Required Minimum Distribution RMD Form Sentinel Security Life

What is the Required Minimum Distribution RMD Form Sentinel Security Life

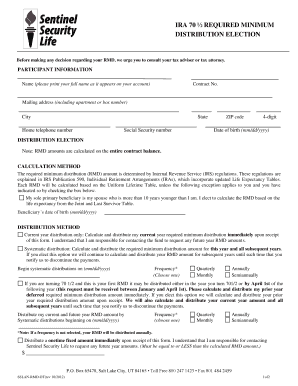

The Required Minimum Distribution (RMD) Form from Sentinel Security Life is a crucial document for individuals who are required to withdraw a minimum amount from their retirement accounts, such as IRAs and 401(k)s, once they reach a certain age. This form ensures compliance with IRS regulations regarding minimum withdrawals, which typically begin at age seventy-two. The RMD Form outlines the necessary information to calculate the required distribution and assists in managing retirement funds effectively.

How to use the Required Minimum Distribution RMD Form Sentinel Security Life

Using the RMD Form from Sentinel Security Life involves several straightforward steps. First, gather relevant personal information, including your account details and Social Security number. Next, accurately complete the form by providing the required financial information, such as the balance of your retirement account. Ensure that you follow the instructions carefully to avoid any errors. Once completed, submit the form according to the specified submission methods, which may include online submission or mailing it to the designated address.

Steps to complete the Required Minimum Distribution RMD Form Sentinel Security Life

Completing the Required Minimum Distribution Form involves a series of clear steps:

- Gather necessary documents, including your retirement account statements and personal identification.

- Enter your personal information, such as name, address, and Social Security number.

- Provide details about your retirement accounts, including account numbers and balances.

- Calculate your required minimum distribution using the IRS guidelines or consult a financial advisor if needed.

- Review the form for accuracy, ensuring all information is complete and correct.

- Submit the form through the designated method, whether online or via mail.

Key elements of the Required Minimum Distribution RMD Form Sentinel Security Life

The RMD Form from Sentinel Security Life includes several key elements crucial for accurate processing. These elements typically consist of:

- Personal Information: Name, address, and Social Security number.

- Account Information: Details of retirement accounts, including account numbers and balances.

- Distribution Amount: The calculated required minimum distribution based on IRS guidelines.

- Signature: Acknowledgment and signature to validate the form.

Legal use of the Required Minimum Distribution RMD Form Sentinel Security Life

The legal use of the RMD Form is essential for ensuring compliance with IRS regulations. Individuals must submit this form to avoid penalties associated with failing to withdraw the required minimum amount from their retirement accounts. Proper completion and submission of the form safeguard against potential tax implications and ensure that individuals meet their financial obligations regarding retirement distributions.

Form Submission Methods

Submitting the Required Minimum Distribution Form can be done through various methods, depending on the preferences of the individual and the guidelines provided by Sentinel Security Life. Common submission methods include:

- Online Submission: Many individuals prefer submitting forms electronically through the Sentinel Security Life website.

- Mail: Alternatively, forms can be printed and sent via postal mail to the designated address provided by Sentinel Security Life.

- In-Person: Some individuals may choose to deliver the form in person at a local office, if available.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the required minimum distribution rmd form sentinel security life

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Required Minimum Distribution RMD Form Sentinel Security Life?

The Required Minimum Distribution RMD Form Sentinel Security Life is a document that allows individuals to withdraw a minimum amount from their retirement accounts as mandated by the IRS. This form ensures compliance with federal regulations and helps you manage your retirement funds effectively.

-

How can airSlate SignNow help with the Required Minimum Distribution RMD Form Sentinel Security Life?

airSlate SignNow provides a seamless platform for sending and eSigning the Required Minimum Distribution RMD Form Sentinel Security Life. With its user-friendly interface, you can easily complete and submit your forms, ensuring a hassle-free experience.

-

What are the pricing options for using airSlate SignNow for the Required Minimum Distribution RMD Form Sentinel Security Life?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose from monthly or annual subscriptions, which provide access to features that simplify the process of managing the Required Minimum Distribution RMD Form Sentinel Security Life.

-

Are there any features specifically designed for the Required Minimum Distribution RMD Form Sentinel Security Life?

Yes, airSlate SignNow includes features tailored for the Required Minimum Distribution RMD Form Sentinel Security Life, such as customizable templates and automated reminders. These features help ensure that you never miss a deadline for your required distributions.

-

What benefits does airSlate SignNow offer for managing the Required Minimum Distribution RMD Form Sentinel Security Life?

Using airSlate SignNow for the Required Minimum Distribution RMD Form Sentinel Security Life streamlines the document management process. It enhances efficiency, reduces paperwork, and provides a secure way to store and access your important financial documents.

-

Can I integrate airSlate SignNow with other tools for the Required Minimum Distribution RMD Form Sentinel Security Life?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to connect your workflow for the Required Minimum Distribution RMD Form Sentinel Security Life with tools you already use. This integration capability enhances productivity and simplifies your document management.

-

Is airSlate SignNow secure for handling the Required Minimum Distribution RMD Form Sentinel Security Life?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Required Minimum Distribution RMD Form Sentinel Security Life is handled safely. The platform employs advanced encryption and security measures to protect your sensitive information.

Get more for Required Minimum Distribution RMD Form Sentinel Security Life

- Mecklenburg electric cooperative residential membership meckelec form

- Rally coach template form

- High school sponsorship letter form

- New york wholesale certificate of sale receipt form

- Sign of the beaver pdf form

- Hopewell va building permits form

- Vendor information form 203211212

- Fair market valuation form 776870085

Find out other Required Minimum Distribution RMD Form Sentinel Security Life

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure