Guidelines for Completing RF 1175 "Income Statement 1 2021-2026

Understanding the RF 1175 "Income Statement 1"

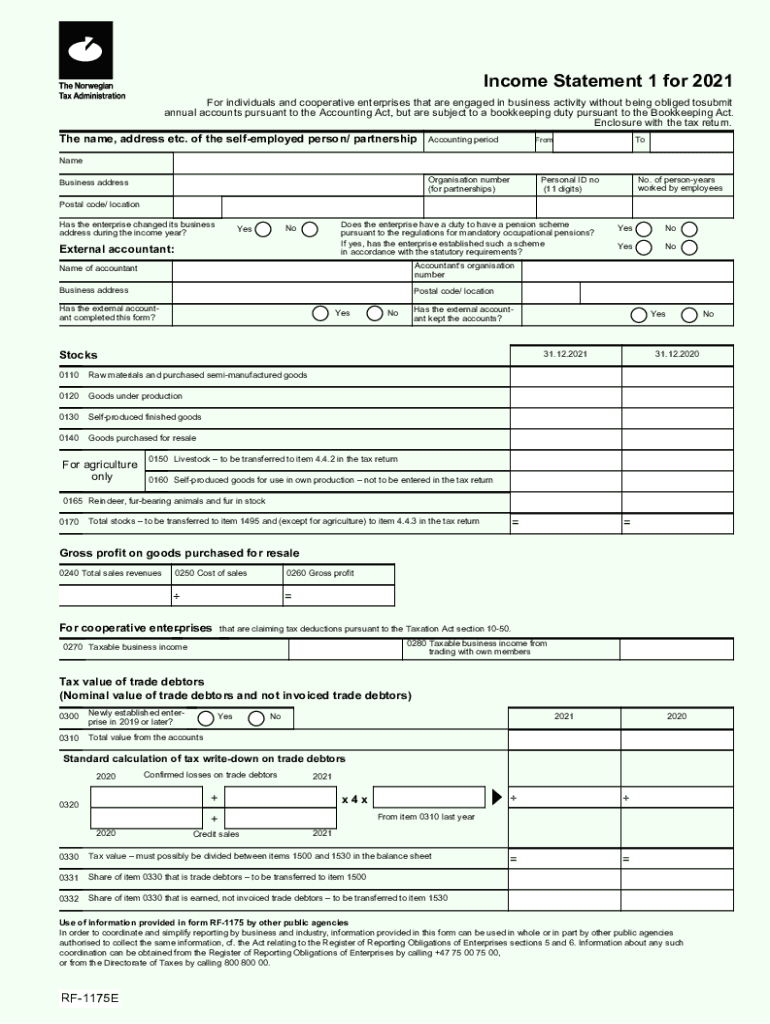

The RF 1175 "Income Statement 1" is a crucial document used for reporting income, expenses, and other financial information. It serves as a primary tool for individuals and businesses to disclose their financial status to the relevant authorities. This form is often required for tax purposes, ensuring compliance with federal and state regulations. Familiarity with this form is essential for accurate reporting and to avoid potential penalties.

Steps to Complete the RF 1175 "Income Statement 1"

Completing the RF 1175 involves several key steps:

- Gather Financial Information: Collect all necessary financial documents, including income statements, expense receipts, and bank statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number or Employer Identification Number (EIN) at the top of the form.

- Report Income: List all sources of income, including wages, dividends, and any other earnings. Be precise in reporting amounts.

- Detail Expenses: Itemize all deductible expenses related to your income. This may include business expenses, medical costs, and other allowable deductions.

- Review and Sign: Carefully review all entries for accuracy before signing the form. Ensure that the information provided is complete and truthful.

Key Elements of the RF 1175 "Income Statement 1"

Understanding the key elements of the RF 1175 is vital for accurate completion:

- Income Section: This section requires detailed reporting of various income sources, which may include wages, self-employment income, and investment earnings.

- Expense Section: Here, you will list all deductible expenses. It is important to categorize these expenses correctly to maximize deductions.

- Signature Line: The form must be signed by the individual or authorized representative, confirming the accuracy of the information provided.

- Filing Information: This section provides guidance on where and how to submit the completed form, including deadlines and submission methods.

Legal Use of the RF 1175 "Income Statement 1"

The RF 1175 is legally binding, meaning the information submitted must be truthful and accurate. Misrepresentation or failure to file can lead to penalties, including fines or legal action. It is essential to understand the legal implications of the information provided on this form to ensure compliance with tax laws and regulations.

Obtaining the RF 1175 "Income Statement 1"

The RF 1175 can typically be obtained through official government websites or local tax offices. It is advisable to ensure that you are using the most current version of the form to avoid any issues during submission. Additionally, many tax preparation software programs include the RF 1175, making it easier to complete and file electronically.

Filing Deadlines for the RF 1175 "Income Statement 1"

Timely submission of the RF 1175 is critical. The filing deadlines may vary based on individual circumstances, such as whether you are self-employed or filing jointly. Generally, the deadline aligns with the federal tax filing date, which is usually April fifteenth for most taxpayers. It is important to stay informed about any changes to deadlines to avoid late filing penalties.

Create this form in 5 minutes or less

Find and fill out the correct guidelines for completing rf 1175 ampquotincome statement 1

Create this form in 5 minutes!

How to create an eSignature for the guidelines for completing rf 1175 ampquotincome statement 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Guidelines For Completing RF 1175 "Income Statement 1"?

The Guidelines For Completing RF 1175 "Income Statement 1" provide detailed instructions on how to accurately fill out the income statement form. These guidelines ensure that all necessary financial information is reported correctly, helping businesses maintain compliance and transparency.

-

How can airSlate SignNow assist in completing RF 1175 "Income Statement 1"?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing RF 1175 "Income Statement 1". With features like document templates and eSignature capabilities, users can efficiently fill out and sign their income statements, ensuring accuracy and compliance with the guidelines.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow provides various pricing plans to cater to different business needs. Each plan includes access to features that support the Guidelines For Completing RF 1175 "Income Statement 1", making it a cost-effective solution for businesses of all sizes.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow. These integrations can help streamline the process of following the Guidelines For Completing RF 1175 "Income Statement 1" by connecting your financial tools and document management systems.

-

What are the benefits of using airSlate SignNow for income statements?

Using airSlate SignNow for income statements offers numerous benefits, including increased efficiency and reduced errors. By following the Guidelines For Completing RF 1175 "Income Statement 1", businesses can ensure that their documents are completed accurately and submitted on time.

-

Can I access airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing users to complete RF 1175 "Income Statement 1" on the go. This flexibility ensures that you can manage your documents and adhere to the guidelines anytime, anywhere.

-

Is there customer support available for airSlate SignNow users?

Yes, airSlate SignNow offers robust customer support to assist users with any questions or issues. Whether you need help with the Guidelines For Completing RF 1175 "Income Statement 1" or technical support, our team is ready to help you succeed.

Get more for Guidelines For Completing RF 1175 "Income Statement 1

Find out other Guidelines For Completing RF 1175 "Income Statement 1

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement