Fair Market Valuation Form 2025-2026

What is the Fair Market Valuation Form

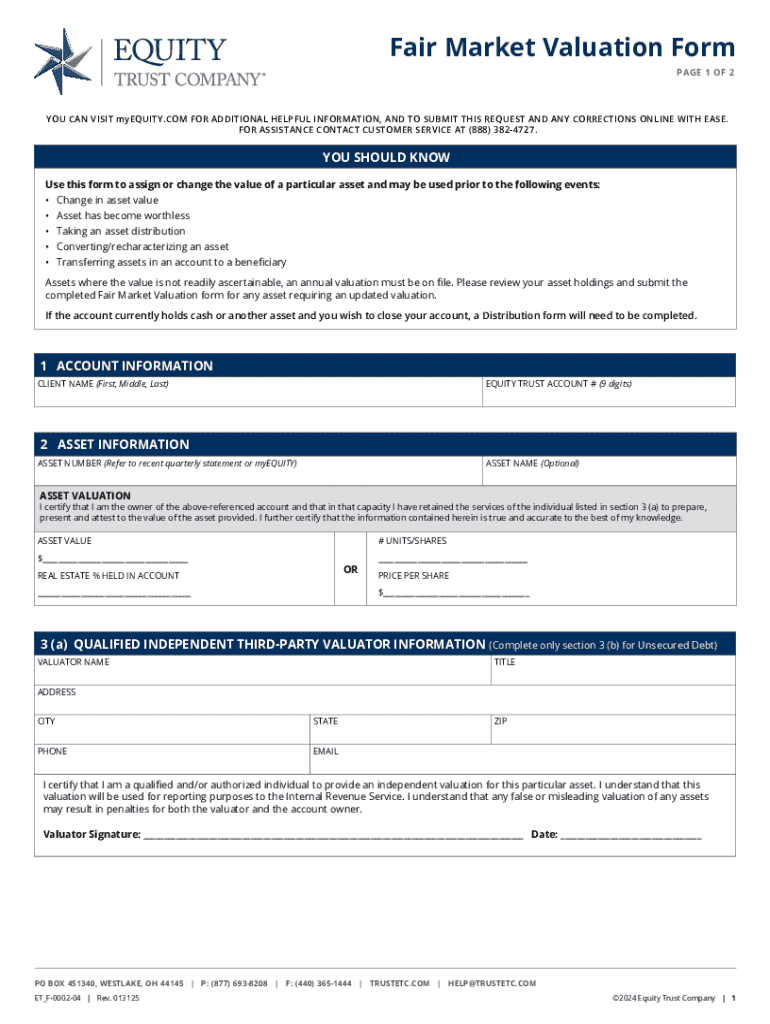

The Fair Market Valuation Form is a document used to determine the fair market value of an asset. This form is essential for various purposes, including tax reporting, estate planning, and financial transactions. It provides a standardized method for assessing the value of real estate, personal property, or business interests, ensuring that valuations are consistent and legally defensible.

How to use the Fair Market Valuation Form

Using the Fair Market Valuation Form involves several steps. First, gather all necessary information about the asset, including its current condition, location, and any relevant market data. Next, fill out the form accurately, detailing the asset's characteristics and any supporting documentation. Finally, submit the completed form to the appropriate authority, which may vary depending on the asset type and intended use.

Steps to complete the Fair Market Valuation Form

Completing the Fair Market Valuation Form requires careful attention to detail. Follow these steps:

- Identify the asset you are valuing and gather relevant documentation.

- Provide a detailed description of the asset, including its location and condition.

- Research comparable sales or market trends to support your valuation.

- Fill in the form with accurate and complete information.

- Review the form for any errors or omissions before submission.

Legal use of the Fair Market Valuation Form

The Fair Market Valuation Form serves a critical legal function, particularly in tax assessments and estate settlements. Accurate valuations are necessary to comply with IRS regulations and state laws. Misvaluations can lead to penalties or disputes, making it essential to ensure that the form is completed correctly and submitted to the appropriate entities.

Key elements of the Fair Market Valuation Form

Key elements of the Fair Market Valuation Form include:

- Asset description: A clear and detailed description of the asset being valued.

- Valuation method: The approach used to determine fair market value, such as comparable sales or income approach.

- Supporting documentation: Any evidence that substantiates the valuation, including appraisals or market analyses.

- Signature and date: Required for validation and to confirm the accuracy of the information provided.

Examples of using the Fair Market Valuation Form

Examples of when to use the Fair Market Valuation Form include:

- When selling a property to ensure the sale price reflects its fair market value.

- During estate planning to determine the value of assets for inheritance purposes.

- For tax reporting, particularly for capital gains calculations.

Create this form in 5 minutes or less

Find and fill out the correct fair market valuation form 776870085

Create this form in 5 minutes!

How to create an eSignature for the fair market valuation form 776870085

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Fair Market Valuation Form?

A Fair Market Valuation Form is a document used to determine the value of an asset based on current market conditions. This form is essential for businesses looking to assess the worth of their assets accurately. By utilizing the Fair Market Valuation Form, companies can make informed financial decisions.

-

How can airSlate SignNow help with the Fair Market Valuation Form?

airSlate SignNow provides a seamless platform for creating, sending, and eSigning your Fair Market Valuation Form. Our user-friendly interface ensures that you can easily customize the form to meet your specific needs. With airSlate SignNow, you can streamline the valuation process and enhance document security.

-

Is there a cost associated with using the Fair Market Valuation Form on airSlate SignNow?

Yes, there is a pricing structure for using airSlate SignNow, which includes access to the Fair Market Valuation Form. We offer various plans to suit different business sizes and needs, ensuring you get the best value for your investment. You can choose a plan that fits your budget while benefiting from our comprehensive features.

-

What features does airSlate SignNow offer for the Fair Market Valuation Form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking for your Fair Market Valuation Form. These features enhance the efficiency of document management and ensure that all parties can sign and access the form easily. Additionally, our platform supports collaboration among team members.

-

Can I integrate the Fair Market Valuation Form with other software?

Absolutely! airSlate SignNow allows for seamless integration with various software applications, making it easy to incorporate the Fair Market Valuation Form into your existing workflows. Whether you use CRM systems, cloud storage, or other business tools, our integrations enhance productivity and streamline processes.

-

What are the benefits of using airSlate SignNow for the Fair Market Valuation Form?

Using airSlate SignNow for your Fair Market Valuation Form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored safely and can be accessed anytime, anywhere. This convenience allows you to focus on your core business activities.

-

How secure is the Fair Market Valuation Form on airSlate SignNow?

Security is a top priority at airSlate SignNow. The Fair Market Valuation Form is protected with advanced encryption and secure access controls, ensuring that your sensitive information remains confidential. We comply with industry standards to provide a safe environment for all your document transactions.

Get more for Fair Market Valuation Form

Find out other Fair Market Valuation Form

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT