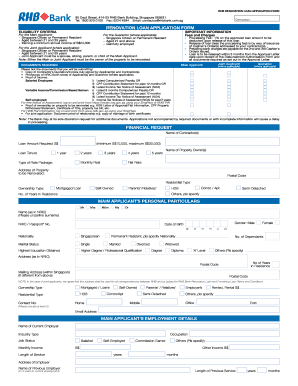

Rhb Renovation Loan Form

What is the RHB Renovation Loan?

The RHB renovation loan is a financial product designed to assist homeowners in funding renovations and improvements to their properties. This type of loan allows borrowers to access the necessary funds to enhance their living spaces, whether through structural changes, aesthetic upgrades, or essential repairs. The loan amount typically depends on the value of the property and the extent of the renovations planned. By offering flexible repayment terms and competitive interest rates, the RHB renovation loan aims to make home improvement projects more accessible for homeowners.

How to Obtain the RHB Renovation Loan

To obtain the RHB renovation loan, applicants must follow a straightforward process. First, potential borrowers should assess their financial situation and determine the amount needed for renovations. Next, they can visit an RHB branch or the bank's official website to gather information about the loan terms and eligibility criteria. It is essential to prepare necessary documentation, such as proof of income, property ownership details, and renovation plans. After submitting the application along with the required documents, the bank will review the application and inform the applicant of the loan approval status.

Steps to Complete the RHB Renovation Loan Application

Completing the RHB renovation loan application involves several key steps:

- Gather necessary documents, including identification, income statements, and property details.

- Fill out the RHB renovation loan application form accurately, ensuring all information is complete.

- Submit the application form along with the gathered documents to the bank, either in person or online.

- Await the bank's review and approval process, which may include a credit assessment.

- Once approved, review the loan agreement carefully before signing.

Key Elements of the RHB Renovation Loan

The RHB renovation loan comprises several critical elements that borrowers should understand:

- Loan Amount: The maximum amount available for borrowing is typically based on the property's value and the planned renovations.

- Interest Rates: Interest rates may vary based on market conditions and the borrower's credit profile.

- Repayment Terms: Borrowers can choose from various repayment options, which may include flexible monthly installments.

- Fees: Be aware of any associated fees, such as processing fees or early repayment penalties.

Legal Use of the RHB Renovation Loan

Utilizing the RHB renovation loan legally requires adherence to specific guidelines and regulations. Borrowers must ensure that the funds are used solely for the intended purpose of home renovations. It is crucial to keep accurate records of expenditures related to the renovations, as these may be required for future reference or audits. Additionally, borrowers should be aware of any local regulations governing home improvements to ensure compliance throughout the renovation process.

Eligibility Criteria

To qualify for the RHB renovation loan, applicants must meet certain eligibility criteria. Typically, these criteria include:

- Being a legal resident or citizen of the United States.

- Having a steady source of income to demonstrate repayment capability.

- Possessing a good credit score, which may influence loan approval and interest rates.

- Owning the property that is to be renovated, with proper documentation to prove ownership.

Quick guide on how to complete rhb renovation loan

Effortlessly Prepare Rhb Renovation Loan on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can access the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Rhb Renovation Loan on any platform with airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The Easiest Way to Modify and eSign Rhb Renovation Loan with Ease

- Acquire Rhb Renovation Loan and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes only a few seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to finalize your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Rhb Renovation Loan to guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rhb renovation loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RHB renovation loan and how does it work?

The RHB renovation loan is a financial product designed to help homeowners finance their home renovation projects. It offers flexible loan amounts and repayment terms, allowing you to tailor the loan to fit your renovation needs. By applying for an RHB renovation loan, you can transform your living space without straining your budget.

-

What are the eligibility requirements for the RHB renovation loan?

To qualify for the RHB renovation loan, applicants generally need to be a Malaysian citizen or a permanent resident with a stable income. Additionally, you must have a good credit history and provide required documentation, including proof of income and the renovation plan. Meeting these criteria ensures that you can access the funds needed for your home improvement project.

-

What are the interest rates associated with the RHB renovation loan?

Interest rates for the RHB renovation loan are competitive and can vary depending on your creditworthiness and the loan amount. Typically, rates are fixed, providing predictability in your repayment schedule. It's advisable to compare current rates to ensure you receive the best possible deal for your renovation financing.

-

How much can I borrow with the RHB renovation loan?

The RHB renovation loan offers flexible borrowing options, with amounts typically ranging from RM 10,000 to RM 100,000, depending on your project size and financial situation. The exact borrowing limit will be assessed during your application process. This flexibility allows you to fund various home improvement projects effectively.

-

What types of renovations can I finance with the RHB renovation loan?

You can finance a wide range of renovations with the RHB renovation loan, including kitchen remodels, bathroom upgrades, and home expansions. The loan can also cover repairs and enhancements to improve your property's value. Before applying, it's helpful to outline your renovation plan to ensure it aligns with the loan's purposes.

-

Are there any fees or charges associated with the RHB renovation loan?

Yes, there may be processing fees, legal fees, or other charges when obtaining the RHB renovation loan. These fees vary depending on the loan amount and terms. It's important to review the loan agreement thoroughly to understand all potential costs before committing to ensure you're financially prepared.

-

How quickly can I receive the funds from the RHB renovation loan?

Once your application for the RHB renovation loan is approved, you can typically expect to receive the funds within a few working days. The exact timeline may vary based on the completeness of your documentation and the loan processing procedures. This quick turnaround can help you commence your renovation project without signNow delays.

Get more for Rhb Renovation Loan

- Asw weekly tracking log california board of behavioral bbs ca form

- Claim of inaccuracy ca dept of justice form 8706

- Na 960y sar korean california department of social services cdss ca form

- Mc210a form

- Wic referral form 2010

- Fsp transfer request form

- Ca sfl 461 form

- Placer county birth certificate form

Find out other Rhb Renovation Loan

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF