Business Personal Property Rendition Form Hidalgo 2024-2026

Understanding the Business Personal Property Rendition Form

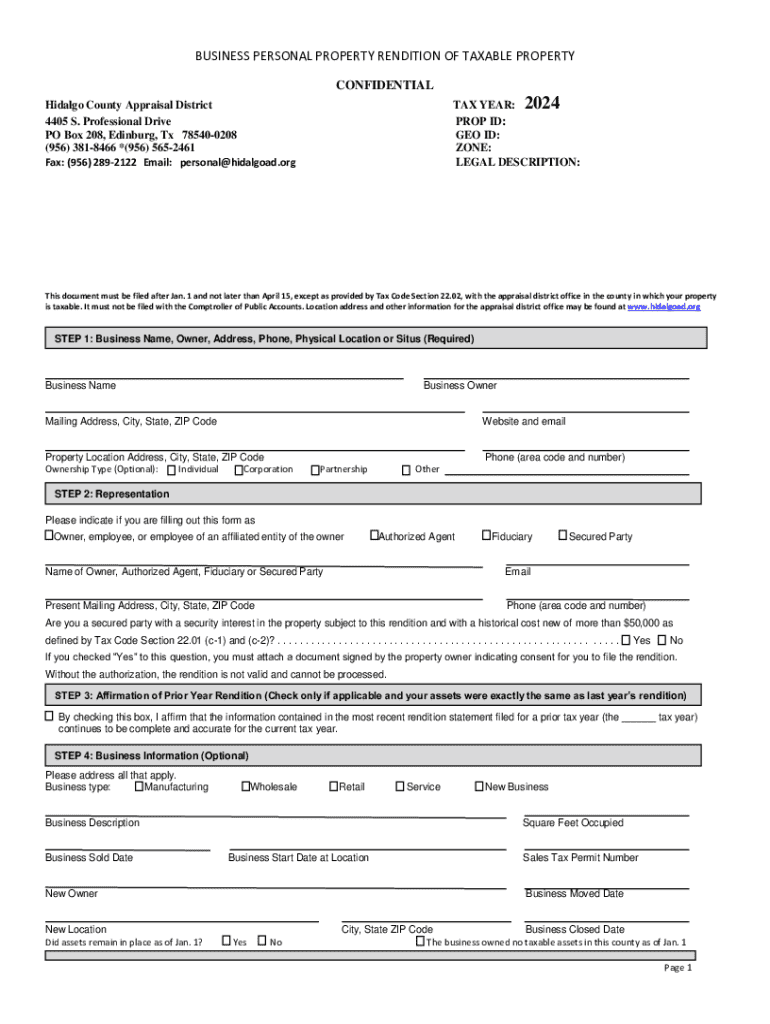

The Business Personal Property Rendition Form is a crucial document for businesses in Texas. It is used to report the personal property owned by a business to the local appraisal district. This form helps ensure that businesses are accurately assessed for property taxes, reflecting the value of their tangible assets. The form typically includes details about the type of property, its location, and its estimated value.

Steps to Complete the Business Personal Property Rendition Form

Completing the Business Personal Property Rendition Form involves several key steps:

- Gather necessary information about your business assets, including equipment, furniture, and inventory.

- Obtain the form from your local appraisal district office or their website.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy before submission.

- Submit the form by the designated deadline to avoid penalties.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines for the Business Personal Property Rendition Form. Typically, the form must be submitted by April 15 of each year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Missing this deadline can result in penalties, so timely submission is crucial.

Required Documents for Submission

When completing the Business Personal Property Rendition Form, you may need to provide supporting documents. These can include:

- Purchase receipts for assets.

- Previous years' tax returns, if applicable.

- Inventory lists detailing the types and quantities of personal property.

Having these documents ready can facilitate the completion of the form and ensure accurate reporting.

Penalties for Non-Compliance

Failure to file the Business Personal Property Rendition Form by the deadline can lead to significant penalties. These may include:

- A percentage increase in the assessed value of your property.

- Additional fines imposed by the local appraisal district.

Understanding these penalties underscores the importance of timely and accurate submissions.

Form Submission Methods

The Business Personal Property Rendition Form can typically be submitted through various methods, including:

- Online submission via the local appraisal district's website.

- Mailing a completed paper form to the appraisal district office.

- In-person submission at the appraisal district office.

Choosing the right method can depend on your preferences and the resources available to you.

Create this form in 5 minutes or less

Find and fill out the correct business personal property rendition form hidalgo

Create this form in 5 minutes!

How to create an eSignature for the business personal property rendition form hidalgo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Texas business personal property rendition?

A Texas business personal property rendition is a declaration that businesses must file with their local appraisal district, detailing the personal property owned by the business. This process is essential for property tax assessments in Texas, ensuring that businesses are accurately taxed based on their assets.

-

Why is it important to file a Texas business personal property rendition?

Filing a Texas business personal property rendition is crucial for compliance with state tax laws. It helps businesses avoid penalties and ensures that they are not overtaxed on their personal property, which can signNowly impact their financial health.

-

How can airSlate SignNow help with Texas business personal property rendition filings?

airSlate SignNow streamlines the process of preparing and submitting Texas business personal property renditions by allowing businesses to eSign and send documents quickly. This efficient solution reduces paperwork and saves time, making compliance easier for business owners.

-

What features does airSlate SignNow offer for managing Texas business personal property renditions?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing Texas business personal property renditions. These tools enhance the filing process, ensuring that businesses can submit their renditions accurately and on time.

-

Is airSlate SignNow cost-effective for small businesses handling Texas business personal property renditions?

Yes, airSlate SignNow provides a cost-effective solution for small businesses managing Texas business personal property renditions. With flexible pricing plans, businesses can choose a package that fits their budget while still accessing powerful features to simplify their filing process.

-

Can airSlate SignNow integrate with other software for Texas business personal property rendition management?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing for efficient management of Texas business personal property renditions. This integration helps streamline workflows and ensures that all necessary documents are easily accessible.

-

What are the benefits of using airSlate SignNow for Texas business personal property rendition submissions?

Using airSlate SignNow for Texas business personal property rendition submissions offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. Businesses can confidently manage their filings, knowing they are using a reliable and user-friendly platform.

Get more for Business Personal Property Rendition Form Hidalgo

Find out other Business Personal Property Rendition Form Hidalgo

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP