Federal Tax Schedule 1 Cra Arc Gc 2018

What is the Federal Tax Schedule 1 Cra arc Gc

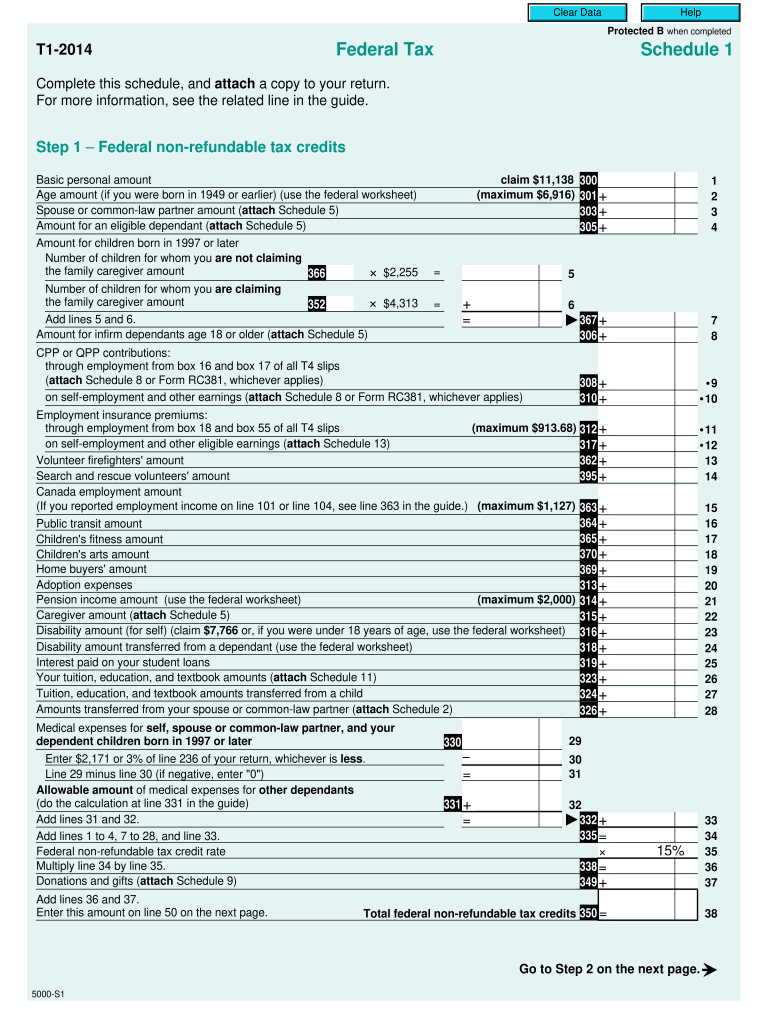

The Federal Tax Schedule 1 is a crucial form used by taxpayers in the United States to report additional income and adjustments to income that are not included on the standard Form 1040. This form is essential for accurately calculating taxable income and ensuring compliance with federal tax regulations. It allows taxpayers to declare various types of income, such as unemployment compensation, and to claim deductions for specific adjustments, including educator expenses and student loan interest deductions. Understanding this form is vital for anyone looking to file their taxes correctly and maximize their potential refunds.

How to use the Federal Tax Schedule 1 Cra arc Gc

Using the Federal Tax Schedule 1 involves several steps. First, gather all necessary documentation related to your additional income and adjustments. This may include W-2 forms, 1099 forms, and receipts for deductible expenses. Next, fill out the form by entering the required information in the appropriate sections. Be sure to double-check your entries for accuracy. Once completed, Schedule 1 should be attached to your Form 1040 when you file your taxes. It is essential to keep a copy of your completed forms for your records.

Steps to complete the Federal Tax Schedule 1 Cra arc Gc

Completing the Federal Tax Schedule 1 requires careful attention to detail. Follow these steps:

- Begin by entering your name and Social Security number at the top of the form.

- Report any additional income in Part I, which may include items like unemployment compensation or alimony received.

- In Part II, list your adjustments to income, such as educator expenses or health savings account contributions.

- Calculate the total adjustments and additional income to determine your overall taxable income.

- Review the form for accuracy before signing and dating it.

Key elements of the Federal Tax Schedule 1 Cra arc Gc

The Federal Tax Schedule 1 comprises several key elements that are vital for accurate tax reporting. These include:

- Additional Income: This section captures income types not reported on Form 1040, such as unemployment benefits.

- Adjustments to Income: This area allows taxpayers to claim deductions that reduce their overall taxable income.

- Total Income Calculation: The form provides a space to calculate the total of additional income and adjustments, which impacts the final tax liability.

Filing Deadlines / Important Dates

Filing deadlines for the Federal Tax Schedule 1 align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of these dates to avoid penalties and ensure timely submission of their tax forms.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have various options for submitting the Federal Tax Schedule 1. The form can be filed electronically using tax preparation software, which often simplifies the process and reduces errors. Alternatively, taxpayers may choose to print the form and submit it by mail. For those who prefer in-person assistance, many local IRS offices can help with filing. Each method has its advantages, so selecting the one that best suits your needs is essential.

Create this form in 5 minutes or less

Find and fill out the correct federal tax schedule 1 cra arc gc

Create this form in 5 minutes!

How to create an eSignature for the federal tax schedule 1 cra arc gc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Federal Tax Schedule 1 Cra arc Gc?

The Federal Tax Schedule 1 Cra arc Gc is a form used by individuals to report various types of income and claim deductions on their tax returns. Understanding this schedule is crucial for accurate tax filing and ensuring compliance with Canadian tax laws.

-

How can airSlate SignNow help with the Federal Tax Schedule 1 Cra arc Gc?

airSlate SignNow simplifies the process of signing and sending documents related to the Federal Tax Schedule 1 Cra arc Gc. With our platform, you can easily eSign your tax documents, ensuring they are securely transmitted and legally binding.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, our cost-effective solutions provide access to features that streamline the management of documents, including those related to the Federal Tax Schedule 1 Cra arc Gc.

-

What features does airSlate SignNow offer for tax document management?

Our platform includes features such as customizable templates, automated workflows, and secure cloud storage, all designed to enhance your document management experience. These features are particularly beneficial when handling the Federal Tax Schedule 1 Cra arc Gc and other tax-related documents.

-

Is airSlate SignNow compliant with Canadian tax regulations?

Yes, airSlate SignNow is designed to comply with Canadian tax regulations, including those related to the Federal Tax Schedule 1 Cra arc Gc. Our platform ensures that all eSigned documents meet legal standards, providing peace of mind for users.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software. This allows you to seamlessly manage your documents related to the Federal Tax Schedule 1 Cra arc Gc alongside your existing tools.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including the Federal Tax Schedule 1 Cra arc Gc, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform streamlines the signing process, allowing you to focus on what matters most.

Get more for Federal Tax Schedule 1 Cra arc Gc

- Chapter test form a answers

- University of papua new guinea application form

- Hsmv 77096 1048382 form

- Maine dot driveway permit form

- Duty resumption form 477204229

- International marketing test bank pdf form

- Tauhara north form

- Form i 929 petition for qualifying familymember of a u 1 nonimmigrant 518861377

Find out other Federal Tax Schedule 1 Cra arc Gc

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple