Lowe's Accounts Receivable Application Form

What is the Lowe's Accounts Receivable Application

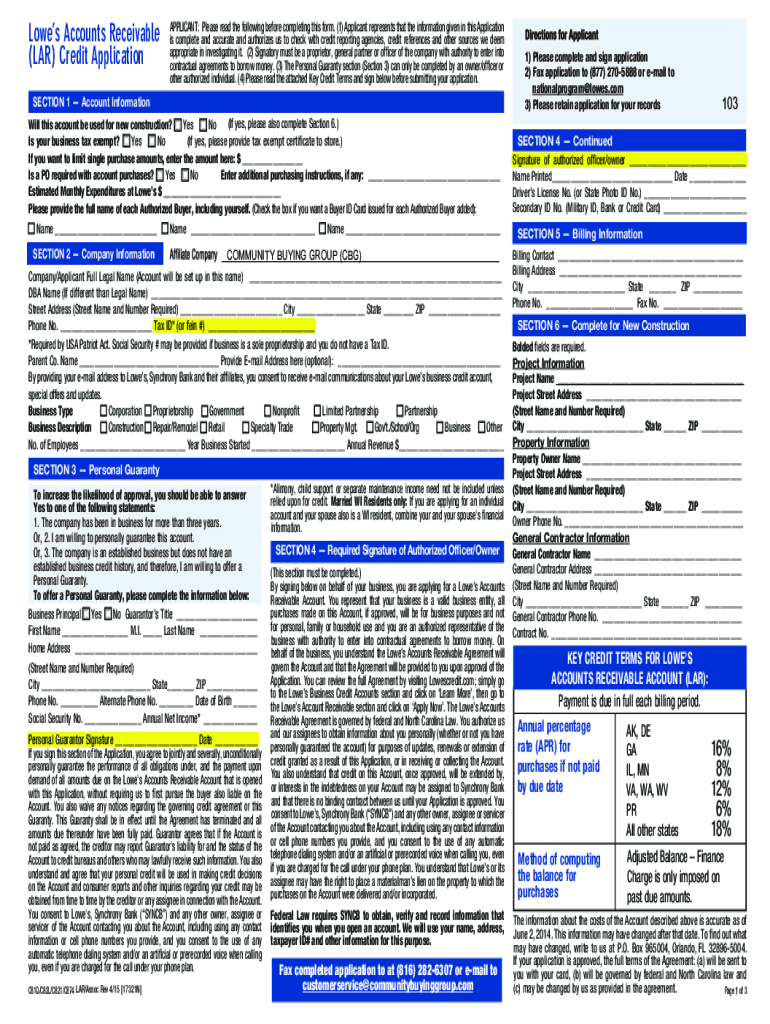

The Lowe's Accounts Receivable Application is a financial tool designed for businesses to manage their credit accounts with Lowe's. This application allows businesses to establish a commercial account, facilitating purchases and payments while tracking account balances. Through this system, companies can streamline their purchasing processes, enabling them to acquire necessary supplies without immediate payment, thus improving cash flow management.

How to use the Lowe's Accounts Receivable Application

Using the Lowe's Accounts Receivable Application involves a straightforward process. After obtaining the application, businesses must fill out the required information, which typically includes company details, tax identification numbers, and financial information. Once completed, the application can be submitted for approval. After approval, businesses can begin making purchases on credit, allowing them to manage their expenses effectively while maintaining a good relationship with Lowe's.

Steps to complete the Lowe's Accounts Receivable Application

Completing the Lowe's Accounts Receivable Application requires careful attention to detail. The following steps outline the process:

- Gather necessary business information, including legal business name, address, and contact details.

- Provide financial information, such as annual revenue and banking details.

- Complete the application form accurately, ensuring all sections are filled out.

- Review the application for any errors or omissions.

- Submit the application either online or via mail, depending on the preferred method.

Required Documents

When applying for a Lowe's commercial account, several documents are typically required. These may include:

- Proof of business registration, such as a business license or articles of incorporation.

- Tax identification number documentation.

- Financial statements or bank references to demonstrate creditworthiness.

Eligibility Criteria

To qualify for the Lowe's Accounts Receivable Application, businesses must meet certain eligibility criteria. Generally, applicants should be established companies with a valid business license and a tax identification number. Additionally, businesses should demonstrate a stable financial history and the ability to manage credit responsibly. Meeting these criteria increases the likelihood of approval for a commercial account.

Application Process & Approval Time

The application process for a Lowe's commercial account is designed to be efficient. After submitting the completed application along with the required documents, businesses can typically expect a response within a few business days. Approval times may vary based on the volume of applications being processed and the completeness of the submitted information. Once approved, businesses can immediately start utilizing their account for purchases.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lowes accounts receivable application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Lowes commercial account account receivable?

A Lowes commercial account account receivable refers to the outstanding invoices and payments due from customers who have purchased goods or services on credit from Lowes. Managing this effectively is crucial for maintaining cash flow and ensuring timely payments.

-

How can airSlate SignNow help with Lowes commercial account account receivable management?

airSlate SignNow streamlines the process of sending and signing documents related to Lowes commercial account account receivable. With its user-friendly interface, businesses can easily create, send, and track invoices, ensuring that all transactions are documented and managed efficiently.

-

What are the pricing options for using airSlate SignNow for Lowes commercial account account receivable?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses managing Lowes commercial account account receivable. These plans are designed to be cost-effective, providing essential features without breaking the bank, making it accessible for businesses of all sizes.

-

What features does airSlate SignNow offer for Lowes commercial account account receivable?

Key features of airSlate SignNow for managing Lowes commercial account account receivable include customizable templates, automated reminders for payments, and real-time tracking of document status. These features enhance efficiency and help businesses stay organized.

-

Are there any benefits to using airSlate SignNow for Lowes commercial account account receivable?

Using airSlate SignNow for Lowes commercial account account receivable provides numerous benefits, including reduced paperwork, faster transaction times, and improved accuracy in invoicing. This leads to better cash flow management and enhanced customer relationships.

-

Can airSlate SignNow integrate with other accounting software for Lowes commercial account account receivable?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions to enhance the management of Lowes commercial account account receivable. This integration allows for automatic updates and synchronization of financial data, simplifying the overall process.

-

How secure is airSlate SignNow for handling Lowes commercial account account receivable?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information related to Lowes commercial account account receivable. Businesses can trust that their data is safe while using the platform.

Get more for Lowe's Accounts Receivable Application

Find out other Lowe's Accounts Receivable Application

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation