Individual Income Tax Adjustments 2024-2026

What is the Individual Income Tax Adjustments

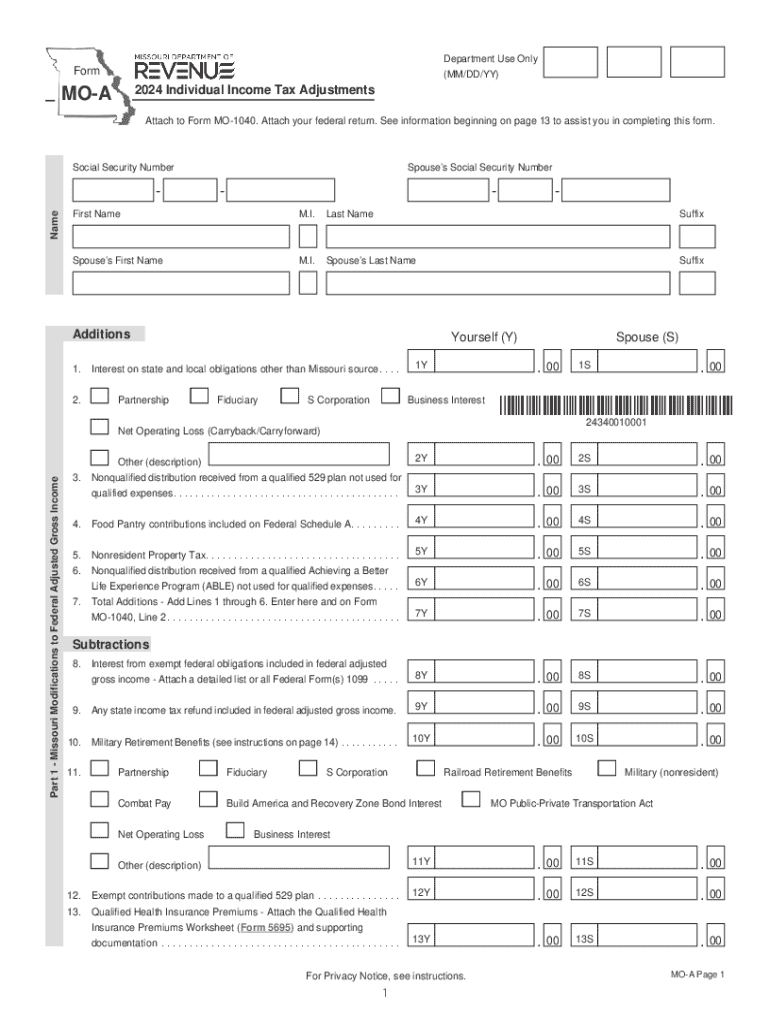

The Individual Income Tax Adjustments refer to specific modifications that taxpayers can make to their reported income on their federal tax returns. These adjustments help in accurately reflecting the taxpayer's financial situation and can lead to a reduction in taxable income. Common adjustments include contributions to retirement accounts, student loan interest deductions, and certain educational expenses. Understanding these adjustments is crucial for ensuring compliance with tax regulations and optimizing tax liability.

How to use the Individual Income Tax Adjustments

To effectively use the Individual Income Tax Adjustments, taxpayers should begin by identifying which adjustments apply to their financial circumstances. This involves reviewing eligible deductions and credits that can be claimed on the federal tax return. Once identified, taxpayers can fill out the appropriate sections of their tax forms, ensuring that all necessary documentation is prepared. Accurate calculations are essential, as they directly affect the overall tax obligation.

Steps to complete the Individual Income Tax Adjustments

Completing the Individual Income Tax Adjustments involves several key steps:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts for deductible expenses.

- Identify eligible adjustments based on your financial situation, such as retirement contributions or educational expenses.

- Fill out the appropriate sections of your tax return, ensuring all adjustments are accurately reported.

- Review the completed return for accuracy and completeness before submission.

- Submit the tax return by the designated deadline, either electronically or via mail.

Key elements of the Individual Income Tax Adjustments

Key elements of the Individual Income Tax Adjustments include understanding the types of adjustments available, the documentation required to support these adjustments, and the impact they can have on overall tax liability. Taxpayers should be aware of the limits and rules associated with each adjustment, as these can vary significantly. Staying informed about changes in tax law is also important for maximizing the benefits of these adjustments.

Filing Deadlines / Important Dates

Filing deadlines for Individual Income Tax Adjustments typically align with the overall tax filing deadlines set by the IRS. For most taxpayers, the deadline to file the federal income tax return is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any specific deadlines related to extensions or additional forms that may be required for certain adjustments.

Required Documents

To complete the Individual Income Tax Adjustments, several documents are typically required. These include:

- W-2 forms from employers showing annual earnings.

- 1099 forms for any freelance or contract work.

- Receipts or statements for deductible expenses, such as medical costs or educational expenses.

- Documentation of retirement contributions, such as Form 5498.

Having these documents organized and readily available can streamline the tax preparation process.

Create this form in 5 minutes or less

Find and fill out the correct individual income tax adjustments

Create this form in 5 minutes!

How to create an eSignature for the individual income tax adjustments

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to mo a?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and eSign documents efficiently. With its user-friendly interface, it simplifies the document signing process, making it an ideal choice for those looking for a mo a solution.

-

How much does airSlate SignNow cost for mo a users?

airSlate SignNow offers flexible pricing plans tailored for various business needs. For mo a users, the pricing is competitive and designed to provide maximum value, ensuring that businesses can manage their document workflows without breaking the bank.

-

What features does airSlate SignNow offer for mo a?

airSlate SignNow includes a range of features such as customizable templates, real-time tracking, and secure cloud storage. These features enhance the mo a experience by streamlining document management and ensuring compliance with legal standards.

-

Can airSlate SignNow integrate with other tools for mo a?

Yes, airSlate SignNow seamlessly integrates with various applications like Google Drive, Salesforce, and Microsoft Office. This integration capability enhances the mo a experience by allowing users to manage documents across different platforms effortlessly.

-

What are the benefits of using airSlate SignNow for mo a?

Using airSlate SignNow for mo a provides numerous benefits, including increased efficiency, reduced turnaround time for document signing, and enhanced security. These advantages help businesses streamline their operations and improve overall productivity.

-

Is airSlate SignNow secure for mo a transactions?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect your documents. This ensures that all mo a transactions are safe and compliant with industry standards.

-

How can I get started with airSlate SignNow for mo a?

Getting started with airSlate SignNow for mo a is simple. You can sign up for a free trial on their website, explore the features, and see how it fits your business needs before committing to a plan.

Get more for Individual Income Tax Adjustments

Find out other Individual Income Tax Adjustments

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF