?

Using airSlate SignNow for the Sample Clergy Annual Housing Allowance Declaration provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform minimizes the risk of errors and ensures that your documents are legally binding. Additionally, you can access your documents from anywhere, making it convenient for busy clergy members.

-

How secure is the Sample Clergy Annual Housing Allowance Declaration when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The Sample Clergy Annual Housing Allowance Declaration is protected with advanced encryption and secure access controls. This ensures that your sensitive information remains confidential and is only accessible to authorized users.

Get more for Sample Clergy Annual Housing Allowance Declaration

Find out other Sample Clergy Annual Housing Allowance Declaration

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile