Complete This Schedule and Attach it to Your Return 2018-2026

What is the 2021 Federal Tax Forms Canada?

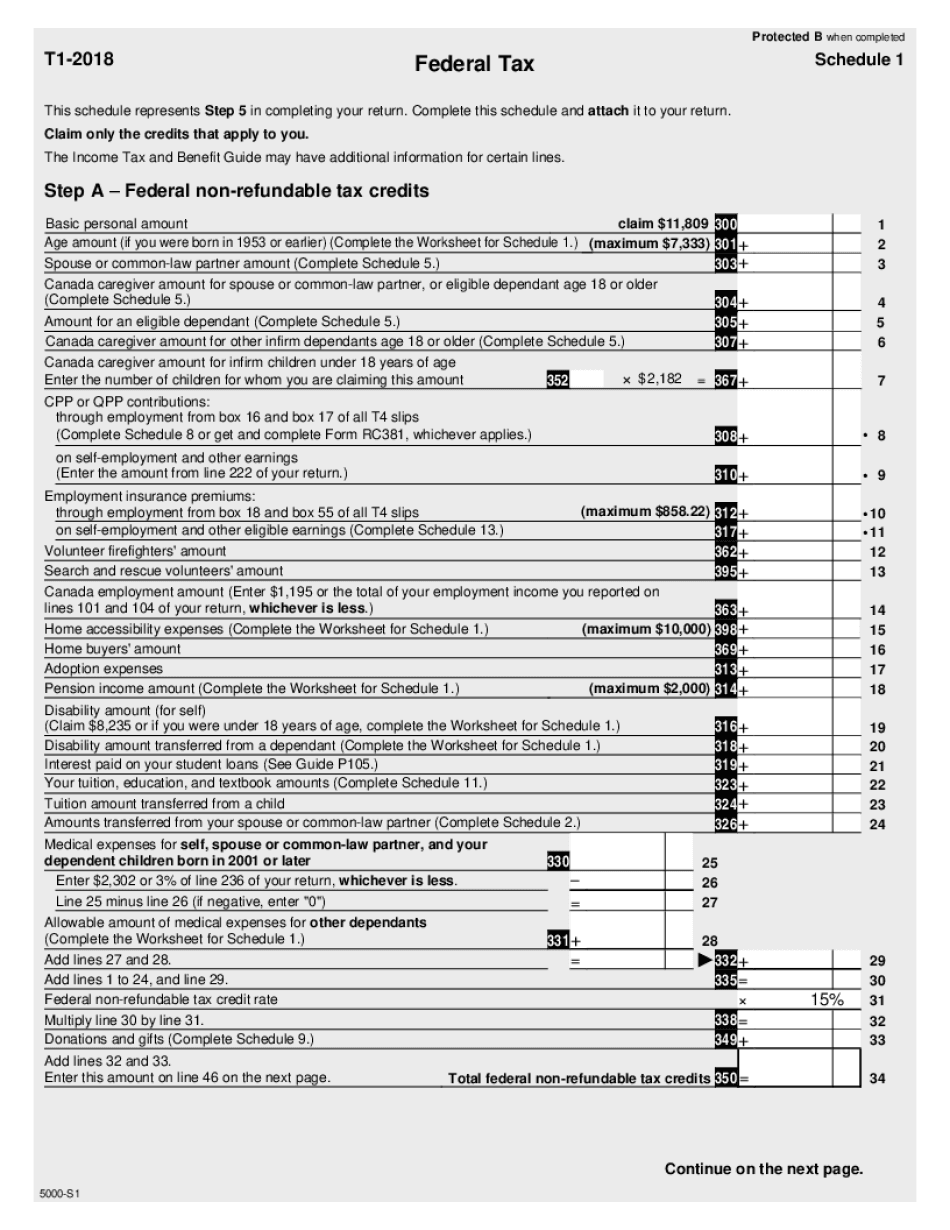

The 2021 federal tax forms in Canada, including the T1 federal tax form, are essential documents used by individuals to report their income and calculate taxes owed to the government. These forms are crucial for ensuring compliance with Canadian tax laws and regulations. The T1 form is specifically designed for individual taxpayers, including employees, self-employed individuals, and retirees. Each form requires specific information regarding income, deductions, and credits, which ultimately determine the taxpayer's final tax liability.

Steps to Complete the 2021 Federal Tax Forms Canada

Completing the 2021 federal tax forms requires careful attention to detail. Here are the key steps:

- Gather all necessary documents, including T4 slips, receipts for deductions, and any other relevant financial information.

- Download the T1 federal tax form and any applicable schedules from the Canada Revenue Agency (CRA) website.

- Fill out the form accurately, ensuring all income sources and deductions are reported.

- Review the completed form for accuracy and compliance with tax laws.

- Sign and date the form, acknowledging the information provided is true and complete.

- Submit the form either electronically through CRA's online services or by mailing a paper copy to the appropriate tax center.

Filing Deadlines / Important Dates

Taxpayers must be aware of the critical deadlines associated with the 2021 federal tax forms. The standard deadline for filing individual tax returns is April 30, 2022. However, if you or your spouse/common-law partner is self-employed, the deadline extends to June 15, 2022. It is vital to file your return on time to avoid penalties and interest on any unpaid taxes. Additionally, ensure that any taxes owed are paid by the April 30 deadline to prevent further charges.

Required Documents for Filing

To complete the 2021 federal tax forms, specific documents are required. These typically include:

- T4 slips from employers, detailing employment income.

- Receipts for deductible expenses, such as medical expenses or charitable donations.

- Information regarding any investment income, including T5 slips.

- Records of any other income sources, such as rental income or self-employment earnings.

Having these documents organized and readily available will streamline the filing process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting their 2021 federal tax forms. The most efficient method is electronic filing through the CRA's online services, which allows for quicker processing and confirmation of receipt. Alternatively, individuals can mail their completed forms to the appropriate tax center. In-person submissions are generally not available, but some tax clinics may offer assistance in filing. Regardless of the method chosen, it is crucial to keep a copy of the submitted forms and any supporting documents for personal records.

Penalties for Non-Compliance

Failure to file the 2021 federal tax forms by the deadline can result in significant penalties. The Canada Revenue Agency imposes a late-filing penalty, which is typically five percent of the balance owed, plus an additional one percent for each month the return is late, up to a maximum of twelve months. Additionally, interest is charged on any unpaid taxes. It is essential to file on time to avoid these financial repercussions and maintain compliance with tax regulations.

Quick guide on how to complete complete this schedule and attach it to your return

Complete Complete This Schedule And Attach It To Your Return seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly without holdups. Manage Complete This Schedule And Attach It To Your Return on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Complete This Schedule And Attach It To Your Return effortlessly

- Locate Complete This Schedule And Attach It To Your Return and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select relevant sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Decide how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or missing files, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Complete This Schedule And Attach It To Your Return and ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct complete this schedule and attach it to your return

Create this form in 5 minutes!

How to create an eSignature for the complete this schedule and attach it to your return

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the t1 federal tax and how does it affect my business?

The t1 federal tax refers to the personal income tax form that individuals must file with the IRS. Understanding your t1 federal tax obligations is crucial for compliance and financial planning. Proper management of documents related to your t1 federal tax can help avoid errors and potential penalties, making solutions like airSlate SignNow essential for seamless document handling.

-

How can airSlate SignNow help with t1 federal tax documentation?

airSlate SignNow simplifies the process of collecting signatures and sending documents related to your t1 federal tax filings. By providing an easy-to-use platform, you can ensure that all necessary paperwork is signed and stored digitally, reducing the risk of misplaced documents. This efficiency allows you to focus on maximizing your tax deductions and minimizing liabilities.

-

What features does airSlate SignNow offer for managing t1 federal tax forms?

With airSlate SignNow, you get features such as templates for t1 federal tax forms, secure eSigning, and cloud storage for easy access. These tools streamline the process, allowing you to fill out, sign, and send your t1 federal tax documents quickly. The user-friendly interface ensures that all your tax document needs are met without hassle.

-

Is airSlate SignNow pricing competitive for small businesses handling t1 federal tax?

Yes, airSlate SignNow offers competitive pricing tailored to small businesses, making it an affordable option for managing t1 federal tax documentation. With various pricing tiers, you can choose a plan that fits your budget while still receiving robust features. Investing in airSlate SignNow can save you time and reduce costs associated with traditional document management.

-

Can I integrate airSlate SignNow with accounting software for t1 federal tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, streamlining the management of your t1 federal tax documents. This integration allows for easy sharing and collaboration on tax-related documents, reducing the risk of errors and improving efficiency as you prepare for tax season.

-

What are the benefits of using airSlate SignNow for my t1 federal tax needs?

Using airSlate SignNow for your t1 federal tax needs offers several benefits, including faster document turnaround, improved accuracy, and enhanced security. The platform helps you organize and track all your tax-related documents in one place, ensuring compliance and easing the stress associated with tax filing. Ultimately, this leads to a smoother experience when managing your t1 federal tax obligations.

-

How secure is airSlate SignNow for my t1 federal tax documentation?

Security is a top priority for airSlate SignNow, especially when handling sensitive information related to your t1 federal tax. The platform employs industry-standard encryption and secure access controls to protect your documents. You can confidently manage your t1 federal tax forms knowing that your data is safe from unauthorized access.

Get more for Complete This Schedule And Attach It To Your Return

- Electromagnetic spectrum worksheet pdf with answers form

- Batavia downs win loss statement form

- Scioto downs win loss statement form

- Mypay aramark form

- Wipro offer letter 2022 pdf form

- Sss form cld 15

- Oral motor assessment checklist pdf form

- Unofficial transcript request ashford university ashford form

Find out other Complete This Schedule And Attach It To Your Return

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement